It’s All About The Base

Can sportsbooks like Fanatics leverage their databases to close the gap with FanDuel and DraftKings?

The Bulletin Board

THE LEDE: Based on its promotional spend, it’s safe to say that Fanatics believes its product is ready for prime time.

ROUNDUP: DraftKings + Dan Le Batard; Maine resurrects iCasino bill; OH online casino faces challenges; LA sweeps bill’s big day.

NEWS: Tribes have a “frustrating” call with CFTC commissioners.

VIEWS: Illinois hammers licensed sportsbooks with another tax increase.

AROUND the WATERCOOLER: Follow the money (to online casinos).

STRAY THOUGHTS: I don’t care.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: Are Databases the Path to Becoming a Tier 1 Sportsbook?

Databases are seen as the backbone of modern sports betting, enabling personalized marketing, targeted promotions, and seamless customer experiences.

Brant James’ insightful report at InGame on how DraftKings and FanDuel left the US sports betting starting blocks at a full sprint and how, more recently, Fanatics appears to be leveraging its customer database to drive sportsbook engagement.

The report highlights Fanatics’ ability to cross-pollinate its merchandise and betting platforms, using data to identify high-value customers and tailor offers. However, while databases are undeniably powerful, there is some missing context worth exploring, such as what happens when they fail to deliver?

Fanatics’ database, built on years of e-commerce and sports fandom, should have sent it to the moon when the company entered the sports betting market. Instead, the company experienced a sluggish start, struggling to convert its loyal merchandise buyers into consistent bettors. This raises a critical question: Shouldn’t such a robust database have driven stronger results from the outset?

The answer lies in execution and market dynamics. A database, no matter how comprehensive, is only as effective as the product it supports. If the sportsbook’s user experience, odds, or promotions lag behind competitors like DraftKings or FanDuel, even the best data can’t close the gap.

Furthermore, when you enter an existing market, a database of potential sports bettors is actually a database of existing sports bettors. Rather than activating these customers, you must poach them from a competitor, which is quite challenging when the competitor’s UX, odds, or promotions outperform yours.

There is also the underwhelming track record of casino databases. Casinos use sophisticated loyalty programs and player data to retain gamblers, but their success in funneling casino patrons to sportsbooks has been limited. Why?

The simple answer is that betting behavior differs significantly between casino games and sports wagering. Fanatics may face similar challenges, as its merchandise customers may not naturally transition to betting. Unlike daily fantasy sports, jerseys are not an apples-to-apples comparison to sports betting.

The more complicated answer is a blend of all of the above.

And what about a company like Bet365, which is growing in parallel with Fanatics, despite not having a US database?

As Eilers & Krejcik Gaming (a newsletter sponsor) noted, Fanatics (and Bet365) are surging and could soon overtake the more entrenched BetMGM and Caesars.

And as Citizens notes, Fanatics’ and Bet365’s growth is jumping off the page:

Fanatics is growing its share, but as I’ve noted, it is also outspending its competition in terms of promotional dollars. What happens when the promotional dollars dry up? As EKG recently noted, Fanatics’ promo to GGR ratio “spiked to 76.7% and promo to NGR to 334.0% in the trailing three months, suggesting “a strategy focused on customer onboarding and short-term market penetration over immediate profitability… Fanatics’ net hold (2.2% T12M) trails far behind FanDuel (7.8%) and DraftKings (5.6%), reinforcing that current performance is fueled more by promo spend than margin.”

The counterargument is that Fanatics only ramped up its marketing spend when it felt its product was competitive with the top dogs, and it believes that if it can woo customers to its platform, it can now keep them.

Ultimately, Fanatics’ story underscores a universal truth: you’re only as good as your product. A database can amplify reach, but if the sportsbook doesn’t meet user expectations, it risks becoming a marketing tool for competitors.

Customers exposed to a subpar betting experience may explore rival platforms, turning Fanatics’ data-driven campaigns into unintended advertisements for the competition. To succeed, Fanatics’ product must be on par with its promotional spend, as even the most powerful database can’t compensate for a weak product.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Roundup: DK + Dan Le Batard; Maine iCasino Bill; OH online casino challenges; LA Sweeps Bill

DraftKings renews Meadowlark Media partnership [Legal Sports Report]: DraftKings has renewed its media content deal with Meadowlark Media (founded by former ESPN exec John Skipper and Dan Le Batard), which distributes the Dan Le Batard Show with Stugotz and other programs. The details were not disclosed, but DraftKings will maintain exclusive rights to sell advertising and sponsorships across all of the content. As LSR notes, the original three-year deal was in the $40 million to $50 million range.

