Best Of The Best

Who are the best online casino candidates heading into 2025? STTP offers up its top 5 candidates today.

The Bulletin Board

NEWS: The five best online casino legalization candidates heading into 2025.

NEWS: Fanatics is approaching a 5% national market share. Can it challenge the FanDuel and DraftKings duopoly?

NEWS: Spectrum’s 10 Trends for 2025 + STTP’s thoughts on each.

AROUND the WATERCOOLER: Michigan has issued 800 live dealer licenses.

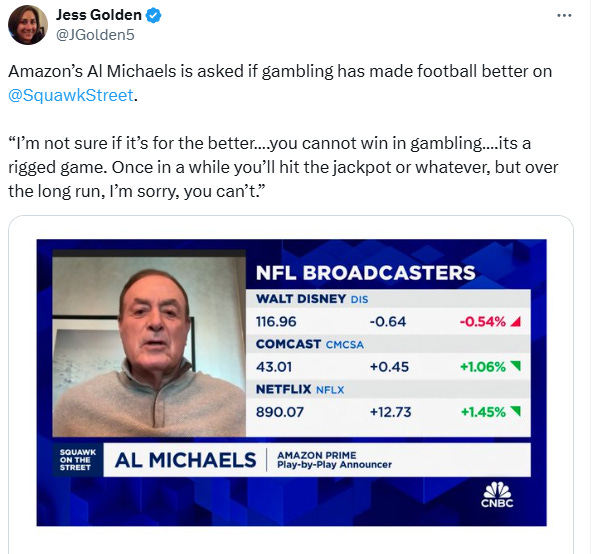

STRAY THOUGHTS: Al Michaels offers some straight talk about gambling.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade is now live in their fifth state; Virginia

The 5 Best iCasino Candidates in 2025

Who are the best online casino candidates heading into 2025? Let’s take a look at my Top 5 picks with some quick analysis (tomorrow’s newsletter will round out the Top 10), but as I’ve said in the past, being the best online casino candidate is a lot like being the valedictorian of summer school.

Arkansas

STTP FORECAST: Possible

A battle is brewing in Arkansas as Saracen Casino continues to push for regulatory changes that would authorize online gambling (starting with 50/50 raffles) via regulatory approval. You can find a full explanation of the Arkansas rule Saracen is trying to leverage here. Saracen CMO Carlton Saffa recently said he anticipates online casinos will begin in 2025 after voters nixed the Pope County casino. Saffa has also been highly critical of rival Oaklawn, which opposes online casino legalization.

Indiana

STTP FORECAST: Possible

Indiana is trending positive, as the bribery scandals involving former lawmakers and gambling operators are becoming a distant memory. There is still some legislative opposition, and at least one casino operator remains opposed. As an aside, the Indiana Behavioral Health Commission’s 2024 annual report suggested a sports betting tax rate increase; a better idea and an easy case to make, would be legalizing iCasino.

Iowa

STTP FORECAST: Possible, but unlikely

State Rep. Bobby Kaufmann, who has led the charge for online casino legalization in Iowa, and the Iowa Gaming Association’s Wes Ehrecke have both called 2025 “unlikely.” Ehrecke recently told Play USA the industry is 100% focused on legislation to stop the building of any new properties. And until that is completed, online casinos will not be discussed. However, revenue and visitation numbers at land-based casinos are declining, which could spur discussions.

New Hampshire

STTP FORECAST: Possible, but unlikely

New Hampshire is trending in the wrong direction now that Cordish Companies’ proposed $200 million casino has been approved. An iGaming bill passed the Senate in 2023 before failing in the House, but a casino scandal involving the spouse of a key lawmaker (who chaired the committee where the 2023 bill died) put an end to 2024 efforts before they started.

Colorado

STTP FORECAST: Unlikely

As Bonus.com reported in September 2023, Colorado iCasino chatter has been under the radar, with “casino owners and existing sports betting operators” discussing online casino gambling. I chose Colorado as a top candidate because of its experience with sports betting, ability to put iCasino on the ballot in odd-numbered years, and a $900 million budget deficit in 2025-26.

Want more of this type of analysis? Reach out to Steve to sign up for The Forecast, a premium service from Straight to the Point Consulting, for quarterly reports and weekly updates on legislative efforts in online casino, poker, and sports betting.

