Greener Pastures

Kindred has announced its exodus from the North American online gambling arena, joining a growing list of operators that have found the US inhospitable.

The Bulletin Board

NEWS: Kindred calls it quits in North America.

BEYOND the HEADLINE: The US sports betting market isn’t for the faint of heart.

NEWS: Most bettors aren’t using responsible gambling tools, and people are starting to ask why.

ICYMI NEWS: Adelson to Texas; Bot Allegations; Ontario Self-Exclusion; Penn deal with the NHL.

AROUND the WATERCOOLER: More on the Adelson-Mavericks rumors.

STRAY THOUGHTS: Catch me on the Gamble On Podcast.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Kindred Announces North American Exit

Kindred is the latest operator to throw in the towel on the North American online gambling market. Observers see the move as setting up a potential sale.

During the company’s Q3 earnings call, interim CEO Nils Andén said, “We are, with immediate effect, entering into an exit procedure for our North American business.” Kindred expects a complete exit by Q2 2024.

The company presently operates sportsbooks in New Jersey, Virginia, Indiana, Pennsylvania, Arizona, and Ontario. It has online casinos in New Jersey, Pennsylvania, and Ontario.

The move is Kindred’s second North American reset, as it comes a year after the company pulled out of the Iowa sports betting market and announced it would take a more strategic approach to the US, focusing on multi-vertical states.

As Earnings+More reported yesterday, the US has been a “horror show” for Kindred, with total losses of £73.6m since its launch in Q1 2021 (see image below).

In its latest EKG Line newsletter (subscribe here) Eilers & Krejcik Gaming estimated Unibet’s online casino national market share at.5% and online sports betting at.1%.

Beyond the Headline: Another One Bites the Dust

The US sports betting market has not been kind to many operators. Kindred is the latest operator to end, significantly pull back, or reset its foray into the US online gambling space. And the list has some increasingly big names on it:

Churchill Downs

Penn/Barstool Sportsbook

FOX Bet

Maxim

Fubo

PlayUp

WynnBet

Bally Bet

Kindred/Unibet

Additionally, PointsBet was acquired by Fanatics and William Hill by Caesars.

Each of these exits/scalebacks/resets is unique, but underpinning everything is the hyper-competitiveness in the US and several entities’ willingness (and means) to spend, which has created a barrier to entry that is impossible for most operators to overcome.

Sponsorship opportunity

Want to sponsor the fastest-growing newsletter in the gambling space? Straight to the Point has multiple sponsorship opportunities available.

Reach out to Steve at iGamingPundit.com for more details.

Sports Bettors Aren’t Using RG Tools

Yesterday’s newsletter led with the Massachusetts Gaming Commission's interest in thwarting account sharing with underage bettors. But that wasn’t the only interesting part of Monday’s MGC meeting. The MGC also reviewed the usage of responsible gambling tools, or better put, the lack of use of said tools.

During individual presentations, Penn indicated that 1.8% of users utilize at least one responsible gambling tool. At DraftKings, the number is at least 2.3%, as that’s the percentage of users that have set a deposit limit.

But it’s DraftKings breakdown of other limit-setting tools that is more concerning, as less than .1% set a time limit, and just .4% set a wager limit.

These numbers are concerning because the industry (operators, regulators, and RG advocates) has placed a lot of emphasis on RG tools. The lack of usage raises two questions the industry needs to grapple with:

Are customers interested in such tools?

Are these tools being promoted properly?

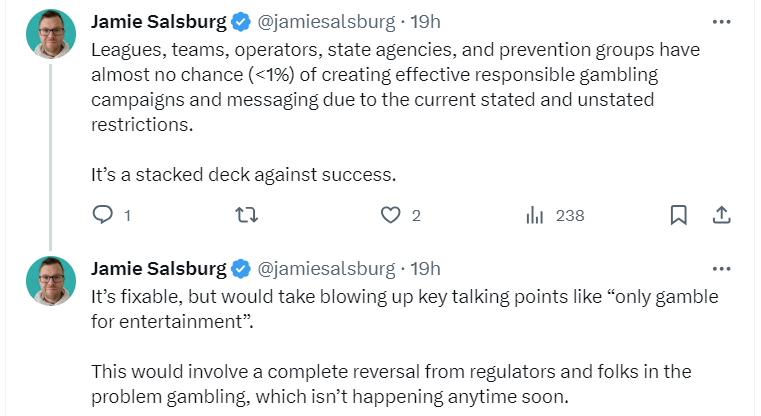

As RG Consultant Jamie Salsburg said:

Salsburg also spoke at length on the use of RG tools with Robyn McNeil over at Bonus.com. I highly recommend reading the article if this topic is of interest to you.

ICYMI News: Adelson to Texas; Bot Allegations; Ontario Self-Exclusion; Penn and the NHL

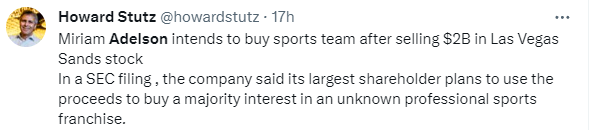

Miriam Adelson is closing in on a deal to buy the Dallas Mavericks from Mark Cuban, with Cuban retaining complete control of basketball operations. Las Vegas Sands has had its eye on building a destination resort casino in Texas for several years.

Scroll down to the Watercooler section for social media commentary

Another gaming/gambling case in California, as AviaGames is accused of deploying bots in its peer-to-peer skill game contests. Per the lawsuit, “Instead of competing against real people, Avia’s computers populate and/or control the games with computer “bots” that can impact or control the outcome of the games.”

iGaming Ontario wants to centralize its self-exclusion database. iGO has issued a request for proposals, with the requirement that, as Gaming Intelligence reports, “the self-exclusion system must allow players to complete KYC identity verification in an intuitive and simple manner, and exclude themselves from all licensed online gambling websites in Ontario through a single registration.”

PENN Entertainment and the NHL have announced a partnership that designates ESPN Bet in the US and theScore in Ontario as Official Sports Betting Partners of the NHL. This is a non-exclusive deal, but as official league partners, Penn will have access to “IP rights, and media and marketing integrations across League programming and premium NHL experiences.”

Around the Watercooler

Social media conversations, rumors, and gossip.

About that sale of the Mavericks.

From Howard Stutz:

From Chris Grove:

From Joe Pompliano:

Stray Thoughts

I will be a guest on the US Bets Gamble On Podcast today. Look for the episode to be released around noon.

I covered a wide range of topics with hosts Eric Raskin and Jeff Edelstein, including online poker in the US, responsible gambling, and a look back at the biggest surprises in the first five years post-PASPA.