Maine online casino bill is still alive, but hanging by a thread [Channel 13 WGME]: After a divided report in April, Maine’s online casino bill cued up the Undertaker gif, as it was reported out of committee on May 30. “Under the bill, Maine’s Wabanaki Nations would have exclusive rights to contract with internet gaming companies. Tribal leaders say the bill would not harm existing casinos but would provide critical revenue for tribal communities… 16 percent of revenue from online gaming would go to the state, with funds earmarked for gambling addiction prevention, veteran housing, and opioid use disorder treatment.” As is the case in other states, it’s being cast as a potential job killer by the state’s two commercial casinos.

Ohio online casinos may require a constitutional amendment [Channel 3 WKYC]: Despite two competing bills to choose from, the Ohio legislature may have an overarching obstacle to contend with, as some legal experts believe online expansion isn’t possible without a constitutional amendment, “Ohio’s constitution very specifically authorizes just four casino locations, spells out where they can be, and limits the number of slot machines that can exist at each facility.”

Ohio Gov. Mike DeWine is not a fan of online casino [Cleveland.com]: At a business event for a new tech company last week, Gov. Mike DeWine raised concerns about the proposed online casino legislative efforts: “Just so everybody understands, this would be 24-7. Anyone with an iPhone can essentially have a casino on their device. And the potential for addiction is just massive.” DeWine sidestepped whether he would veto legislation passed, “I’m not going to get into what I’m going to do yet, but I think everybody needs to understand what this is. This is just not an incremental increase in gaming.” there is also a new letter signed by more than 100 pastors opposing the bill, which will place even more political pressure on lawmakers.

House will consider Louisiana sweepstakes bill today [Sweepsy]: After being pushed back last week, Louisiana’s sweepstakes prohibition bill is expected to be debated on the House floor today. SB 181 has already passed the Senate. STTP’s latest updates on sweepstakes bills.

News: Tribes’ “Frustrating” Meeting With the CFTC

Representatives from several tribes and tribal groups met with the Commodity Futures Trading Commission (CFTC) on Friday to discuss prediction markets. Invitations were extended to entities that submitted public comments before the cancelled April meeting.

The 45-minute call with the tribal representatives provided some clues as to how the CFTC will deal with the foray into sports contracts from prediction markets like Kalshi, with one tribal source telling InGame that acting CFTC Chair Caroline Pham “ain’t doing anything,” nor did the source have high hopes for incoming chair (assuming confirmation) Brian Quintenz taking action. “It was basically like she was showing us all the ways they can’t do anything.”

A second unnamed source said Pham did try to answer questions, “but for the most part, it was extremely frustrating. She basically said at the outset, ‘I’m happy to talk to you, but I am out the door and I have no idea what the new director might do with this issue.”

None of this is surprising. STTP believes the CFTC will deal with sports contracts by doing nothing, meaning that by not requesting the removal or review of the sports contract markets, it effectively allows them to proceed, thereby avoiding direct intervention.

That likely means we will soon see tribes pursue action in court or get involved in one of the existing legal cases.

News: IL Legislature Raises Sports Betting Tax (Again)

As I reported in yesterday’s weekender edition, Illinois lawmakers, in a last-minute budget amendment, imposed a new fee on licensed sportsbooks as they rushed to meet the state's budget deadline.

The new per-wager fee is not a slight increase:

25 cents per wager for the first 20 million wagers accepted

50 cents per wager after that

With a bit of assistance from AI, here is what the new fees will cost operators:

For the major players (FanDuel and DraftKings), the per-wager fee is equivalent to a 17-20% tax. Coupled with last year’s tax increase, the tax rate in Illinois is now in the 57-60% range.

Smaller operators that don’t meet the 50-cent threshold would see their tax rate increase by approximately 12.5%, with a minimum rate perhaps as high as 32.5%.

Mid-tier operators would fall somewhere between those two numbers.

These numbers were echoed by an industry source, who estimated the new per-wager fees are equivalent to a 12-25% tax.

Speaking of the industry, itlaunched an all-hands-on-deck counteroffensive, but like last year’s effort to prevent Illinois from raising the tax rate, lawmakers were not moved.

Here’s a copy of the email sent by DraftKings to Illinois bettors:

And here are some of the calls to action from social media:

Gronk’s call-to-action tweet received 33 likes (his previous tweet about the Knicks had 33,000 likes). Head down to the Stray Thoughts section for more on why that engagement difference is important.

