Did Caesar Live Here?

Caesars leveraged its longtime presence in North Carolina to grab a near double-digit mobile sports betting market share in March.

The Bulletin Board

NEWS: Caesars comes out swinging in North Carolina; is the fast start sustainable?

BEYOND the HEADLINE: Sportsbooks have paid billions of dollars for “official” and often not exclusive partnership deals.

NEWS: NBA and MLB Commissioners field sports betting questions at the Associated Press Sports Editors Commissioners Conference.

VIEWS: Google Update: Gambling affiliates brace for the fallout.

AROUND the WATERCOOLER: Is anyone even interested in RSI?

STRAY THOUGHTS: The second time around.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade is now live in Iowa, alongside Colorado and New Jersey.

Caesars Makes a Splash in North Carolina

When the US sports betting discussion turns to market share, it is dominated by news about DraftKings and FanDuel, with a smattering of BetMGM. The trendy challenger brands like Fanatics and ESPN Bet grab their share of headlines, with everyone else, even a massive company like Caesars, getting table scraps.

It’s a bit surprising, and if you’re Caesars, disheartening, considering the company is active in 26 mobile sports betting states.

The good news for Caesars is it has been making some news. First, they launched their new and improved mobile casino app. But, what people should be discussing is the company’s performance in North Carolina, where it had a near-double-digit market share in March.

CEO Tom Reeg said its market share in North Carolina “was almost 9% of the market, which is about 3x what we’ve been doing in other new launch states.”

According to estimates by Eilers & Krejcik Gaming (a newsletter sponsor), Caesars’ national market share is around 4.5%.

As Caesars Digital President Eric Hession said during the company’s Q1 earnings call, “We’re encouraged by the early results [in North Carolina] and have signed up new customers at a faster pace than prior state launches, translating into a higher initial market share.”

So, what explains Caesars North Carolina’s success? It likely comes down to regional brand awareness and a few structural edges.

As John Mehaffey noted on X, “Several things come to mind here: Caesars has an NC casino player database that goes back over 20 years. It has the only 2 real NC retail sportsbooks, which helped it create 3 years of data. The Caesars app went live on Cherokee reservations more than a week before the statewide launch.”

More evidence: According to JMP Securities, April US app downloads totaled 2.3M, with North Carolina a major contributing factor: “FanDuel downloads are up 60% YoY, Caesars is up 39%, and DraftKings is up 27%… Notably, Fanatics continues to make inroads in online gaming, with 8% of the downloads market share in April, up from 6% in March and 4% in April.”

Beyond the Headline: Partnerships Hurt the Bottom Line

Covers.com’s Geoff Zochodne highlighted an interesting nugget from the Caesars earnings call.

“Caesars reported yesterday that its “Sports Sponsorship/Partnership Obligations” amounted to $566M as of March 31, down from $605M as of the end of 2023,” Zochodne tweeted. “Contracts extend through 2040, the company says.”

In an excellent article on the topic, Zochodne noted that these partnership obligations aren’t confined to Caesars:

“FanDuel-parent Flutter Entertainment PLC reported "other purchase obligations" that were connected to sponsorship, marketing, and media agreements of more than $2 billion as of the end of 2023, with $763 million payable within 12 months.”

“DraftKings reported "other purchase obligations" of more than $1.4 billion as of the end of 2023, of which $467.6 million was due over the coming year. As of the end of 2022, DraftKings' "other" obligations amounted to more than $1.7 billion.”

Still, this money was probably a better investment than the numerous market access deals companies signed, many of which have become zombie deals due to how sports betting licenses are awarded in different states.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

NBA and MLB Offer Up Views on Sports Betting

Speaking at the Associated Press Sports Editors Commissioners Conference, NBA Commissioner Adam Silver and MLB Commissioner Rob Manfred were peppered with questions about sports betting.

Both leagues are dealing with high-profile sports betting scandals, with MLB dealing with the Shohei Ohtani betting case and the NBA recently banning Jontay Porter after an internal investigation uncovered he bet on NBA games, provided bettors with confidential information, and manipulated his own stats.

Silver, who was the first commissioner to embrace legal sports betting in a 2014 New York Times op-ed, pointed to the temptation a two-way player might face, the types of bets that are easily manipulated, and the league’s new push to limit some markets.

Here are Silver’s comments on these matters, per CBS Sports Jack Maloney:

"There's clearly a lot more at stake for a superstar player than there is for a two-way player.

“So it goes to the kinds of players those bets can be placed on, and then the types of bets as well. Certainly, prop bets, depending on how precise they are, lend themselves to more shenanigans than other kind of bets.

“There are limits to our control, but we think there should be a regulated framework, where it's the leagues working together with the state oversight groups and the betting companies, whether or not we have partnerships with them.”

Meanwhile, MLB Commissioner Rob Manfred is trying to “thread the needle,” as CBS Sports Matt Snyder put it.

