Give A Little Bit

States facing budget shortfalls are asking sports betting operators to dig deeper into their pockets pitting revenue needs versus industry growth.

The Bulletin Board

THE LEDE: The latest on efforts to increase the sports betting tax rates.

BEYOND the HEADLINE: Are tax increase efforts having a knock-on effect?

VIEWS: Brick & Mortar expansions hurt New Hampshire online casino chances.

VIEWS: Is ESPN’s DTC streaming service the boost ESPN Bet needs?

AROUND the WATERCOOLER: Even winning gamblers have regrets.

STRAY THOUGHTS: Prediction markets and regulatory quicksand.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: Checking in on Tax Increase Efforts

States are facing budget shortfalls, and with most taking further expansions like online casinos off the table, many are eyeing higher sports betting taxes. From Louisiana’s proposed hike to 32.5% to North Carolina’s potential doubling to 36%, these efforts are pitting revenue versus industry growth.

To date, only two states have raised their sports betting tax rates post-launch, but five others have increased tax burdens on operators:

Ohio: Doubled its tax rate from 10% to 20% in 2023.

Illinois: Shifted from a flat 15% rate to a tiered tax rate of 25-40% in 2024.

In 2023, Tennessee shifted from a 20% revenue tax to a 1.85% handle tax, which can be construed as a tax rate increase.

Four states — Louisiana, Colorado, Maryland, and Virginia — have reduced the amount of promotional spending operators can deduct from their tax obligations.

Here’s a look at this year’s active efforts.

STTP Note: Budget deadlines are rarely inflexible.

Louisiana: HB 639 would increase the tax rate on online sports betting from 15% to 32.5%. The bill passed the House Appropriations Committee in a 20-1 vote in April 2025. A previous attempt in 2024 to raise the rate to 51% failed, but the issue has resurfaced due in part to a growing national trend and Louisiana’s $700 million budget shortfall. The bill is scheduled for floor debate in the House of Representatives on Tuesday, May 20 (today), where it requires a 2/3 majority vote to pass. The Louisiana budget is usually finalized in June.

New Jersey: Governor Phil Murphy proposed increasing the sports betting tax rate from 13% to 25% and the iGaming tax rate from 15% to 25% in his 2025 budget. This proposal has faced pushback from the industry and some lawmakers, who argue it could harm a thriving market that has created jobs and generated significant revenue. The budget deadline is June 30, 2025.

Massachusetts: SD 1657, sponsored by State Sen. John Keenan, proposes, among other things, raising the sports betting tax rate from 20% to 51%. This follows a similar proposal in 2024 that did not advance. The bill is part of broader reform efforts, making its passage unlikely.

Maryland: Governor Wes Moore’s budget proposal included doubling the sports betting tax rate from 15% to 30%, alongside increasing the table games tax at brick-and-mortar casinos from 20% to 25%. Moore’s proposal was reduced to 20% by the House Ways and Means Committee in March 2025.

Indiana: State Sen. Fady Qaddoura introduced SB 394, which would increase the sports betting tax rate from 9.5% to 11%. With the session concluded, the bill is in the morgue and awaiting the official death certificate.

Ohio: After an effort by Gov. Mike DeWine to double the sports betting tax rate (for the second time in three years) failed, a new legislative proposal has been put forth. SB 199 would add a 2% sports betting handle tax to the current 20% tax on revenue. If passed, Ohio would become one of the most heavily taxed sports betting states, as a 2% handle tax is equivalent to a 20-25% tax on revenue. The bill would allow operators to deduct the 0.25% federal excise tax on handle from their state tax obligations. A separate measure would reduce the retail sports betting tax rate from 20% to 10%.

Colorado: HB 1311, a bill that eliminates promotional bet deductions, has passed the Colorado legislature. Though it’s not a direct tax rate increase, it will impact operator margins and promotional strategies.

North Carolina: The North Carolina Senate budget (passed in April) included a significant tax increase on sports betting, bumping the rate from 18% to 36%. The House budget has yet to be released (the budget deadline is July 1, 2025). The House Education Appropriation Subcommittee is reviewing the budget, and early indications suggest the House may not support doubling the tax rate. And, as it has done elsewhere, the Sports Betting Alliance has been urging North Carolinians to contact their lawmakers.

Beyond the Headline: The Trickle-Down Effect

As STTP often warns, these bills don’t have to pass to have an impact. The mere existence of these efforts will impact and shape policy in other states. We’re already seeing SAFE Bet Act policies show up in state bills, and even though only a few have passed, new legislation is skewing towards higher tax rates and less promotional deductions since states began discussing tax rate increases.

Consider the online casino effort in Ohio, where the proposal calls for a $50 million licensing fee (plus $5 million renewals) and a 36% tax rate. Those numbers balloon to $100 million and 40% if the licensee doesn’t have at least a 50% stake in the online platform operator.

Sponsor’s Message: Introducing Vixio Workspace: Regulatory Intelligence Meets Action

Gaming compliance pros spend up to 95% of their time on admin, not strategy. With 85% facing growing complexity and 77% saying it’s stalling growth, it’s time for change.

Vixio Workspace is your new command centre for regulatory change management. From new sweepstakes rules to AML, to advertising and responsible gambling - it turns regulatory updates into action — no more spreadsheets, silos, or missed tasks.

✅ Real-time dashboards

✅ Actionable checklists

✅ Centralised task tracking & attestation

Streamline workflows, reduce risk, and regain control — all in one intuitive platform.

Smarter gambling compliance management starts here

Views: B&M Expansion Creates Challenges for NH iGaming

New Hampshire’s stock as a potential online casino state is sinking.