The SBA also released a statement on Sunday evening, saying in part:

“For the second consecutive year, the Illinois legislature chose to balance its budget with a crippling tax on legal online sports betting operators and their million plus Illinois customers -- this time with no warning and no consideration of the devastating impact this tax would have on the legal market.

“… With this change, lawmakers are essentially urging customers - and especially these small-dollar bettors - to switch to unsafe and unregulated sportsbooks who defy state consumer protections and generate zero taxes for state priorities. These illegal operators are the big winners from Saturday’s vote.

“It’s also extremely disappointing that the legislature chose to pass this tax and disregard the $1 billion in new revenue that a regulated and consumer-protected iGaming market would provide Illinois -- allowing instead to let the current unregulated iGaming market that lacks any real consumer protections thrive.”

SPONSOR’S MESSAGE - Kambi is the industry’s leading independent provider of premium sports betting technology and services. Trusted by dozens of operators worldwide, each benefitting from the power of Kambi’s global network, Kambi has a proven track record of giving partners the decisive competitive edge required to grow and outperform the market.

As the home of premium sports betting solutions, Kambi offers an expansive product portfolio that caters to the evolving needs of operators and players alike. At its core is Kambi's flagship Turnkey Sportsbook, renowned for its scalability, flexibility, and unrivaled track record of delivering world-class betting experiences globally. Complementing this are Kambi’s cutting-edge standalone products: Odds Feed+, Managed Trading, Sportsbook Platform, Bet Builder, Esports, and Front End.

Around the Watercooler

Social media conversations, rumors, and gossip.

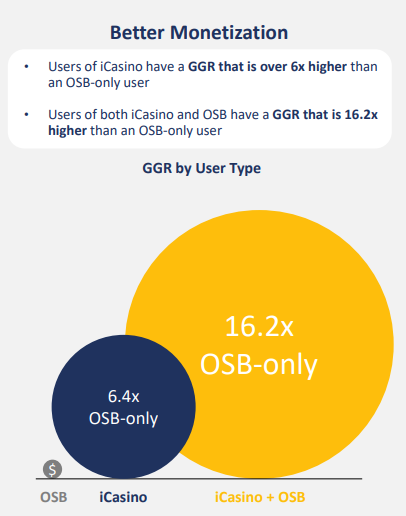

Why is the industry laser-focused on legalizing online casinos (and frustrated by the lack of progress)? The answer is quite simple: That’s where the valuable players are.

“We continue to achieve strong results by prioritizing innovation and the quality of our player experience, while at the same time, excelling in the efficient acquisition and retention of high-value players,” Rush Street Interactive CEO Richard Schwartz said during the company’s Q1 earnings call. “We are consistently adding more players to our platform. These players are of higher value, and we are acquiring them as efficiently as ever.”

So, what makes a player valuable? There are a lot of variables, but, as seen in the RSI’s Q1 slide deck, the valuable customers are on the casino side:

As Eilers & Krejcik Gaming (a newsletter sponsor) noted, “That iGaming boost helped RSI post an industry-leading $368 ARPMAU for North American users in 1Q25. For comparison, BetMGM was at $205 for the quarter, itself a new high and up 26% y/y.”

Stray Thoughts

When one of our students who's been with us for a while comes in and complains to me about being tired, or having a busy day, or some minor ailment, I give the same response every time, “Guess what… I don’t care.” Sometimes other kids in the class will say it for me, “he’s going to tell you he doesn’t care!”

It’s said in jest, and the kids laugh, but I really don’t care most of the time.

Not always feeling 100% and still giving it your all (even if your all is only 80% that day) is something I want to instill in them, and something we often discuss.

This is essentially what lawmakers are telling the industry when they raise concerns about the dangers of increasing financial burdens on them: We don’t care. As I’ve said many times in this newsletter, no one is going to cry about sportsbooks paying too much in taxes or having their advertising restricted. Does it help the black market? Probably. But guess what, nobody cares.

Perhaps it’s time for a new idea, as I’ve mentioned a few times in this newsletter — feel free to reach out; I do have a consulting business.

Scare Tactics: I’ve taken to referring to the gambling black market as a bogeyman, a convenient threat unleashed whenever policies are considered that the industry disagrees with.

Whoa, Little Fella, You're Not Speaking My Language: Explain it to me like I'm five years old is valuable advice, particularly when the conversation isn't widely understood, like responsible gambling.