Crumblin' Down

Online casino hopes dashed early as multiple states quickly shelve legislation amid cannibalization and social harm concerns.

The Bulletin Board

THE LEDE: Online gambling bills fail to gain traction.

WEEKEND ROUNDUP: NJ considers an iGaming tax hike; Catena scraps its AI venture; Gaming expansion on the table in AL; France’s gambling tax debate.

NEWS: Minnesota sports betting bill sidelined, despite signs of compromise.

NEWS: NH considers iCasino; VT bill would prohibit online sports betting.

AROUND the WATERCOOLER: VGW (Chumba and Global Poker) raises minimum age to 21+.

STRAY THOUGHTS: A great movie scene, is actually a genius scene.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade is now live in their fifth state; Virginia

The Lede: States Pull the Plug on Online Gambling Bills

In January, a flurry of bills to legalize online gambling were introduced in statehouses nationwide. We’re only midway through February, and several of those efforts are already dead, with the rest shriveling on the vine.

That outcome isn’t surprising, as most analysts (including yours truly) predicted that zero new states would be added to the legal column in 2025. What is a little surprising is how quickly two of the best online casino candidates, Wyoming and Indiana, ditched their efforts.

Online Casino Bills

Wyoming: Wyoming’s 2025 effort lasted about as long as the state’s 2024 effort, which was shelved after about a week. A report from Spectrum called online casinos accretive to tribal casinos. Still, two tribes testified in opposition to HB 162 on Jan. 30, saying that the proliferation of gambling options in the state has already cut into their revenue. The measure failed to gain support from the committee, was put on hold, and is effectively dead.

Indiana [Mostly Dead]: The House Public Policy Committee passed HB 1432, sponsored by Rep. Ethan Manning, in a 9-2-2 vote on January 28, 2025 — Manning is the chair of the committee. And that’s as far as the legislation is likely to go in 2025, as the bill was shelved in the House after it failed to gain traction in Ways & Means due to cannibalization concerns. That prompted House Speaker Todd Huston to say, “There are all sorts of moving parts about how it impacts communities and what it does overall to the gaming environment in Indiana.” I’ll discuss Indiana’s online casino struggles in tomorrow’s newsletter.

Virginia — Virginia was considering two bills to legalize online casinos, SB 827, sponsored by State Sen. Mamie Locke, and HB 2171, sponsored by Del. Marcus Simons. Both bills limited online casino licenses to existing B&M casinos, at a cost of a $1 million license fee and a 15% tax rate, with 2.5% of that revenue earmarked for problem gambling. The efforts didn’t last very long, as Locke and Simons pulled their respective bills on January 20 for further study. At issue was a fiscal note that concluded online casinos would hurt the state’s lottery sales.

Sports Betting Bills

North Dakota: HCR 3002, which would have put sports betting on the 2026 ballot in the state, was voted down in the House shortly after it was introduced.

Minnesota [Somewhat Dead]: Minnesota has three bills to consider: State Sen. Jeremy Miller introduced SC 1900, State Sen. Matt D. Klein introduced SF 757, and State Sen. John Marty introduced SB 978. However, the best of the three (in terms of stakeholder agreement), Sen. Klein’s SB 757, failed to make it out of committee and is now in legislative limbo. You can find a deeper dive into the Minnesota situation further down in this newsletter.

Weekend Roundup: NJ iGaming Tax Hike; Catena Scraps AI; AL Gaming Expansion; France Gambling Tax Debate

New Jersey Gov. is considering an online gambling tax hike: New Jersey is facing a $3.8 billion budget deficit, and anonymous sources suggest that Gov. Phil Murphy is considering increasing the tax on online gambling in his forthcoming budget. “Murphy is said to be mulling a boost in the tax rate for online gaming revenue—currently at 13% for mobile sports betting and 15% for online casino gaming,” Casino Reports John Brennan notes.

Catena Media scraps its AI program, but not AI: Catena Media CEO Manuel Stan said the company has discontinued “the AI content generation platform joint venture” launched under previous CEO Michael Daly. “We continue to see AI as an important business enhancer, for example, in scaling up content output and quality,” Stan said. The new CEO also highlighted Google updates as hitting the company’s bottom line and its continued embrace of sweepstakes sites.

Poarch Band of Creek Indians in gambling expansion talks with Alabama lawmakers: After opposing a gambling expansion in 2024, The Poarch Band of Creek Indians and Alabama lawmakers are in talks to consider a new gambling expansion package in 2025. Per 1819 News, “Multiple sources have confirmed talks between the Poarch Band of Creek Indians (PCI) and lawmakers in the Alabama Senate to pursue gambling expansion during the ongoing legislative session.”

iGaming trade group fights against tax rate increases in France: France’s online gambling trade body AFJEL is pushing back against proposed tax increases on online gambling operators. Per Jake Pollard, “The government included the amendments in last week’s social security budget. While lottery monopoly Française des Jeux will see GGR tax levels rise from 6.6% to 7.6%, for OSB operators, the rise will be from 10.5% to 15% of GGR. Tax levels for online poker sites will rise from 0.2% on stakes to 10% of GGR.”

SPONSOR’S MESSAGE: Calling all iGaming founders—limited availability remaining!

Step into the world of iGaming with an engaging lineup of industry experts. Daniel Burns and Karolina Pelc will break down “The Art of the Deal,” offering a deep dive into the strategies shaping the market. Dustin Gouker will pull back the curtain on iGaming’s PR machine, revealing the good, the bad, and the unexpected. Then, Philip Drury, Tom Hall, and Joe Asher will explore what it takes to build for the future, followed by a session on the industry’s newest disrupters by David Huffman, Zach Bruch, and Akshay Khanna.

Don’t miss this chance to connect, learn, and get ahead. Click here to register!

News: MN Sports Betting Bill Fails, Despite Compromise

A hearing to discuss one of Minnesota’s sports betting bills, State Sen. Matt Klein’s SB 757, ended in a 6-6 vote despite the appearance of a universal stakeholder agreement from tribes, charity gaming, and horseracing tracks all supported the measure — STTP would note that one of the state’s racetracks, Running Aces, was quiet on the bill, and hasn’t been fully on board.

The bill is now in legislative limbo, failing to pass its first committee. However, there was some talk that a forthcoming fiscal note could revive the measure. As Ryan Butler of Covers wrote, even if it eventually passes the Senate Local and State Government Committee, “it would still need to pass five additional Senate committees and the full floor” and then repeat the process on the House side.

Other sports betting bills do not have the level of stakeholder agreement that Klein’s bill possesses, including a far more restrictive proposal from State Sen. John Marty, SB 978, that has a 40% tax rate and prohibitions on college props, in-play bets, and advertising, including push notifications.

Under Klein’s bill, sports betting licenses would be available to the 11 gaming tribes in the state, which would be taxed at 22%. Charity gaming would receive 45% of the tax proceeds and racetracks 15%, which formed the basis for the compromise. Another 15% was earmarked for tribal aid.

Working against Minnesota’s efforts is the zeitgeist.

Sen. Erin Maye Quade voiced several responsible gambling and social harm concerns — Maye Quade is a co-sponsor of SB 978. “I have no problem with people betting on sports. I do it all the time,” Maye Quade said. “What I have a problem with is introducing a predatory industry that can use things like algorithms to manipulate our behavior to get people to do things they otherwise wouldn’t do.”

“We tax the industry we’re allowing and authorizing in the bill. We pile that money up in the government, and we develop government and programs with the hope that the government and programs will solve the problem we created with the bill,” Sen. Steve Drazkowski said. “Members, I call that insanity… I don’t think we should be doing bills that create problems with the hope that the government will come along and fix them. Because, as we know, it doesn’t, and it won’t.”

News: NH iCasino Bill Advances; VT Considers OSB Repeal

The Twin States are divided. New Hampshire is making progress on legalizing online casinos, while a Vermont bill would roll back the state’s 2023 law authorizing mobile sports betting.

With two leading online casino candidates (Indiana and Wyoming) already out of the race, New Hampshire has become the top contender.

After a January 29 hearing failed to produce a vote, State Sen. Tim Lang’s online casino bill, SB 168, received some good news after an amendment, which led to the Ways and Means Committee passing the bill.

