Aloha Mr. Hand

A sports betting bill has weaved its way through the Hawaii legislature, as the Aloha State inches closer to what many thought impossible: Legalizing gambling.

The Bulletin Board

THE LEDE: Don’t look now, but Hawaii is a sports betting candidate.

ROUNDUP: CFTC Chair’s 2021 comments; New PGCB Commish; Kalshi’s top lawyer to DOGE; Robinhood Bank; IL sends C&D, & LA “assessing” Kalshi.

NEWS: A look at four March Madness betting estimates.

VIEWS: Is the Citifield casino project now a licensing frontrunner?

AROUND the WATERCOOLER: California OSB tension and why the black market will always have customers.

STRAY THOUGHTS: Joe Pesci’s 50% success rate.

Why hire Steve Ruddock? Over the years, Steve has advised startups, national gambling companies, government agencies, and investment banks on a wide variety of topics.

Whether you’re looking for market research, want to raise your brand awareness, or are trying to develop responsible gaming strategies, Steve can help with honest, balanced, no-nonsense analysis of the situation.

Steve’s unique experience and insights are often the missing piece to the puzzle.

Reach out for more information: Straight to the Point Consulting.

The Lede: Is Hawaii the Big Surprise of 2025?

Whenever I’m asked to list the top candidates to legalize online casinos or, in recent years, sports betting, I always make a point of saying that a state is likely to come out of nowhere. In 2025, that state could be Hawaii, one of two states sans any legal betting options, no casinos, no lottery, no nothing.

STTP has been tracking Hawaii’s online sports betting bill with bemused skepticism. My skepticism has faded with each committee passage and then passage by the House. As I recently noted, “It might be time to take Hawaii’s sports betting bill, HB 1308, seriously, as it has passed the House and is moving through the Senate.”

This week, the legislation passed the Senate Ways and Means Committee, where Senate gambling bills met their end this year, and where STTP expected progress to halt.

That sets up a potential vote on the Senate floor, and if that comes to pass, the signature of a governor who recently said gambling was a key to the Aloha Stadium project. STTP would note that there is still quite a bit of work to be done before the bill gets to the governor’s desk.

Governor Josh Green told local press:

“As you see, the legislature is being cautious, and that’s smart. But it was interesting to see. We got a survey or poll of people, and about two out of three in our state wanted to do gaming as long as the monies went to an important set of projects, mostly housing. So, a lot of people want housing. Interestingly, the Hawaiian community, in an overwhelmingly big number, wanted this gambling option as long as it went towards housing for Hawaiians. So it may find its time, and that would certainly unlock the key to building a bigger and more beautiful stadium and entertainment district.”

Throughout its journey, HB 1308 has been short on specifics. The Senate Ways and Means Committee changed that, adding a $250,00 licensing fee to the bill and setting the tax rate at 10%. The bill requires the state to award at least four licenses and calls for an accelerated launch timeline of January 1, 2026, considering Hawaii has zero experience with gambling of any kind.

The tax and licensing numbers could change, particularly if the governor is looking to sell the state’s first foray into gambling as a means to fund civic projects.

As the bill inches closer to passage, expect opposition voices to increase in intensity. The bill has the support of DraftKings, BetMGM, FanDuel, Fanatics, and local trade groups. It’s opposed by Boyd Gaming (Boyd operates Vacations Hawaii, a lucrative business that offers “convenient and affordable” flights from Hawaii to Las Vegas), the Hawaii Department of the Attorney General, the City of Honolulu, and the usual anti-gambling voices.

Roundup: CFTC Chair Sports Comments; New PGCB Commish; Kalshi to DOGE; Robinhood the Bank; IL C&D & LA Assessing Kalshi

Incoming CFTC Chair supports sports contracts. Full stop: However friendly you thought incoming CFTC Chair Brian Quintenz would be to Kalshi’s sports markets… It’s friendlier. Quintenz, a Kalshi board member, said the following during his first stint at the CFTC in 2021 when a previous company tried offering sports markets (h'/t Daniel Wallach), “the statute is unconstitutional, the regulation is invalid, and even without those issues, there were flaws in the Order that made it arbitrary and capricious. He also said, “When we think of commodities, we think of tangible things. Oil, corn, gold. But what about an event? An election? Whether the Summer Olympics will occur in Japan? A football game? Those, too, are commodities!… All events are commodities, which means all contracts on future events are commodity futures contracts, which means all future event contracts need to be traded on a regulated and registered futures exchange.”

