A Feature Not A Bug

Bad policy is becoming par for the course, and a lot of gamblers want to know how these changes come to be and what can be done to prevent them going forward.

There is a lot of talk about politicians unwittingly destroying the legal sports betting market with stupid policies, from the per-wager fee in Illinois to a ban on proxy betting in New Jersey to the 90% cap on gambling loss deductions recently passed by Congress, which will be the focus of today’s column.

SPONSOR’S MESSAGE: Is that a new user? Or is it a bonus hunter opening their 56th account on an iPhone 11…

And over there—is that a player in Moscow, Kansas? Or is it a hyper-growth fraud ring in Moscow, Russia teleporting via WiFi injection so they can try to launder money through an app?

What about that Sunday afternoon chargeback (again) being filed from that same sofa (again)?

Find out, be certain, and take action with GeoComply’s next-generation technology.

After over 10 years of leading the industry in compliance and anti-fraud solutions for iGaming platforms across the globe, GeoComply’s geolocation intelligence can’t be beat. Operators can count on device, location, and behavioral signals that are grounded in truth and delivered in milliseconds—so they have the speed and precision required to stop 7-figure-a-month fraud attacks without impacting legitimate players.

Discover what’s at your fingertips today

It’s the End of the World As We Know It

There are few echo chambers as reverberant as Gambling Twitter.

I’ve seen many posters calling this a crisis-level event that could impact tens of millions of taxpayers. The new cap on gambling loss deductions is a crisis-level event… if you are a specific type of gambler — a professional or a losing VIP who receives numerous W-2G tax forms.

Since only those who itemize can deduct gambling losses, the actual number of filers itemizing gambling deductions is a small subset of total filers. As I noted on Monday, according to the most recent available data from the IRS (2020), approximately 662,000 tax filers claimed gambling losses as itemized deductions out of 161 million tax returns filed, or about 0.4% of all tax filers.

And let’s be serious about gambling filings:

Essentially, although this is not a favorable development for professionals and some VIPs (and there are efforts underway to revert to the old policy), the new rule will affect only a small number of people. It just so happens that those people account for a ton of the gambling done in the US.

This is a terrific summary of the history of gambling loss deductions, the changes in the One Big Beautiful Bill, and the potential ramifications for different types of gamblers, and Phil Galfond did a great job explaining precisely who in the poker community this will impact the most, and how the early knee-jerk reactions were overblown for most (but certainly not all) gamblers:

But now I want to get to the meat of this column, which is how these policies end up being enacted.

Features Not Bugs

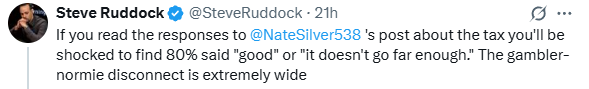

As I said on X, the responses to the gambling accounts posting about the change, and the responses to non-gambling accounts posting about it, are stark:

Or as I said privately, imagine thinking Rep. Mike Crapo (believed to be the architect of the 90% cap on gambling losses) thinks the following is a negative outcome:

“By only allowing professionals to deduct 90% of losing wagers, these gamblers are now going to be unprofitable and will not be able to wager for a living anymore.”

Getting people to gamble less and kneecapping the gambling industry is precisely what many lawmakers want to happen. And sometimes they say the quiet part out loud.

Keep reading with a 7-day free trial

Subscribe to Straight to the Point to keep reading this post and get 7 days of free access to the full post archives.