I Know It When I See It

AGA survey indicates the public thinks prediction markets are gambling, but at the end of the day, it will come down to what the courts think.

The Bulletin Board

THE LEDE: AGA releases data on public perception of prediction markets.

ROUNDUP: CFTC and SEC announce joint roundtable; MO sports betting license deadline looms; The Quintenz Files.

NEWS: Fanatics continues to make inroads as market share grows.

AROUND the WATERCOOLER: Kalshi > NJ during Third Circuit arguments.

STRAY THOUGHTS: I’m pretty much prediction-marketed out.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: AGA Research: Prediction Markets = Gambling

New research from the American Gaming Association (AGA) suggests what many of us already suspect: the public (2,025 registered voters surveyed by YouGov) overwhelmingly believes sports prediction markets are a form of sports betting.

Per the press release:

“The American Gaming Association (AGA) today released new research showing strong sentiment that sports events contracts offered through prediction markets — online platforms where users wager on the outcomes of future events — should be regulated in the same way as other forms of legal, state-regulated sports betting. The study also shows that the public overwhelmingly views them as a form of gambling that requires oversight.”

Key Findings:

85% of respondents say sports event contracts are most like gambling, while only 6% believe they are most like a financial instrument.

80% say that sports event contracts should be regulated like other online sports betting.

65% believe these bets should be overseen by state and tribal gaming regulators, not the federal Commodity Futures Trading Commission (CFTC).

84% of Americans, and 69% of sports bettors, say that sports event contracts should only be available in state-licensed sportsbooks in the states where they are offered.

69% of Americans believe each state should have a say on whether sports event contracts can be offered in their state.

70% say prediction platforms offering sports event contracts are exploiting loopholes to act as unlicensed sportsbooks.

“This research has made it clear: Americans know a sports bet when they see one—and they expect prediction markets offering sports event contracts to be held to the same rules and consumer safeguards as every other state-regulated sportsbook,” said AGA President and CEO Bill Miller. “This underscores the need for the CFTC to enforce and uphold its own regulations that prohibit gaming contracts, and for Congress to use its oversight power to ensure prediction markets are not used as a backdoor for gaming.”

Meanwhile, prediction markets are pointing to a new commentary that (as I noted yesterday) claims any attempt to remove sports contracts from prediction markets could collapse the global economy:

“This debate may seem like a trivial regulatory turf war over a startup industry. But we have learned the hard way what happens when the CFTC is absent from these markets. The agency guarantees the smooth functioning of derivatives, a vast marketplace that underpins the global economy. Allowing states to start chipping away at its power would sow investor doubt, potentially unraveling U.S. primacy in the marketplace and sparking capital flight from our commodities markets. The market disruption that would follow is a summer sequel nobody wants to see.”

Kalshi’s Sara Slane was even more apocalyptic, saying on LinkedIn:

“Now, state gambling regulators are trying to claim jurisdiction anyway. If they succeed, they won’t just strangle a growing industry — they could open the door to states picking and choosing which futures and derivatives contracts are legal. That puts at risk the $730 trillion global derivatives market that underpins the economy… Allowing states to chip away at federal preemption would unwind hard-won post-crisis reforms and invite chaos in U.S. and global markets.”

Let’s be serious for a second, every prediction market in existence could disappear overnight and nothing would change (as previously noted: the US swaps market’s notional value is likely $250–350 trillion, compared to sports betting’s $200–300 billion in handle).

But that’s not even the current ask. The current ask is that they stay out of sports markets — That’s it. States are not nibbling away at CFTC oversight; they are simply saying that in the last several months, CFTC licensees have moved into an area long believed to be the domain of states.

