Our House, In The Middle Of Our Street

The word of the day is Madness. EKG offers up some betting predictions for the NCAA Tournament. Some thoughts on statements from gaming conferences. And more.

The Bulletin Board

NEWS: Eilers & Krejcik Gaming’s March Madness sports betting predictions.

VIEWS: Here is why so many wild statements get thrown around at gambling industry conferences.

NEWS: Standard General offers to purchase remaining shares in Bally’s.

NEWS: Will DFS and international online poker return to Ontario?

AROUND the WATERCOOLER: Means testing.

STRAY THOUGHTS: Quiet enough to hear thousands of pin drops.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Learn more about what makes Sporttrade an unparalleled player experience here.

EKG’s March Madness Betting Estimates

North Carolina’s mobile betting launch coincides with a tentpole event (perhaps my new favorite industry term) on the sports calendar: March Madness.

As big as the Super Bowl is, March Madness is bigger. It’s a lot bigger.

Eilers & Krejcik Gaming (a newsletter sponsor) estimated $1.25 billion in handle before the Super Bowl. In a recent Flash Note, the firm’s March Madness prediction is more than 2x that number, coming in at a precise $2.68 billion.

The reason is pretty simple. The Super Bowl is one game with a week (two if we’re generous) of buildup. March Madness is 67 games over 18 days with a similar lead-in time.

When we look at those numbers, we also need to remember that many states have restrictions on college betting that don’t exist for the NFL. The restrictions range from an outright ban in Oregon to various prohibitions on in-state teams and prop bets in numerous locales. EKG estimates a 5-10% reduction in handle due to the recently instituted bans on prop bets in Ohio and Maryland.

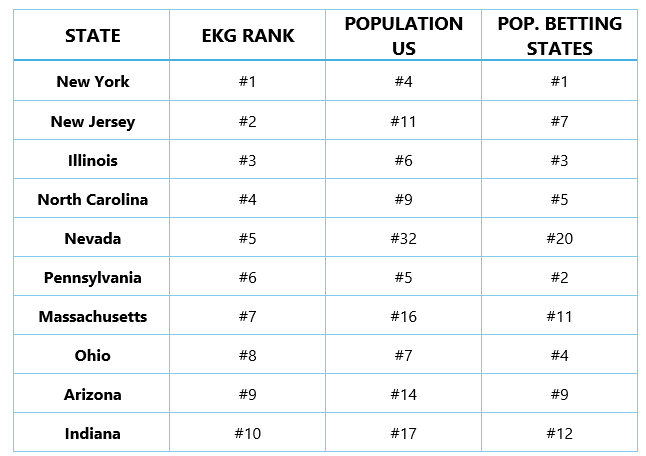

Here’s a look at the EKG Top 10 as well as some population data:

As seen in the chart above, several states overperform their population. Note Florida and its tribal-only sports betting model are not on the list.

Let’s set aside the outlier that is Nevada for the purposes of this conversation. A couple of states are punching well above their weight, as Massachusetts and Indiana bumped several states to claim a spot in the Top 10.

Among mobile betting states on the EKG list, Three states jump out as underperformers:

Michigan - #6 population among mobile betting states and #11 in EKG estimates

Virginia - #8 population among mobile betting states and #14 in EKG estimates

Tennessee - #10 population among mobile betting states and #19 in EKG estimates

Here’s a look at the limitations on college betting in the three underperforming states:

Michigan = None

Virginia = A betting ban on in-state college schools

Tennessee = A prohibition of player props and in-play team wagers (per EKG, 35-40% of March Madness bets will be in-play)

Making Sense of the Hot Takes from NEXT.io Summit

Whether it was Yolo Investments’ Julian Buhagiar’s proclamation that “Gambling Is Dead” or Acies Investments’ Edward King tossing California into the online casino candidate hat, there was no shortage of eyebrow-raising quotes coming out of the NEXT.io conference in New York.

Both statements are wild in isolation. But they can be perfectly reasonable in context and with more time to explain.

Buhagiar used an attention-grabbing line to say what many people before have said about shifting trends. King didn’t have to mention California in the same sentence as more short-term candidates, but he didn’t say California was imminent; he said it was inevitable.

I’ve been attending gaming conferences for a decade. In the first couple of years, I learned a lot. Over the next couple of years, I learned that most of what I had previously learned was high hopes and well-crafted sales pitches. So, what I really learned was not to blindly trust anything said at these events.

Here are the reasons I say that:

Some of it is absolute bullshit from people that don’t know what they’re talking about.

Some of it is well-spoken people identifying a problem for which they happen to have a solution.

Some people just say what the audience wants to hear.

And then there are the well-intended speakers (dreamers) who simply have bad ideas.