George Dunbar appointed to PGCB: Former State Rep. and supporter of regulated online gambling, George Dunbar has been appointed to a two-year term on the Gaming Control Board by House Republican Leader Jesse Topper.” Dunbar’s knowledge (he is a self-professed online poker player) should help the PGCB as it is in the late stages of joining the MSIGA, and pooling its online poker players with other states.

Kalshi’s top lawyer has left to take a job with DOGE: Several outlets (Reuters and Bloomberg) are reporting that Kalshi’s Chief Legal and Regulatory Officer, Elizier Mishory, has accepted a job overseeing DOGE efforts related to the Securities and Exchange Commission (SEC). Kalshi CEO Tarek Mansour confirmed the news on X: “Effective last week, Elie is joining Elon Musk and the team at DOGE. Elie has served as Kalshi's Chief Legal and Regulatory Officer for four years, having previously worked at the CFTC and IRS.” The timing is, of course, quite interesting.

Robinhood expands into banking, and why that may not be a good thing: In his Event Horizon newsletter, Dustin Gouker noted, “Robinhood is rolling out wealth management services and banking.” Gouker’s take is, “At a minimum, I would argue Robinhood needs to allow all customers — or at least banking customers — the ability to opt out of prediction markets and/or sports betting on the investment app.” He then ran the following thought experiment: “Let’s say Bank of America or Wells Fargo announced they are launching sportsbooks under their brands that are seamlessly integrated with their banking apps. This is, of course, a ridiculous concept. Everyone would have their pitchforks out, and the idea wouldn’t even make it out of a pitch meeting.”

Illinois sends Kalshi a cease-and-desist letter: Illinois is the fourth state (New Jersey, Nevada, and Ohio are the others) to send a cease-and-desist letter to Kalshi, saying the company’s sports markets violate state law — Illinois also sent letters to Robinhood and Crypto.com. Per Casino Reports, the letters, all dated April 1, state, “No person or entity may engage in a sports wagering operation or activity in Illinois unless licensed by the IGB… It is unlawful to knowingly establish, maintain, or operate an Internet site that permits a person to make a wager upon the result of any sport, game, contest, political nomination, appointment, or election via the Internet without an IGB-issued license.” In addition to the C&D states, Massachusetts, Connecticut, Louisiana (see below), and Washington State are investigating prediction markets.

Louisiana looking into prediction markets: Per Robert Linnehan, “Chris Hebert, Chairman of the Louisiana Gaming Control Board, says the board is aware of the recent developments regarding sports event prediction markets and is ‘currently assessing the situation.’"

SPONSOR’S MESSAGE - BroThrow.com is growing the most player-friendly, subscription-based sports betting experience in the industry. Our TRUE no-juice/vig/commission platform is the fairest, simplest way to bet on sports.

Sign up and explore: BroThrow

News: March Madness Betting Estimates: Who Will Win the Showcase Showdown?

I previously covered two March Madness betting estimates:

The American Gaming Association is estimating a record-setting $3.1 billion will be legally wagered on the upcoming NCAA Basketball Tournaments (men’s and women’s). That number is up from the AGA’s $2.7 billion estimate in 2024.

Vixio Regulatory Compliance (a newsletter sponsor) forecasts $3.2 billion in legal wagers on the tournaments.

Two other firms also released betting estimates: H2 Gaming Capital and Eilers & Krejcik Gambling (a newsletter sponsor).

Per iGaming Business, “H2 Gambling Capital has estimated a total of 169 million bets will be placed during March Madness this year, resulting in handle for the event reaching $2.9 billion. H2’s 2025 estimates indicate a 1.5% dropoff from 2024, with the firm pointing to a lack of new online sports betting state launches since the last tournament, and Women’s tournament betting likely to fall due to the “Caitlin Clark effect.”

EKG’s estimate is the lowest of the bunch, coming in at $2.6 billion. The firm wrote, “We note our number is significantly below some other public estimates and actually down 2% from our projection last year.” It also notes that the dropoff is steeper, as this year’s estimates include Florida. Per EKG, the change is due to model refinements and customers shifting toward “high-margin products like SGP.”