Roundup: CFTC + SEC Roundtable; MO Sports Betting Licenses; The Quintenz Files

CFTC and SEC to host joint roundtable [CFTC Press Room]: On Monday, September 29, the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) will host a “Joint Roundtable on Regulatory Harmonization Opportunities.” In a joint release, the two agencies said: “It is a new day at the SEC and the CFTC, and today we begin a long-awaited journey to provide markets the clarity they deserve,” said SEC Chairman Paul S. Atkins and CFTC Acting Chairman Caroline D. Pham (the only CFTC commissioner at the moment). “By working in lockstep, our two agencies can harness our nation’s unique regulatory structure into a source of strength for market participants, investors, and all Americans.” Among the topics likely to be discussed are crypto and prediction markets.

ESPN Bet files for a sports betting license in Missouri [Sports Betting Dime]: The Missouri online sports betting market is beginning to come into focus. With a September 12 application deadline looming, ESPN Bet is the seventh operator to hand in their paperwork: “PENN Sports Interactive, and its ESPN BET online sports betting platform, is the latest to submit an online sports betting license application to the Missouri Gaming Commission. Circa and DraftKings secured the two untethered licenses. Fanatics, Caesars, ESPN Bet, FanDuel, and Underdog have all submitted applications. Operators are expected to launch on December 1.

The Quintenz Files [Event Horizon]: We are in a strange timeline: “The nominee to lead the Commodity Futures Trading Commission posted screenshots of a Signal chat history with the Winklevoss twins — the co-founders of the Gemini cryptocurrency exchange — on Wednesday.” Rumor has it that the Winklevii are the reason Quintenz’s nomination has stalled. Previous STTP coverage on the current status of the Quintenz nomination process.

SPONSOR’S MESSAGE: This Responsible Gaming Education Month, the AGA and our members are aligning around Play Smart from the Start—a new hub making responsible gaming education more consistent and accessible. Explore resources, share them with your networks, and join the industry’s collective commitment to leading on responsibility in gaming.

To get involved, explore the RGEM 2025 and Play Smart from the Start industry toolkits.

Challengers Continue to Gain Market Share

While everyone is focused on the ‘threat’ of prediction markets stealing market share during the upcoming NFL season, the top sportsbooks should be paying very close attention to their peers in the “challenger” category.

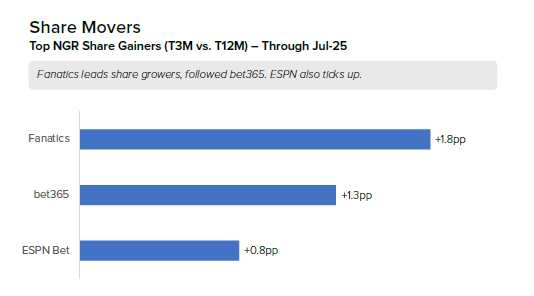

As Eilers & Krejcik Gaming (a newsletter sponsor) recently noted, Fanatics and bet365 (and ESPN Bet) are all growing:

The most significant increase is occurring in New York, where Fanatics has recently posted a 27.7% market share, a 500% rise compared to last year, when it held a 6.5% market share. In two of the previous three weeks, Fanatics has been the market share leader by handle. As Earnings+More noted, “Data from the New York State Gaming Commission revealed that from an average handle of $34m in the 10 weeks to August 10, Fanatics suddenly leapt to over $147m in the week to August 17.”

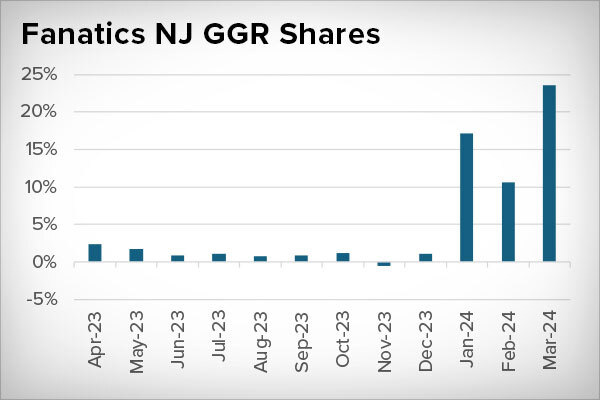

However, like Fanatics’ previous rise in New Jersey in 2024, the current uptick in New York could be the work of a single VIP bettor. Per InGame:

“The possible appearance of a VIP bettor, commonly called a “whale” in gambling parlance, could have been the key component of New York’s mobile sports betting handle surpassing $2 billion in August, according to monthly figures released Thursday by the New York State Gaming Commission.”

