Heads Or Tails?

there are reasons to be bullish and bearish about the future of sweepstakes casinos, but one thing is for certain, this won't be the last fight over a product's legal standing.

The Bulletin Board

NEWS: Will tailwinds bring sweepstakes to the promised land, or will headwinds blow it off course?

BEYOND the HEADLINE: Everything is gambling, and that’s ok.

VIEWS: Is Hard Rock really going to give up its Florida monopoly?

NEWS: ESPN Bet’s underwhelming New York debut.

AROUND the WATERCOOLER: Sports betting/Casino takes in the wild.

STRAY THOUGHTS: I’ve seen this movie before.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

“Sporttrade is now live in Arizona on Android and iOS!”

Sweepstakes Tailwinds and Headwinds

Tailwinds: As many noted on social media, everyone is suddenly in the sweepstakes business. Whether it’s major operators or small startups, there are sweeps coins in them thar hills, and people are going after it.

According to Eilers & Krejcik Gaming (a newsletter sponsor), the social casino industry (traditional and sweepstakes sites) has a total addressable market of $11 billion in 2024.

Of course, not everyone prospers in a gold rush, and plenty of people willing to cut corners will enter the space. That could create some additional pressure on the operators trying to gain legitimacy.

With that in mind, enter the Social and Promotional Games Association (SPGA), a recently launched trade group with 11 members: 10 Ten Gaming, Blazesoft, Fliff, FSG Digital, Gold Coin Group, High 5 Entertainment, KHK Games, Kickr Games, Octacom, Rolling Riches, and Woopla Gaming.

Per a press release, the SPGA aims to “highlight the well-established legality and legitimacy of social sweepstakes games, providing regulators, policymakers, and consumers with a comprehensive understanding of these offerings.”

Speaking with Straight to the Point, an SPGA spokesperson said:

"It's not unusual for innovative categories to come under fire from incumbents. Part of the mission of the SPGA is to counter the misinformation campaign mounted by companies who simply don't like competition."

Headwinds: Where is that misinformation coming from? Pockets of the industry are crying foul; several states (Michigan, Delaware, and Connecticut) have already issued cease-and-desist notices to sweepstakes operators. The American Gaming Association is sniffing around the edges by asking states to investigate the legality of sweepstakes operators within their borders.

California tribes are also starting to take a closer look at these operators. For years, they’ve protected their brands by not letting online gambling firms enter through the front door, and they won’t sit idly by while others come through the side door. Or, as Victor Rocha put it, as only Victor can, “If the Vampire Squid called Sweepstakes Gambling insists on sticking its blood funnel into California, we will chop it off.”

“I was on the phone and emailing all day yesterday,” Rocha tweeted. “The lawyers are researching. Tribal leaders are talking. Nothing unites the California tribes like a good ass whoopin’.”

- The Indian Gaming Association is hosting a webinar on Sweepstakes today titled California's Gray Market Invasion: Sweepstakes Gambling & DFS 2.0 — Register here.

There is also a growing list of class action lawsuits against Sweepstakes operators, which, while largely meaningless (the industry is a magnet for class action lawsuits), provide some extra ammunition to sweepstakes critics.

One of the lawsuits, in Florida, has an extra layer, as it names Worldpay as a defendant alongside VGW. Per attorney Daniel Wallach, the suit alleges that “VGW's online sweepstakes casino is an illegal gambling operation" and that Worldpay "aided and abetted" VGW's gambling business by acting as its payment processing partner.”

I’ve dubbed payment processors as a weak link in the sweepstakes chain. If processors get cold feet working with sweepstakes sites, life will be complicated for the operators.

That said, payment processors aren’t the only weak link. Other critical elements exist that, if removed, could massively impact sweepstakes operators — I’ll save that for another day or a private conversation if anyone wants to reach out.

Beyond the Headline: Everything Is Gambling

Speaking of sweepstakes and legally ambiguous offerings, if we follow the letter of the law, virtually everything becomes gambling, containing the three elements: consideration, chance, and prize.

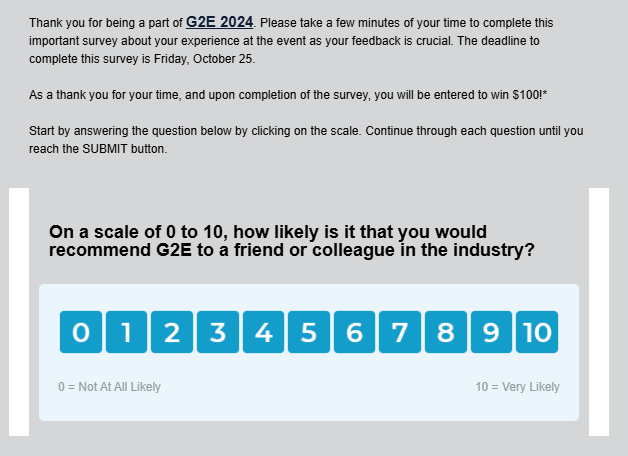

I’ve made this argument about everything from baseball cards to the claw machine. If we expand consideration to include personal data or information, we can even add surveys to this list, like the one sent out by G2E:

As I previously said in the newsletter:

“There is always a loophole to exploit… and when there isn’t, you get black market operators filling the void.

“Second, I have no idea where to draw the line, and neither do lawmakers and regulators who know way less about these topics than I do.”

“Bottom line: What is and isn’t gambling is a game I have little interest in playing. There are two things I want to know about a “gambling” product:

Is the company licensed or operating with regulatory approval?

Is the company legitimate and acting responsibly in the space?

“If it meets those two bars, it’s hard for me to get worked up about it.

“I always circle back to former Massachusetts Gaming Commission Chair Stephen Crosby’s simple solution, “Call it all gambling and let the regulators work it out.”

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Why Would Hard Rock Give Up its Florida Monopoly?

One of the most interesting comments from G2E 2024 was made by Hard Rock International Chairman and Seminole Gaming CEO Jim Allen, who told CNBC:

"I would say whether it's FanDuel or whether it's DraftKings, we've actually developed a great relationship with them. We do recognize that long-term, some type of strategic relationship with some of the brands that really have marquee value could be helpful to both of us and we are receptive to those conversations."

The idea that Hard Rock would be willing to share its Florida monopoly comes as a bit of a surprise — particularly if, as expected, online casino is on the table in the coming years.

My guess is Allen is “speaking politician,” and Hard Rock is only interested in bringing FanDuel and DraftKings to market if the deal is perfect and reaps more benefits for Hard Rock than its current monopoly.

Sports betting is a low-margin business (yes, hold rates are skyrocketing in the SGP era, but the overall business still has little meat on the bone), so if Hard Rock could reach an agreement whereby FanDuel and DraftKings give them a larger (not to mention, no-risk, guaranteed) percentage of their revenue than Hard Rock gets from its own. Allen called that type of deal “helpful to both,” which is the classic win-win situation.

As enticing as a deal would be, reaching an agreement won't be easy. A coordinated bid is possible, but the more likely scenario is Hard Rock playing FanDuel and DraftKings off one another, as neither would want to cede Florida to the other. That would drive up the price, perhaps into “this is no longer viable” territory.

As an aside, I think this is why California tribes and commercial operators will eventually reach an agreement with the major commercial operators rather than go the B2B route: it is better to receive 25% of revenue from someone else’s work than 5% of your own.

As a second aside, the operators will also have to tread carefully in their discussions with the Seminole Tribe to avoid unraveling the work done (mainly by FanDuel) to mend tribal relations after the California debacle in 2022, particularly if, as CNIGA’s James Siva said at G2E, 2026 is a possibility.

ESPN Bet’s First New York Revenue Numbers

The early numbers are out, and while ESPN Bet didn’t throw down the gauntlet in New York, it did generate $9.1 million in handle, landing it in the bottom half of the nine-operator pack, ahead of Bally Bet and Empire Resorts and essentially tied with BetRivers.

With the caveat that it was its first week in the market, the numbers are not where Penn and ESPN Bet want to be. Some are now wondering if ESPN Bet is too late to the party and lacks the offerings of a true disruptor, with its brand as its one true asset.

These concerns are far from new. A month ago, Chris Grove told Business Insider (paywall):

"When you factor in the structural advantages that so many of their competitors have, it becomes challenging to see how Penn can effectively make up a substantial amount of ground in the rest of the decade — let alone in a single NFL season," Chris Grove, partner emeritus at research firm Eilers & Krejcik Gaming, LLC, told Business Insider.

"ESPN is a singular brand, and there's no doubt that it provides Penn with unique opportunities, and there's no doubt that you'll see Penn unlock more of those opportunities as the integrations across the ESPN ecosystem become deeper and more meaningful and as the ESPN Bet product improves," Grove said. "The problem is that Penn's competitors are not standing still."

Another interesting comment from that time was made by former Catena CEO Michael Daly on LinkedIn: “ESPN appears to be too late unless they wish to expend excessive capital marketing reasons to convert and also have a compelling reason to.”

Daly went on to say that FanDuel and DraftKings got to their dominant market positions via a “marketing bloodbath.” Still, with few new markets on the horizon, that strategy could be obsolete, Daly wrote:

“Now that new markets are no longer appearing, will we see more player evaluation of product and perhaps switching on that front? But ESPN would have to have far superior product features to switch enough market share to be meaningful. And ESPN does not seem to have that product at this point.”

And I’d be remiss not to mention that this is the mild criticism. Other commentators are far more critical and not without reason.

I’ve been withholding judgment on ESPN Bet’s long-term outlook and will give it more time before removing it as a potential podium contender.

SPONSOR’S MESSAGE - Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences.

The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless.

Visit: www.kambi.com

Around the Watercooler

Social media conversations, rumors, and gossip.

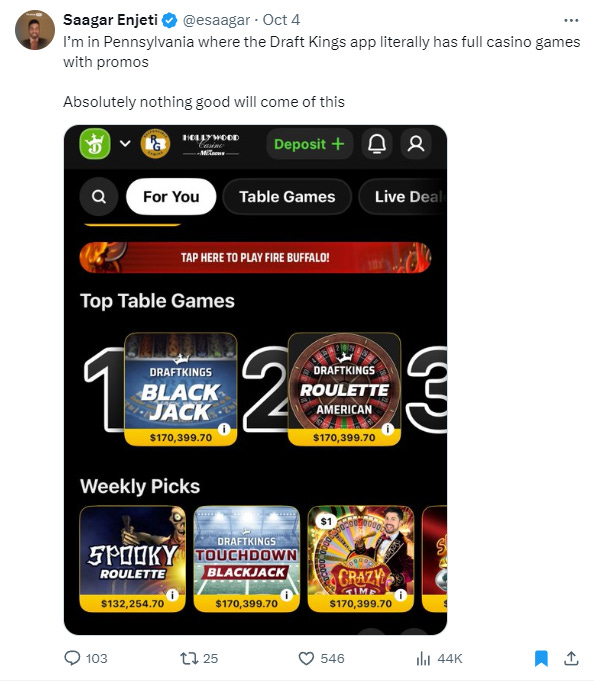

I’ve been sitting on this tweet for a while, but it falls into my ongoing coverage of sports betting in the wild social media posts.

As I’ve said in past instances where mainstream media, celebrities, or randoms discuss or tweet about sports betting (here and here), the comment section will give you a good idea of how the average person views the post-PASPA sports betting world.

Stray Thoughts

Everything old is new again.

Case in point, my latest column at Casino Reports looks at the similarities between the current arguments around sweepstakes sites and the DFS battles from a decade ago:

“The fact of the matter is that sweepstakes operators exist because of antiquated thinking that restricts the legalization and regulation of online gambling.

“Sweepstakes casinos are filling the same void that DFS filled pre-PASPA repeal; they are a stand-in product for licensed mobile casinos, which are only available in seven states.”