A Change Will Do You Good

DC sports betting hasn't produced the desired results, and now lawmakers and regulators are weighing their options as they try to right the ship.

The Bulletin Board

NEWS: The District of Columbia has been one of the most disappointing sports betting markets, and now it’s considering a change.

NEWS: Minnesota has a new sports betting bill, but is 2024 the year the Gopher State legalizes mobile sports betting?

NEWS: Dissecting Pennsylvania’s annual problem gambling report.

VIEWS: Is RSI the right product at the wrong time?

AROUND the WATERCOOLER: Opposition to the GRIT Act explained.

STRAY THOUGHTS: It’s ok to make a mess.

DC Considers Replacing Disappointing GambetDC App

Are Gambet’s days numbered in DC?

At a hearing last week, the DC Lottery expressed some frustration with Intralot’s performance to date - the company’s contract with the DC Lottery expires in July.

However, it doesn’t appear the DC Lottery will cut ties with Intralot; instead, it suggested Intralot subcontract operations to a major commercial operator.

Per Sports Handle’s Bennett Conlin, the lottery’s plan is “the contract with Intralot would get extended, but mobile sports betting in the District would essentially run through the subcontracted operator.” DC Lottery Executive Director Frank Suarez indicated that Intralot was already in talks with a potential subcontractor.

The other option is for DC to return to the drawing board and shift from a monopoly to an open market. Currently, retail operators are able to offer mobile betting within a two-block radius of their brick-and-mortar sportsbooks. Intralot has mobile access to the entire district.

As I wrote in October, “DC sports betting is fundamentally broken.”

“Gambet is a disaster,” Former DC council member Elissa Silverman told Sports Handle in October. “I am not a fan of sports gambling, but if we are going to do it, it should generate revenue for important things like schools, public safety, and housing. The Council needs to scrap Gambet and move to a market-based system.”

Sponsorship opportunity

Want to sponsor the fastest-growing newsletter in the gambling space? Straight to the Point has multiple sponsorship opportunities available.

Reach out to Steve at iGamingPundit.com for more details.

Minnesota: New Sports Betting Bill Has the Same Problem

The latest effort to legalize sports betting in Minnesota was introduced on January 12 by State Sen. Jeremy Miller in preparation for the start of the legislative session on February 12.

Miller has taken several swings at legalizing sports betting. The new bill seeks to solve the issues that have prevented previous efforts from passing.

The critical issue is the involvement of Minnesota’s two commercial racetracks. The racetracks want in on the retail side, and the tribes want them sidelined.

Miller’s latest attempt to broker a deal doesn’t go far enough for the racetracks, as it would require the tracks (and professional sports teams) to take on a tribal partner to operate a retail sportsbook on-premises.

The bill attempts to assuage the racetracks via an annual stipend. Under Miller’s proposal, tribal sportsbooks would be taxed at 15%, with 15% of that tax (estimated at $60 million annually) split between the two racetracks. This is similar to an effort from 2023 that didn’t gain any traction.

The racetracks are unimpressed by the new bill, with Canterbury Park’s Jeff Maday saying the proposal is not enough.

And then there are tribes. To date, Minnesota tribes have rejected any involvement by the racetracks, which is unlikely to change.

Essentially, Miller’s attempts at compromise, while well-meaning, don’t have the support of tribes or the racetracks at this juncture.

Time is also working against Minnesota. Per Eilers & Krejcik Gaming, the legislature is in session for less than 100 calendar days in 2024. Add in 2024 being a presidential election year, and the amount of time devoted to legislation gets even shorter.

Pennsylvania Problem Gambling Report: The Good & Bad

Pennsylvania’s annual compulsive and problem gambling report was released by the Pennsylvania Department of Drug and Alcohol Programs, so let’s dive into the findings.

Per the report:

“a total of 2,834 calls to the Helpline were intakes for problem gambling treatment resources. This is an increase from the 2,401 intake calls received during SFY 2021-22. Additionally, there were 471 intake communications received through chat and text during SFY 2022-23. This is an increase from the 262 intake communications received during SFY 2021-22.”