Manfred highlighted the integrity rules and monitoring the league does. He also said that when it lobbies for legalization, it tries to limit certain easily manipulated prop bets like the first pitch.

the most interesting part was how Manfred framed MLB as an unwilling participant in legal sports betting, saying, “We were kind of dragged into legalized sports betting as a litigant in a case that ended up in the Supreme Court.” He went on to say that legalization is positive on the integrity front and puts the league in a better position: “It’s a heck of a lot easier to monitor what’s going on than it is with an illegal operation.”

The problem is that the cleansing power of light exposes issues that may have been unseen below the surface.

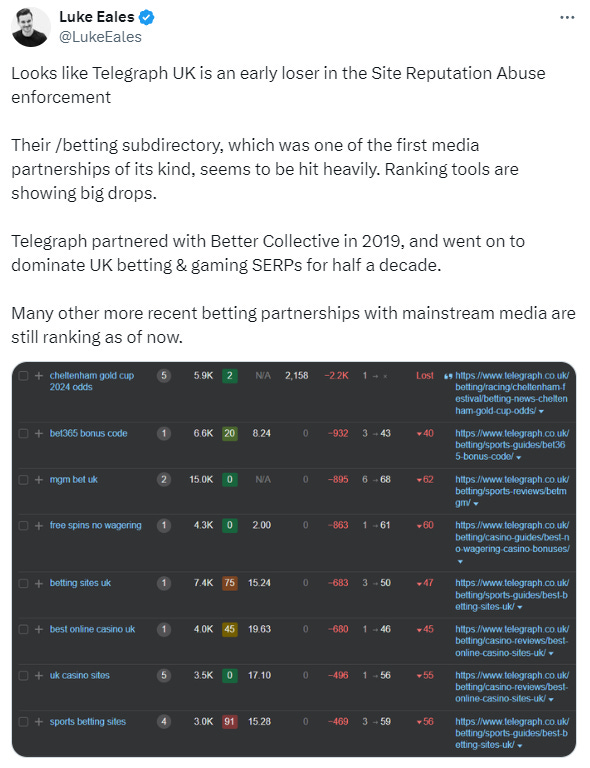

Google Giveth and Google Taketh Away

A Google update has sparked concern among the online gambling affiliate industry, particularly those involved in “parasite content.” For an explanation of parasite content, gambling affiliates, and the new Google update, I recommend this article (h/t Mike Murphy).

The impact of the Google update is already being felt:

For affiliates, Google is like a fickle boss. They are at the mercy of SEO updates and constantly trying to stay within Google’s lanes while outmaneuvering the competition.

I’ve complained about this several times: Many of my old articles are scrubbed from the internet. Not because they were no longer useful, but rather, they were drawing search traffic from what affiliates call “money pages,” the pages that contain the promo links that trigger their CPAs with online gambling sites.

I don’t blame the affiliate companies. They have positioned themselves between a rock and a hard place. They have to do right by their shareholders and are at the mercy of Google search rankings.

And it’s likely to get worse. The second half of 2024 and 2025 will be tough for U.S. affiliates. Following the launch of North Carolina on March 11, there are no new markets on the horizon and few legalization prospects in 2024 – which likely rules out a 2025 launch.

With new markets off the table, affiliates need to find ways to grow revenues, and one way to do that is by trimming costs; as such, they’ve let go of talented but higher-priced writers and turned to AI and the aforementioned parasite content.

As Dustin Gouker tweeted, there is some hope that the new update resets things:

“The good-ish news for them is that it might take them back to the days when the best sites actually about gambling win out. And these deals are not always the best for affiliates. So instead of getting just a piece of revenue from a media deal, you get 100% for your own site.”

My concern is that things are too far gone:

“This is the best-case scenario for affiliates dinged by the latest Google update. With no new state launches on the horizon, I fear many will keep looking for the next workaround.”

SPONSOR’S MESSAGE - Maximize your trading success in 2024 with OpticOdds’ real-time Odds Screen.

Built for operators with an emphasis on speed and coverage, OpticOdds offers:

Pre-match & in-play main lines, alternative markets, player props for the Big 6, soccer, and more

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, settlements, scores & more

Get in touch at opticodds.com/contact.

Around the Watercooler

Social media conversations, rumors, and gossip.

With DraftKings tightening the purse strings and Caesars’s comments from the tweet below, it looks like the list of potential suitors for RSI is shrinking.

As Earnings+More reported, “DraftKings CEO Jason Robins poured cold water on the prospect of the company buying Rush Street Interactive, saying that one Jackpocket-sized acquisition is enough to digest at the moment.”

“It is a question of size. To do two materially sized transactions simultaneously would be very challenging,” Robins said.

And as Chris Lynch notes, it’s a tough market for a multi-billion-dollar company with a sale in mind.

The good news for RSI is that, unlike many other companies in the gambling sector, it wasn’t built with the sole goal of being acquired.

Stray Thoughts

I’ve been rewatching some shows I haven’t seen in 15-20 years, and I have a new appreciation for how good they were and how well they hold up.

I can’t believe how many comedic moments I missed the first time around. This has made me interested in watching more shows from my childhood and teen years to 1) see how they hold up and 2) see what I missed the first time around.

So, what have I been watching? An Idiot Abroad and the original Ali G show.

I also intend to rewatch the Sopranos soon.