The state’s charity casinos are expanding their footprint, making them far more cautious about bringing a potential competitor into the mix — charity casinos have already expressed cannibalization concerns.

Example #1 is the Hampton Beach Casino complex that has secured approval to expand the footprint of the current casino.

Per the Portsmouth Herald, “The town Zoning Board voted 4-1 on May 15 to grant a special exception, allowing owners Sal Lupoli and Fred Schaake to nearly quadruple the gaming space in the future complex, which will include a new Casino Ballroom music venue, 204-room boutique hotel, and 99 condominiums.”

And then there is the Live! Casino Salem, with Phase 1 expected to open in Summer 2025, pending regulatory approvals. The property will be operated by one of the biggest online gambling opponents in the country, Cordish Companies.

Views: Can ESPN Bet Leverage ESPN’s Streaming Service?

ESPN is set to launch a $29.99/month streaming platform in the fall, with plans to integrate sports betting features from ESPN Bet, including account-linking functionality that allows users to track bets and watch games ESPN has rights to within the app..

The service, described as ESPN’s “largest transition” by executives, aims to merge live sports, betting tools, and exclusive content to enhance fan engagement. ESPN’s betting partner, PENN, anticipates these new integrations will boost ESPN Bet's exposure.

When asked about ESPN’s direct-to-consumer streaming service during PENN’s Q1 earnings call, PENN CEO Jay Snowden said, “It's a first-in-market integration and we're incredibly excited about it. It's very cool. And we think it will have a difference in terms of driving users and exposure to our platform.”

CTO Aaron LeBarge called the streaming service “the best in class and first of its kind experience as it relates to watching live events as it relates to bet integrations.”

Still, the venture will likely face criticisms around journalistic integrity (ESPN prohibits insiders from betting on the sports they cover) and responsible gambling, given ESPN’s influence and the growing prevalence of betting-related issues.

At the same time, activist investors are suing PENN, and the future of the PENN-ESPN deal is in doubt due to ESPN Bet’s lackluster market share.

SPONSOR’S MESSAGE: GeoComply: Where advanced geolocation fights advanced fraud.

Gone are the days when detecting IP spoofs and blocking VPN use is enough to tick the “fraud prevention” box. Not when cybercriminals are using state-of-the-art tech and stolen identities to exploit iGaming operators through bonus abuse and fraudulent chargebacks (often to the tune of six to seven figures a month).

These aggressive attacks require forceful solutions. GeoComply’s Risk Research and Data Science teams have been using machine learning and adaptive intelligence to identify fraudsters masquerading as “real” players, immobilizing them before they can get away with stolen funds.

Ready to dismantle the fraudsters' playbook? GeoComply gives you the tools to stop them—all without having to onboard a new vendor or disrupting your legitimate players.

Book a demo to schedule a deep dive.

Around the Watercooler

Social media conversations, rumors, and gossip.

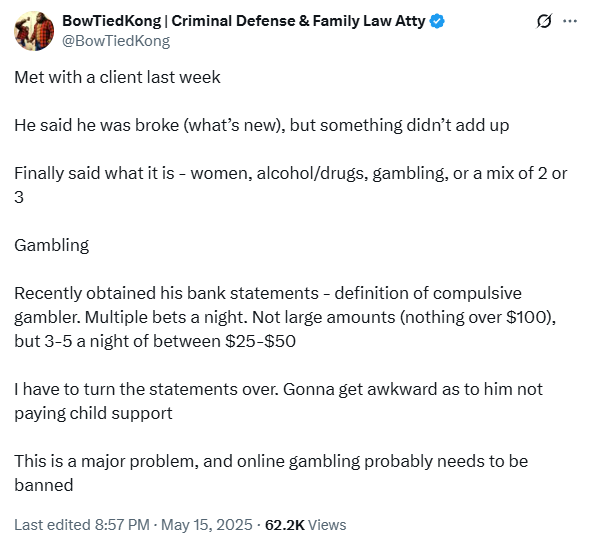

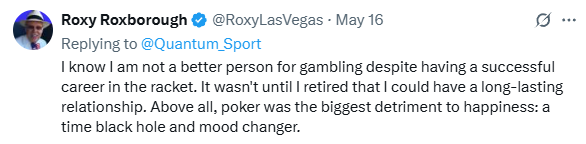

This tweet caused several professional bettors to chime in, and not in the way you might expect:

As I often say, gambling (even when you’re good at it) is a hard way to make an easy living.

Stray Thoughts

I’m going to give the final word today to Andrew Kim (Straight to the Point Talking Shop Podcast episode #48) who noted the double-edged opportunity and danger for prediction markets that enter into the sports betting parlay business that I highlighted in yesterday’s newsletter through the following tweet.

As Kim put it, everything the prediction markets are offering and will offer in terms of sports contracts are “founded on regulatory quicksand. They exist entirely by function of executive grace—i.e., enforcement discretion.”

The CFTC hasn’t expressly authorized these contracts; the regulatory body is simply not asking them to be taken down.

“The CEA allows this through its self-certification process,” Kim wrote. “But unless and until either the CFTC (by rule) or Congress (by law) firms up the foundation, these sports-contract markets can all disappear tomorrow with a snap of the CFTC’s finger.”

The CFTC isn’t abdicating its responsibility, but it is creating an uncertain future that will prevent others from following in Kalshi’s footsteps. Licensed sportsbooks considering the prediction market opportunity know they are stepping into regulatory quicksand, as an administration change or even a shifting viewpoint from the current administration could put these contracts under review.

Click the link below to hear more of Andrew’s thoughts on the topic.