Fanatics Is Challenging the US Sports Betting Duopoly

Per Eilers & Krejcik Gaming (a newsletter sponsor), Fanatics’ national online sports betting market share now sits at just under 5% (4.8% to be precise).

So what’s behind the rise? Per EKG, it’s the same recipe for success that I wrote about last week, “Doing the basics well: a/k/a acquisition and retention.”

Allan Stone, the co-founder of Acquire.bet, recently posted on LinkedIn that “Fanatics entered the market with a focus on acquiring the right customers who offered positive long-term returns” and “leaned into messaging and bonusing that emphasized their core strengths as a user-focused, experience-driven brand.”

Stone sees the company’s retail roots as a considerable asset, saying:

“With a strong retail foundation, they’ve prioritized understanding user behavior better than anyone else in the space.

“Add to that their innovative approach to partnerships—structured for both immediate results and ongoing value—and it’s clear why they’ve pulled ahead.

“Most importantly, their product delivers. It’s intuitive, aligned with what players actually want, and stands out in a crowded field.”

EKG highlighted several reasons for Fanatics’ recent boom:

An improved app (which now ranks third in EKG’s proprietary app testing) that is keeping customers engaged and around longer.

With the improved app (and less fear users will seek out competitors’ products), there is also a new emphasis on acquisition, with more bonusing.

Like Stone, EKG also notes that “Fanatics is getting better at profiling and keeping the right customers around longer, with VIPs clearly a focus,” something STTP has noticed was a focus for the challenger brand.

I very much agree with this final thought from EKG:

“Tie it all together and Fanatics—along with bet365—looks to be one of the challenger brands capable of making a dent in the U.S. duopoly.”

Why hire Steve Ruddock? Over the years, Steve has advised startups, national gambling companies, government agencies, and investment banks on a wide variety of topics.

Whether you’re looking for market research, want to raise your brand awareness, or are trying to develop responsible gaming strategies, Steve can help with honest, balanced, no-nonsense analysis of the situation.

Steve’s unique experience and insights are often the missing piece to the puzzle.

Reach out for more information: Straight to the Point Consulting.

Spectrum Gaming’s 10 Trends

Every year since 2005. Spectrum Gaming releases its top trends to watch for the upcoming year. For 2025, Spectrum produced the following list (I’ve pared down Spectrum’s analysis for space where possible):

Digital Sweepstakes Gaming: … The mainstream gaming industry alike will continue to watch this upstart form of gaming closely to determine whether it is a threat or an opportunity … and potentially a catalyst for states to legalize traditional gaming.

STTP Thoughts: Sweeps will be a hot topic throughout 2025, and I’d echo Spectrum’s sentiment, which is that we simply don’t know how things will shake out.

Historical Horse Racing: Where casino slot machines are not permitted, both states and pari-mutuel and gaming industries will continue to advocate for the legalization or expansion of historical horse racing...

STTP Thoughts: HHR has proven a very successful stand-in for slot machines. However, it’s also a contentious product where existing casinos are trying to protect their revenue, as we saw in Minnesota this year.

Igaming: There appears to be little movement for igaming to be approved in new jurisdictions for 2025. Meanwhile, there are emerging indications that the continuing growth of igaming revenues in some of the seven current states may be slightly impacting retail gaming revenues, as seen in flattening year-over-year growth… This deserves careful analysis in 2025.

STTP Thoughts: A victim of its own success. The booming online revenues, particularly in New Jersey, have reignited protectionist attitudes from land-based operators that haven’t fully embraced online opportunities. A new approach to quelling these concerns is sorely needed.

Merging of Verticals: Operators are employing a single, cross-platform strategy as they seek new ways to leverage technology while gaining greater access to player databases… More such acquisitions across verticals can be expected in 2025.

STTP Thoughts: While a cross-platform strategy will no doubt continue at the top of the food chain, 2025 may see a reversal of this trend among mid-tier companies, who may see specialization as their only means of competing with the most prominent players.

New York City: … New York State intends to award up to three full-scale casino licensees for the New York City metro area. A key decision will be whether the state essentially converts current racetrack gaming operations Empire City and Resorts World NYC into full casinos while also selecting a third winner, or awards the three licenses to other applicants.