A fifth reason, which, in my opinion, is where the examples above fall, is what I’ll call the Twitter problem: Panels aren’t a good way to have meaningful conversations about complex topics. You would think an industry conference would have in-depth conversations, but that’s rarely the case, and most of the conversations are like the three-minute segments on a cable news show.

There’s no time for nuance or dissecting the statement because most panels try to cover a half-dozen topics in less than an hour, plus leave some time for audience questions. In that environment, the #1 goal is not to say anything stupid, followed by having a memorable sound bite.

Don’t get me wrong, most panelists are experts. They’re smart, with exciting ideas and thoughts, and I would love to have an hour-long conversation with them. The issue is they don’t have an opportunity to showcase their talents or knowledge on a panel.

Besides sitting through at least a hundred of these things, I’ve moderated and spoken on enough panels to know how they often go down, which is someone desperately trying to get their prearranged talking points out during a discussion where they may have 5 to 10 minutes of total speaking time.

So when you hear something incendiary or overly optimistic, it’s not always the speaker’s fault. Most of the time, if they had the opportunity at a panel, they could add some nuance.

I’ll dive deeper into this topic in an upcoming feature column.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Will Ontario Join the International Online Poker Pool?

The article has been updated to correctly list Ontario (not Alberta) as asking the Court of Appeal for clarity.

There are developments North of the Border, as the province of Ontario has asked the Court of Appeal: “Would legal online gaming and sports betting remain lawful under the Criminal Code if its users were permitted to participate in games and betting involving individuals outside of Canada as described in the attached Schedule? If not, to what extent?”

Geoff Zochodne said on X that an affirmative ruling “could lead to the return of DraftKings and FanDuel DFS contests in Ontario. The two operators shut those down when they joined the province’s regulated iGaming market in 2022 because one of the rules is all players must be in Ontario, and player pools were no longer deep enough.”

As the Toronto Sun noted in 2022 (h/t to Zochodne), prior to regulation, Ontario residents were part of the international online poker player pool. Regulation ring-fenced the market, causing FanDuel and DraftKings to exit as DFS operators and fundamentally changing the online poker situation in the province.

Bally’s Chairman Makes (Another) Acquisition Offer

Bally’s Chairman Soo Kim is taking another crack at purchasing the company, this time at a significantly reduced price.

In 2022, Kim’s hedge fund, Standard General, offered to buy the remaining shares in Bally’s at $38 per share in Bally’s at $38 per share when the company was valued at $2 billion. The new offer is $15 per share (SG currently owns 23% of Bally’s shares), which values the company at $684 million.

The original offer in January 2022 was rejected, likely because there was hope of a rebound, as Bally’s was on a downward slope from an all-time share price high of $71.58 on March 12, 2021. But the rebound never came.

Bally’s is one of the most interesting companies in the space.

Over a ten-year span, the company (previously known as Twin River) went from a blip on the gambling radar to a Chapter 11 bankruptcy to becoming one of the top regional casino operators in the nation.

And then Bally’s tried to take two massive steps forward.

First, its failed entry into the US online gambling arena led to a massive reset, including a leadership change. That happened alongside its efforts to shed the regional casino brand and dive into the world of billion-dollar properties. Bally’s was selected to build and operate a resort casino in Chicago and is one of the bidders for a New York casino license.

Bally’s goal appears to have been to transform itself into a triple threat, regional, destination, and online. Its regional properties are holding up their end of the bargain. Its foray into online gambling was an unmitigated disaster and has been scaled way back. And its efforts in Chicago and New York are still in the “to be determined” bucket.

Around the Watercooler

Social media conversations, rumors, and gossip.

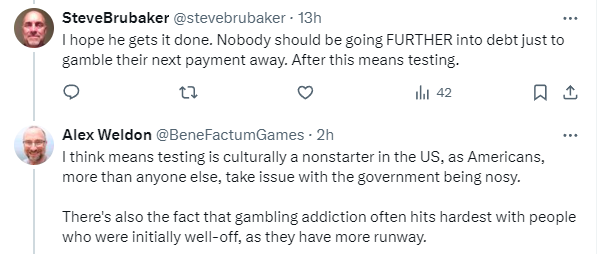

Yesterday on X… There was a fun discussion on means testing.

There is no shortage of ways means testing could be conducted, and I definitely do not believe it’s a non-starter in the US.

As I said in another X thread, “I don’t get the “but it’s inconvenient” argument at all. It should be slightly inconvenient to deposit thousands of dollars on a betting site.”

As I stated in the thread, I wouldn’t means test everyone out of the gate, as the registration process is already filled with friction points. However, it could be deployed later in a customer’s journey.

Perhaps we allow people to deposit up to $5,000 (or pick a different number) in a year, with withdrawals credited against that number, and any attempts to deposit beyond that require means testing. This would not be at the mortgage level but at the buy/lease a car or apply for a short-term loan level.

Stray Thoughts

This could be the most dense GeoComply pin drop map I’ve ever seen: