5 Ways The Prediction Market Experiment Ends

There's a lot of hype and opportunity, but are prediction markets a bubble waiting to burst?

Regular readers of Straight to the Point will know that I’ve got a lot of questions when it comes to the overall opportunity in prediction markets.

Sure, they’re buzzing with hype, and there is clearly a bull case for platforms where you can bet on everything from election outcomes to weather patterns, and of course, sports.

Still, I’m skeptical.

Are they really the next big thing, or just another flash in the pan? Another Napster, Pets.com, NFTs, Segway, 23andMe, or Theranos (which reached a $9 billion valuation).

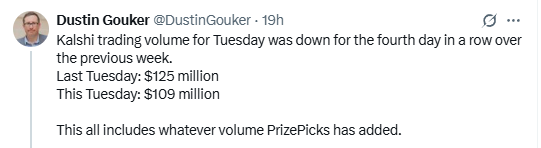

Kalshi should be exploding. Partnerships, the addition of parlays and new sports markets, international expansion, and growing brand recognition. Yet no one can explain this:

Or why traditional sportsbooks are still setting revenue records, despite the new competition from prediction markets.

But there are guesses.

Dustin Gouker (podcast guest #1 and #47):

“I have no clue, but it seems impossible, unless retention and churn are just terrible? Which, I guess, is the simplest answer, but I am sure it’s lots of variables. They’ve also been in the top 10 in the App Store for finance. But adding any PrizePicks volume and going down is nuts.”

Philip Atkinson (podcast guest #67):

“I would strongly suspect that this is a combination of churn, the natural difficulties of reactivation, and a core audience that somewhat skews lower (at least for now) - which has implications for frequency of activity and bet/contract sizing. Would also tally with some anecdotal evidence I have heard about limited liquidity in certain markets.”

My theory all along is that the product only resonates with a niche market. Like trying the new restaurant in town, if the product isn’t up to snuff, they’ll move on rather quickly (the churn both Gouker and Atkinson mentioned). While I’m a prediction market fan (for certain things), I’m not a prediction market fanboy who sees them as revolutionary, like social media or mobile apps. Especially when it comes to sports betting.

Sure, there is a price-sensitive cohort pining for a product like prediction markets, but for the most part, people like to gamble, not treat betting on sports like they’re comparing health insurance plans or retirement funds. The price-sensitive crowd is not a cohort you can build a successful betting company on.

With that as the setup, today, I will look at five ways prediction markets fizzle out or blow up in spectacular fashion — in the future, I’ll write a column on the ways they succeed.

Product: You Think You’re Better Than Me?

At its core, prediction markets appeal to our ego: It’s a gamified way to put your money where your mouth is. But here’s the rub: most people aren’t actually good at it, and peer-to-peer versions of this are known for rapid churn, as casual users overestimate their edge, leading to quick losses — newsflash, losing money (even slowly) isn’t fun, that’s why people are drawn to low-risk high-reward games like lotteries, slots, and SGPs.

For prediction markets to scale as a product and outcompete existing sportsbooks, DFS sites, and more, they must mitigate peer-to-peer churn and develop retention strategies.

As reported by Earnings+More, “Tom Johnson, now CEO at HoldCrunch, and previously an early employee of Betfair, told analysts at Truist this week that he believes there will ‘likely be one big winner’ in the predictions space.” Per Johnson, the winner will be the platform that “the ultimate source of revenue for all prediction market operators will be losing retail consumers… Everyone will gravitate towards the business that owns the retail customer relationships. That’s where the money can be made and the opportunity lies.”

And I would add that those retail customers will be chewed up and spit out, so you will need a never-ending supply.

Thus far, betting exchanges haven’t solved the P2P puzzle, and the current argument is, ‘this time it’s different.’ We shall see.

Historical Example: Following Chris Moneymaker’s 2003 World Series of Poker win, millions of casual players flocked to sites like PartyPoker and PokerStars, and hundreds of online poker sites were created overnight. Some were sold early for staggering amounts, and many just flat failed, as most poker players overestimated their skills, losing money quickly to professionals, resulting in massive churn.

Financial: There’s No There There

Financially, the math doesn’t always add up. Prediction markets promise efficient pricing through crowd wisdom, but just because something is popular doesn’t mean there’s a financial opportunity. There are questions about how sustainable the revenue model is beyond fees, and if every customer is price-sensitive, that’s a problem — and is directly at odds with the previous header.

If margins are razor-thin and user acquisition costs skyrocket, how do these platforms turn a profit? It’s a classic hype trap: great in theory, shaky in execution.

Look at the dot-com bubble, where countless internet startups boomed in the late ‘90s and then crashed spectacularly amid unsustainable models and market corrections. Or more recently, NFTs, the 2021-2022 crypto darling that exploded with multimillion-dollar sales but imploded faster than the Beanie Baby boom, leaving most projects worthless amid market saturation and waning interest.

Still, as Chris Grove said on LinkedIn, the core product may not be the road to riches:

“Industry discourse has pivoted to the economics of the operating model for the prediction market product following commentary from Flutter and DraftKings.

”I don’t think it’s quite as simple as “the market makes money by charging a fee to a customer when the customer makes a trade” (although that’s obviously a core part of the model).”

Grove went on to repeat the thoughts he offered Earnings+More:

“What’s the ultimate business model for a pure-play prediction market? It’s probably not customer fees alone. It’s probably some mix of customer fees, taker fees, other fees, add-on subscription products similar to Robinhood Gold, advertising, and cross-sell to a broader portfolio of related products like crypto trading.

“Uber is a good mental model for conceptualizing how this is likely to evolve. You start with the core service. You optimize the monetization of that core service. You identify adjacent services that ride on top of or alongside the rails you’ve built. You charge for access to your audience. And so on.”

That said, there are a lot of needles that need to be threaded to get to that point.

Historical Example: The British Railway Mania in the 1840s serves as a cautionary tale for how hype can mask shaky financial foundations. Hype around early railway successes led to a speculative bubble, with investors, including the middle class, pouring money into over-optimistic companies that were building routes just to build routes. The market collapsed in 1847, wiping out fortunes and halting construction on thousands of miles of track.

Ubiquity: If Everyone Is a Prediction Market...

… Then nobody is.

Ubiquity sounds like success. Imagine a world where every exchange, from crypto platforms to traditional brokers, adds prediction markets, and where prediction markets are cited in mainstream news, sports, and financial analysis.

But if everyone’s doing it, the market fragments. Liquidity thins out across too many venues, making trades inefficient and unappealing. Revenue sharing eats into everyone’s opportunity. Marketing costs to grab customers rise, and the approach is more scattershot.

It’s the paradox of abundance: more options lead to less depth. Prediction markets thrive on concentration; dilute them, and they fizzle.

Historical Example: The US airline industry post-1978, following the Airline Deregulation Act, spurred massive competition and market entry, fragmenting the industry as new airlines flooded in. While fares dropped, profitability thinned (just like the sharps saying how competition and the prediction market model are good for the customer), leading to more than 100 bankruptcies by 2001, including major carriers like Pan Am and Eastern. The spread of options diluted market depth, forcing consolidations and showing how ubiquity can undermine sustainability.

Regulatory: Ch-Ch-Ch-Changes

Regulation is the big wildcard.

As CFTC Chair nominee Michael Selig said during his hearing on Wednesday, there’s a place for Congress to act, but when the entire sector is built on the whims of the current iteration of the CFTC (and the White House), there is a huge underlying problem.

The gambling industry (or gambling-adjacent if you prefer) should be used to regulatory whiplash; initial green lights followed by crackdowns.

As governments grapple with classifying these as “futures” versus “gambling,” expect several waves of whiplash over the next five to ten years.

The CFTC’s oversight is a start, but, as Andrew Kim has noted on the Straight to the Point Talking Shop Podcast, until there is permanence, we will be stuck in uncertainty. In a world of evolving rules, adaptability is key, but uncertainty scares off investors and users alike.

Prediction markets need stable ground to flourish; right now, it’s, as Kim put it, regulatory quicksand.

Historical Example: The online gambling industry in the US experienced severe whiplash with the 2006 Unlawful Internet Gambling Enforcement Act (UIGEA). As online poker and betting boomed, UIGEA abruptly prohibited payment processing for unlawful internet gambling, causing publicly traded companies like PartyGaming to exit the market and sending their valuations plummeting overnight. Then there was “Black Friday” in April 2011, when major sites like PokerStars and Full Tilt were indicted, freezing assets and disrupting the sector, exemplifying how sudden regulatory shifts and attempts to build a gambling empire on regulatory quicksand can destabilize an emerging industry.

Legal: Kalshi Is Like... Napster?

This brings me to the heart of today’s column: the striking parallels between Kalshi and Napster, the OG disruptor of the music industry.

Keep reading with a 7-day free trial

Subscribe to Straight to the Point to keep reading this post and get 7 days of free access to the full post archives.