STTP Thoughts: The timeline is another facet of the New York casino licensing drama. Until the licenses are awarded, I don’t expect the state to seriously consider online casino legalization. And who the licenses are granted to may push legalization further into the future.

Policy: Emerging generations of elected and appointed officials are modifying and establishing gaming policies that are increasingly at odds with past practices. A vivid example of this can be found in states that are considering authorizing new forms of gaming (as identified in this list) without regard to maintaining standards of licensure or focusing on the integrity of licensees. This trend raises the risk of reducing public confidence in gaming.

STTP Thoughts: This is something I’ve been sounding the alarm on since 2018, and while it’s nice to see others join the chorus, the toothpaste is out of the tube, evidenced by the NCLGS Model Legislation expressly permitting temporary licenses.

Responsible Gaming: Operators and regulators alike are trying to determine how best to prevent problems and get ahead of negative trends in a player’s gambling activities. However, this will require data sharing and new legislation and regulations.

STTP Thoughts: RG and PG could be the most straightforward fix on this list, but entrenched interests and a lack of curiosity make real change highly unlikely. What we will get is more of the same… but with bigger budgets. One area to watch is the federal SAFE Bet Act; if the states and the industry don’t get their house in order, the federal government is likely to step in — which might make things worse.

“Skill” Machines: Various states face an increase in machines that are referred to as “skill” machines, while the regulated gaming industry views them as a form of unauthorized, unregulated gambling… Proponents of these games are endeavoring to seek licensure and to be taxed, while opponents say they cannibalize existing forms of legal gaming, and do not meet the requisite standards for licensure.

STTP Thoughts: The arguments are very reminiscent of sweepstakes and HHR machines. These machines will likely end up in the legal and regulated bucket (at some point in time), considering legal decisions have been all over the map.

Sports Betting: Having expanded wider and faster than any other form of legal gambling in this country’s history, sports betting operators will continue to look for new products, bet types, and promotions while also keeping an eye on potential state gaming-tax hikes as states’ federal pandemic aid runs out.

STTP Thoughts: There is little to add here besides the growing blowback against legal sports betting.

Texas: … [Expect] the usual hope for enabling casino legislation, led by Las Vegas Sands – as well as a push for sports betting in this state highly prized by the gaming industry. But it appears to be another uphill battle for proponents, and the legalization push may have strengthened efforts by opponents.

STTP Thoughts: I’ve written a lot about Texas, but to keep it short, the hurdles in place are significant, and legalization will require an Avengers End Game 1-in-14 million type of scenario to unfold, with the one exception below.

Beyond the Headline: Contradicting Yesterday’s Analysis

In yesterday’s newsletter, I made a case that the Trump administration won’t be overly focused on gambling policy (pro or con).

The one caveat I’d add to that is Texas, where Miriam Adelson and Las Vegas Sands have their eyes set on a casino resort. Adelson propped up the Trump campaign with $100 million of her own money, along with fundraising efforts among other billionaires.

The big question is how pressure to legalize resort casinos is applied to Texas.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Around the Watercooler

Social media conversations, rumors, and gossip.

More on the “Does online gambling create jobs” debate, this time from Michigan Gaming Control Board Director Henry Williams, who sat down with Gambling.com’s Larry Henry:

Two notes from the discussion.

First, Williams believes the customer segments for online and in-person are different. “Each has its own segment of the population, and we’re not seeing it cannibalize the land-based casinos.”

Second, according to Williams, the state has issued 800 occupational licenses for a single live dealer studio (which might explain EKG’s Texas job numbers):

“What we're finding, Larry, is we have more occupational licenses, the dealers, at live Studios than we have in some of our commercial casinos… we're licensing 800 individuals for one company to do online live dealing.”

And because we’re talking about jobs, and this scene makes me laugh every time:

Stray Thoughts

Al Michaels gives some unvarnished thoughts on gambling:

This is just the latest entry for my ever-growing list of gambling takes in the wild.

How is Illinois not in the top 5 iG possibilities? The state is very fiscally challenged, Fed stimmy money is gone, the 2025 budget deficit is conveniently the size of an iG legalization revenue raise ($500M+), JB cranked up OSB rates last year in the 11th hour to balance the budget (and is touting his fiscally prudent bona fides for a possibly bigger political role) and tax payers are revolting against any and all proposed tax increases. iG is the last large, stealth revenue raise available. Thoughts?