One of the more interesting data points was the caller’s self-described most problematic type of gambling. Internet gambling led the way at 30%, followed by slots, sports, table games, lottery, poker, etc.

And there is my first problem, but not the only one, with this report. “Internet” encompasses all those things; Pennsylvania has legal online slots, sports betting, table games, lottery, poker, and more.

The internet shouldn’t be a gambling type. It’s the delivery mechanism and should be categorized separately, with callers asked where they gamble.

It’s important how we parse information, and this report had another headscratcher on that front as the “admissions by income” has a very odd X-axis, particularly the third group, which very few would consider a single income bracket.

Moving on from criticisms, the most important data point was the number of admissions that benefitted from treatment, which was quite positive. Of the admissions to the program, 45% are no longer gambling, 13% report reduced gambling, 2% said gambling behaviors stayed the same, and only 1% reported increased gambling. However, 39% are missing and listed as “do not know.”

The most intriguing finding from the report (see image below from the report) is the preferred gambling method by gender for the several hundred people admitted into the DDAP gambling database.

What jumps out is how few women reported sports betting or DFS.

Another point of interest: When asked about responsible gambling advertising recall, there was little or no increase during Problem Gambling Awareness Month (when advertising and campaigns are at their highest) in the last two years.

Rush Street Interactive Needs Online Casino

Rush Street Interactive is a bit player in the US mobile sports betting space, but the company is punching well above its weight on the online casino front. The problem is very few states have legalized online casinos, and the future outlook is rather bleak.

Per a recent note from Eilers & Krejcik Gaming, “For RSI to make the most of its US market positioning, online casino must continue to expand. But … it isn’t. And this year, we see little chance of that changing.”

EKG went on to reiterate one of its big predictions for 2024, positing that FanDuel could be eyeing RSI, as RSI is “trading at [a] significant discount relative to pureplay peer DraftKings,” making it an “increasingly ripe” acquisition target.

In its January 4 note, EKG said, “Finally, 2024 could be the year Rush Street Interactive—long the subject of M&A speculation—is finally snapped up,” with FanDuel the logical choice.

Around the Watercooler

Social media conversations, rumors, and gossip.

Last week, I explained the industry’s opposition to the GRIT Act, which would earmark 50% of the federal excise tax on sports wagers for addiction treatment. Since the GRIT Act isn’t a new tax (the excise tax already exists) and merely allocates half of the money collected for a worthwhile cause, opposition should be minimal.

But it’s not. And there is a good reason it’s not. The industry has fought to repeal the tax for a decade and elevated it to a key policy point in recent years.

From Page 1 of the AGA’s State of the States 2023, “We will continue to advance these and other important issues—including the repeal of the federal sports betting excise tax…”

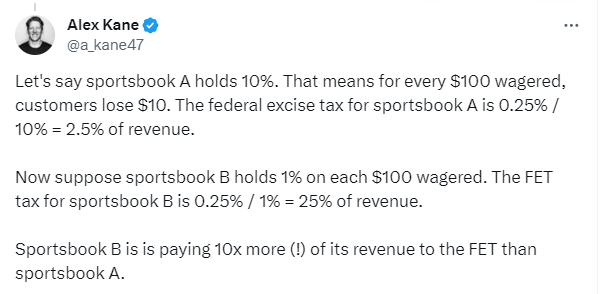

Further, some operators will object to it more than others, as the tax is on handle. That means sportsbooks with low hold rates (customer-friendly books) feel the pinch even more, as SportTrade CEO & Founder Alex Kane explained on X - Kane also appeared on the iGaming Daily Podcast to discuss the GRIT Act and the federal excise tax.

Stray Thoughts

“If you’re making anything, the first thing you need to make is a mess.”

I heard this the other day and have spent several days thinking about how applicable it is to many areas of life (not just a DIY project around the house).