Activist Investors

Two major casino companies, Caesars and Penn are coming under fire from activist investors. Is a sale in the cards?

The Bulletin Board

NEWS: Major casino companies are dealing with pressure from activist investors.

LEGISLATIVE UPDATES: Casino hopes dashed in North Carolina; Online gambling coming to Alberta.

NEWS: Texas casino legalization odds just got slimmer.

VIEWS: Trying to come to grips with the volatility in gambling stocks.

AROUND the WATERCOOLER: Illegal bookies in Las Vegas; the story that will never end.

STRAY THOUGHTS: One change at a time.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade is now live in Iowa, alongside Colorado and New Jersey.

Are Activist Investors Eyeing Penn and Caesars?

Things are getting very interesting for a couple of legacy casino operators who haven’t quite set the world on fire in the new age of online gambling.

Penn and Caesars are now facing pressure from activist investors, and as Earnings+More reports, potential sale rumors are swirling.

After spending some $4 billion trying to plant its flag in the US online gambling market, Penn is no stranger to criticism. As E+M noted in its coverage, this is the third time investors have spoken up against the company’s direction:

In January, HG Vora went public with its desire to get a seat on the board and prevent the company “fumbling the opportunity” with ESPN Bet.

In late May, David Einhorn’s Greenlight Capital said the Barstool “fiasco” had left investors with “serious doubts about the company’s strategy and management’s competence to execute.”

The latest critique was a letter from Donerail Group managing partner Will Wyatt, who believes Penn took its eye off its brick-and-mortar empire when it went all-in on online gambling:

“The Company eschewed its tried-and-true strategy of expanding its brick-and-mortar casino operations in lieu of a ‘bet the house’ focus on constructing an online sports betting business to compete with market leaders DraftKings and FanDuel.”

Wyatt called ESPN Bet Penn’s new “bright and shiny object” but doesn’t see any improvement over its first media-sports betting mashup with Barstool Sports, despite another 10-figure investment:

“Unfortunately, after less than a year into pivoting its attention to ESPN Bet, there has been no improvement in the Company’s ability to execute in [its] Interactive [division]… we ask that the Board take a moment to reflect objectively on the past four years of execution, assess the shareholder capital that has been destroyed, and recognize that shareholders may simply be tired of continued gambling on uncertain outcomes.”

However, as Sportico reports, it’s unclear what stake Donerail has in Penn or its other investments. The company wasn’t listed as a Penn investor in the SEC filing but could have purchased shares recently.

“A search of regulatory filings shows Donerail manages about $36 million in a hedge fund for Harbert Fund Advisors, an $8 billion asset management arm of the Harbert family of Alabama. Donerail likely has other clients. Data compiled by Standard & Poor’s Capital IQ shows Donerail invested $245 million in PBA Tour owner Bowlero in 2021 as part of its going public through a SPAC.”

And then there is Caesars, which missed its expectations in Q1.

Enter Carl Icahn.

The last time I reported on Carl Icahn was way back in 2016-17, when Icahn purchased the Trump Taj Mahal, got into a tiff with organized labor over health insurance and pensions that led to a strike, and The Taj again closed its doors. Icahn later sold the property to Hard Rock.

And now he is back. According to Reuters, Caesars shares have jumped 15% after it was disclosed that Icahn had, for the second time, taken a sizable position in Caesars — Icahn had a near 10% stake in Caesars in 2019 but divested after the company merged with El Dorado in 2020.

Icahn’s current stake has not been disclosed.

Interestingly, the criticisms caused both companies’ stocks to rally, with Caesars up 12% and Penn up 19%.

Legislative Updates: Casino Hopes Dashed in North Carolina; Online Gambling Coming to Alberta

North Carolina casino expansion already on thin ice: North Carolina has spent the last several years trying to legalize commercial casinos to no avail. And it looks like 2025 won’t be any better, as House Speaker Tim Moore has indicated that “hard feelings” from this year’s debate will carry over to 2025. “I do think that the conversation last year as it related to casinos has put a shadow over the discussion about updates to the lottery with VLTs and so forth,” Moore said. That likely removes any small glimmer of hope that North Carolina might consider legalizing online casinos.