Sportsbooks lose? As an aside, with all four #1 seeds making the Final Four, the team at JMP Securities (who do phenomenal work) has lowered its Q1 estimates on DraftKings, writing in a recent note that despite recent upward trends, “March Madness, starting on 3/20, resulted in adverse game outcomes on the back of nearly no upsets and all four number one seeds advancing to the Final Four… heavy betting activity across the favorites during the tournament resulted in unfavorable outcomes late in the quarter.”

Views: Citifield NY Casino Project Gets High-Profile Backer

Last week, I ranked the best contenders (and the not-so-great ones) for one of the coveted New York casino licenses expected to be awarded by the end of this year.

One project, Metropolitan Park in Queens, an $8 billion project near Citifield (that nw includes an affordable housing component), backed by Mets owner Steve Cohen and Hard Rock International, was tagged as a solid contender, on par with Las Vegas Sands’ proposal, and slightly behind the two existing racinos, Resorts World and Empire City.

The Queens project recently received another boost, per Gothamist:

“Queens State Sen. John Liu will back a plan that brings billionaire Mets owner Steve Cohen’s proposal for a casino near Citi Field closer to reality.

“Liu announced Sunday he’d introduce state Senate legislation to reclassify the 50 acres of asphalt parking lots around the Mets ballpark as commercial property instead of parkland – a move that would allow for developments like Metropolitan Park, Cohen’s $8 billion proposal for a sprawling casino and entertainment complex.”

Liu’s sponsorship is necessary because “State Sen. Jessica Ramos (who represents the district for the project announced that she would not introduce the parkland alienation bill to make way for a casino,” last year, per City and State New York. “Though not entirely unprecedented, it’s quite rare for another lawmaker to sponsor this sort of bill in a colleague’s district.”

The breaking of political norms could turn the project into a poisoned well that causes intraparty tension.

“When she announced her decision not to introduce a parkland alienation bill last year, Ramos told reporters that, ‘I would be very surprised, and frankly, offended, if someone would try to go around me and what the people in my district wish,’ City and State New York reports.

Around the Watercooler

Social media conversations, rumors, and gossip.

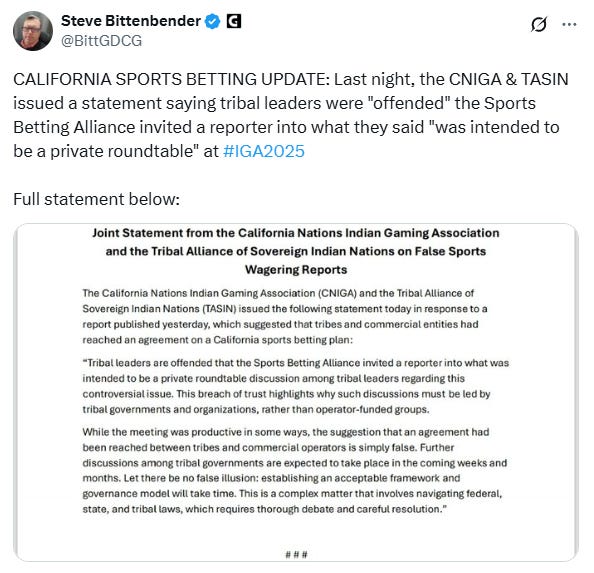

Yesterday’s news about a possible framework (that STTP cautioned, “don’t get too far out over your skies on what this means. As Victor Rocha said on X, “I spoke with several California tribal leaders tonight. It’s DOA.”) has gone south fast:

A great post from Alun Bowden on a customer segment that I’ve discussed many times (customers you really don’t want in or can’t bring into the regulated market):

Stray Thoughts

George Carlin has some terrific bits about religion, but my favorite is when he says he prays to Joe Pesci, who answers his prayers at about the same 50-50 rate that God was. The bit resonates with me because, despite its coin-flip punchline, it’s highly accurate.

Experts hover around that same shaky split when they tackle the unknown or deal with close calls. Carlin’s Pesci prayer lands because it’s less about divine knowledge and more about how we’re all guessing half the time, whether kneeling in a pew or waxing poetic about a topic.