As previously reported in the newsletter:

“The New Hampshire Ways and Means Committee listened to testimony on State Sen. Tim Lang’s online casino bill, SB 168, but failed to vote on the measure. Besides Lang, only two other speakers testified: Brianne Doura-Schawohl, who spoke on behalf of the Campaign for Fairer Gambling, and Alicia Preston, president of the New Hampshire Charitable Gaming Association. Doura-Schawohl talked about the likelihood of increased harm, and Preston voiced concerns about decreased foot traffic at the state’s charity casinos.”

The amendment clarified where the tax revenue would go to placate charities and the state’s charity casinos.

The bill now reads [new language is bolded]:

“AN ACT regulating online gambling and directing net proceeds to the education trust fund, the general fund, charitable organizations, and to reimburse municipalities for elderly, disabled, blind, and deaf tax exemptions.”

The amendment also breaks down the new revenue share for the 45% tax it imposes on online casino operators, including 35% to charitable organizations with whom the licensee contracts.

The remaining 65% is earmarked for the commission to distribute as follows:

25% to the special fund established under RSA 284:21-j.

25% to the elderly, disabled, blind, and deaf exemption reimbursement fund.

50% to the general fund.

And then there is Vermont, where three lawmakers have introduced legislation to repeal the state’s 2023 sports betting law.

Vermont State Rep. Troy Headrick, a co-sponsor of H133, called the state’s sports betting law a “regressive” tax.

“State-sanctioned gaming functions as a camouflaged form of regressive taxation,” Headrick told Play USA. “It disproportionately harms low-income and working families who are forced into desperate financial decisions.”

Vermont is the first state to consider repealing its sports betting law. Putting the genie back in the bottle is no small task. Still, considering the state collected just $6.4 million in tax revenue from sports betting operators in 2024 (mobile betting launched in January 2024), if any state were to execute a sports betting repeal, it could be Vermont.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Around the Watercooler

Social media conversations, rumors, and gossip.

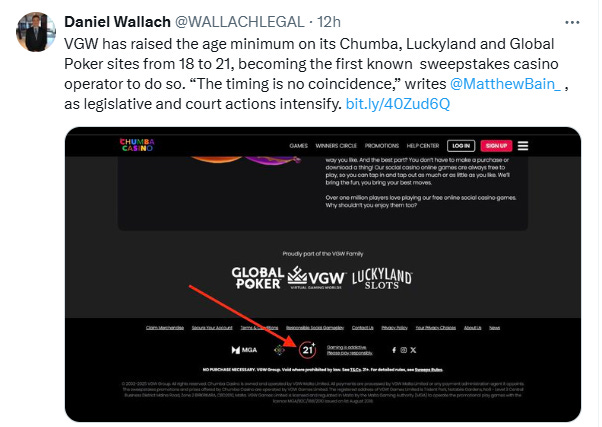

Sweepsy.com reports a very intriguing development in the sweepstakes sector: VGW is raising the age requirement on its casino and poker sites to 21+.

According to Sweepsy, the change will take effect as follows:

Feb. 12 — Gold Coins can no longer be purchased by anyone under 21, but they can continue to use Gold and Sweeps Coins in their account.

Feb. 19 — All games will be locked to anyone under 21, and Sweeps Coins redemptions will no longer be permitted.

April 17 — Access to VGW sites and will be “locked out” until they turn 21.

Daniel Wallach posted a screenshot of the new policy on X:

The news will likely cause a chain reaction in the sweepstakes sector. VGW is the largest operator, and with states casting a critical eye on these operators, the other operators will almost certainly follow suit.

Stray Thoughts

There is a lot to the showdown scene in Tombstone where Doc Holliday guns down Johnny Ringo. Holliday shoots Ringo under the chin and goads him into discharging his gun, and then when Wyatt Earp arrives, he says, “I'm afraid the strain was more than he could bear.”

My interpretation of that scene is that Holliday planned to leave before Wyatt arrived, leaving Ringo shot under the chin and through the head with one bullet missing from his gun, making it look like he took his own life. Why? So Wyatt wouldn’t have to fight Ringo (and lose) and could save face but not letting his friend fight for him.