Regulated online gambling coming to Alberta?: The Alberta legislature has passed Bill 16, which, per Minister Dale Nally’s office, has “specific amendments clarifying ministerial authority over gaming came into effect with Royal Assent.” So what does that mean? Per Canadian Gaming Business, the bill “legally clears the path for the government to allow chosen and licensed third-party operators to offer gaming services and products in Wild Rose Country alongside the AGLC’s PlayAlberta online sportsbook and casino, which the commission operates on behalf of the government.”

Sponsor’s Message - Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences.

The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless.

Visit: www.kambi.com

Gambling Stocks are Extremely Volatile

Publicly traded gambling companies have more than activist investors to worry about. Just as worrisome are the constant overreactions that send share prices hurtling down at every bit of bad news.

The latest example was the news that Illinois would be increasing the tax rate on sports betting operators, which I covered in-depth in Friday’s feature column.

As Alun Bowden tweeted:

“Flutter is down 11%, and DraftKings is down 17%, seemingly on the news that Illinois is raising tax rates and the panic that other states might do the same.

“Really making no comment on the share price as I have no insight to give here, but it really is wild how of ALL the industries in the world that investors are most surprised when gambling doesn't follow a steady state.

“Every mild vaguely predictable shift in conditions and the market reacts a balloon has been popped behind a dog. It's gambling. Variance is baked in. Stop being so credulous.”

In this case, there is some reason for shareholder concern, as Illinois could be an outlier or the tip of the iceberg. The problem is, nobody really knows, nor do they know if the tax bump will have any meaningful impact on DraftKings’ or Flutter’s bottom line.

Of course, the opposite also holds true (look at today’s lead), as gaming stocks rise at the slightest bit of positive news.

Texas Gambling Expansions Slipping Away for 2025

Texas could lead the league in gambling lobbyists, as some prominent names (Miriam Adelson and Mark Cuban) are looking to break Texas’s long-held opposition to gambling of all stripes, including resort casinos.

Progress was made in 2023, with the Texas House of Representatives narrowly failing to pass a bill that would have authorized up to eight resort casinos, as well as retail sports betting. The House passed a bill that authorized mobile sports betting, but it was never brought to the Senate floor for a vote.

The odds for 2025 (the Texas legislature only meets in odd number years), being the year, are already looking very long, as the Texas House of Representatives is kicking the can over to the Senate, which is far more resistant to gambling expansions.

According to State Rep. Jeff Leach, the sponsor of the mobile sports betting bill, any gambling expansion effort will originate in the Senate.

“Based on what happened last session, I believe it’s generally understood that unless and until there is real movement and momentum in the Senate next session — meaning the Senate actually taking up and considering the issue — there is likely not going to be any meaningful action on it in the Texas House,” Leach told The Dallas Morning News.

Due to a quirky Texas legislative rule, the Lt. Gov. has the final say on what bills can be brought to the Senate floor for a vote, action in the Senate is unlikely, particularly if the House isn’t pushing it to act by sending it a bill. Texas Lt. Gov. Dan Patrick is not a fan of gambling.

And then there is the new party platform recently approved by delegates to the Texas Republican convention that called for GOP lawmakers to refuse donations from gambling organizations.

“We oppose any expansion of gambling, including legalized casino gambling,” the platform states.

That doesn’t bode well for gambling expansions next year.

SPONSOR’S MESSAGE - SUBSCRIBE NOW to Zero Latency, the new podcast from Eilers & Krejcik Gaming that provides unparalleled insight into the U.S. online gambling industry through interviews with industry insiders and analysis from EKG experts.

Around the Watercooler

Social media conversations, rumors, and gossip.

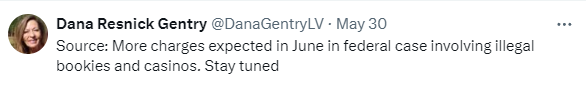

We are not done with the illegal bookie-Las Vegas casino subplot to the Shohei Ohtani betting scandal story just yet. Per Dana Resnick Gentry:

More from the Nevada Current here.

Stray Thoughts

“You’ll never change your life until you change something you do daily. The secret of your success is found in your daily routine.”

John C. Maxwell

I really like this quote but with a caveat. Change one thing at a time. Let the change become a habit, and then move on to the next change. One day at a time and one change at a time.