As E+M noted, the handle bump hasn’t translated into a revenue bump: “In the first two weeks of greatly increased handle, Fanatics produced GGR of $2.7m and a mere $441k.”

Recall, Fanatics had a massive bump in New Jersey in April 2024 before falling back to earth several months later:

“Eilers & Krejcik Gaming believes a minimal number of VIPs, perhaps even a single user, is the catalyst for Fanatics’ sudden rise in January.”

“EKG pointed to Fanatics’ monthly volatility as another indicator that VIP money is behind its ascent, noting its GGR has been on a three-month GGR rollercoaster: $28 million in January, $7 million in February, and $20 million in March. Nor has Fanatics replicated its New Jersey success in other locales.”

SPONSOR’S MESSAGE - Episode 90: Who Has the Best Prediction Market Product?

Host Brad Allen is joined by pro bettor Man of the Vig to discuss prediction markets, including:

The current holes in Kalshi's product

Which rival has a better UX

Whether prediction markets will ever be competitive with sportsbooks

Listen to the episode here.

Around the Watercooler

Social media conversations, rumors, and gossip.

I’m going to dedicate this section to the 15-minute-per-side oral arguments that took place yesterday in front of the Third Circuit Court as Kalshi and the state of New Jersey made their case.

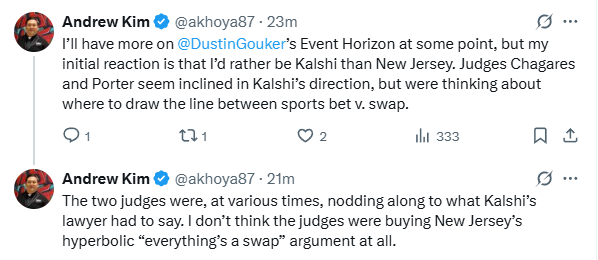

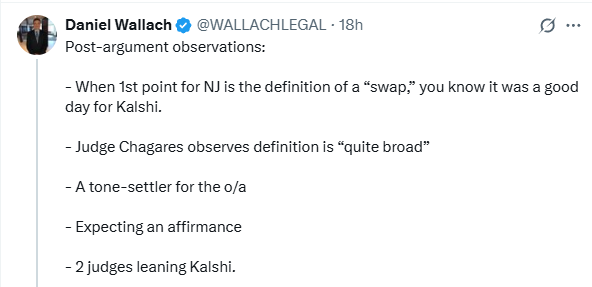

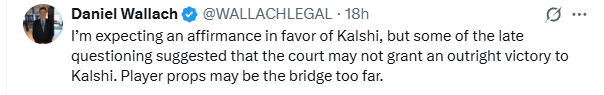

Adhi Rajaprabhakaran, who writes the excellent Fifty Cent Dollars Substack, summarized it, “serious grilling on both sides, no obvious loser, but as one lawyer in attendance said: ‘I’d rather be Kalshi, that’s for sure.’”

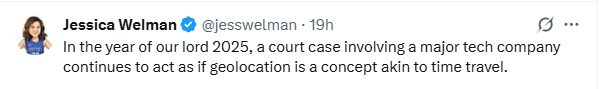

New Jersey argued that sports bets are not swaps (much to the delight of Kalshi) and, as Fifty Cent Dollars put it, “You could hear skepticism from the bench that 'sports ≠ swaps' settle anything; Kalshi’s attorney emphasized that the elected branches, not the court, ultimately draw the line. Then pivoted back to the statute’s actual words.”

One question that came up is, what contracts, precisely, fall outside the definition; what markets don’t have financial interest like some player props.

And because I like to keep it light:

Stray Thoughts

I’ve been prediction market heavy again. Hopefully that will change moving forward.