Emergency Newsletter: What’s Next For Barstool Sports?

My thoughts on where the Penn-Barstool relationship failed, and what's next for Barstool now that it is once again controlled by Dave Portnoy.

The Penn-Barstool-ESPN news is sucking all the oxygen out of the room and for good reason. Penn spent more than $500 million acquiring Barstool and handed the reins back to Barstool founder Dave Portnoy for a few assurances and 50% of a future sale, which is unlikely to happen, according to Portnoy.

The second part of the story, the deal between Penn and ESPN creating ESPN Bet, is the Lede, but here I will focus on the Barstool angle.

What Went Wrong

It’s pretty clear that Penn and Barstool entered the relationship with the best intentions and wanted it to work. Based on its unique sports-driven content and user engagement, Barstool thought it possessed the perfect recipe for sports betting success. Penn was the chef that could put it all together.

The result was something less than a Michelin-star restaurant. The Barstool Sportsbook app built on Kambi’s framework was good but not great per Eilers & Krejcik's testing. The new theScore tech stack scores similarly.

The marketing approach was narrow, eschewing affiliates and traditional marketing and instead focusing on Barstool’s social media audience and Penn’s database.

And then there was the tension as two radically different corporate cultures collided.

All things considered, the mashup wasn’t as big a failure as it’s being portrayed. The divorce stems from a widening rift between Penn and Barstool as the landscape continued to evolve into a more sanitized and less seat-of-the-pants Barstool-like approach. Increased regulatory scrutiny in Ohio and Massachusetts, shifting goalposts around responsible gambling, and the firing of Mintzy, which appeared to be a tipping point event for the partnership. It was becoming evident that neither side knew how to interact with the other, and both lacked authenticity.

Both sides were right. Penn needed a toned-down Barstool to navigate the regulatory landscape. Barstool needed an edge to keep its audience. At the end of the day, the Barstool audience wasn’t interested in a toned-down Barstool, they wanted the edge, so Barstool would only tone down so much. It wasn’t enough for Penn and too much for Stoolies.

Now What?

My guess is Barstool will do what it does best; use the last five years as a storyline arc to generate content, which is already occurring.

Barstool will quickly reestablish its street cred with its core audience – rehiring Mintzy and pulling the “Pirate Ship” out of mothball.

Its content will improve (from Barstool’s perspective), as it has shed many of the regulatory constraints it had to adhere to in order to maintain its licenses.

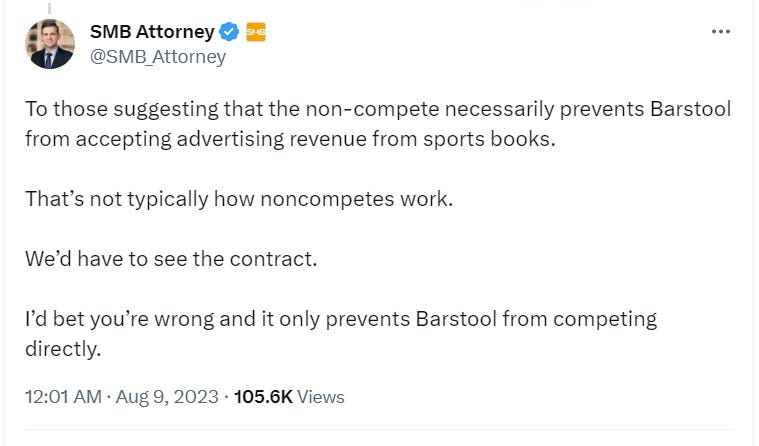

The big question I have is, what is in that non-compete?

The consensus is Barstool will not be able to enter into affiliate agreements with sports betting operators. But we don’t know for sure. We don’t know if that extends to traditional advertising on the Barstool platform. And we don’t know when the marketing restrictions expire (assuming there are any).

Opinions are pretty divided on what is in that non-compete. My best guess is Barstool will be able to accept traditional ad deals but will be prohibited from acting as an affiliate.