The News Never Ends

The CFTC breaks its silence on Prediction markets, and it wasn't great news (nor was it bad news) for Kalshi and others who are offering sports contracts.

The Bulletin Board

THE LEDE: CFTC finally weighs in on sports contracts, and its views are not what prediction markets were hoping for.

ROUNDUP: MGC talks limiting again; Daly lands at Aristocrat; FanDuel inks agreement with Amazon.

NEWS: Exclaim Recovery launches the first AI gambling addiction chatbot.

VIEWS: DraftKings adds Evive resources, strengthening RG tools.

AROUND the WATERCOOLER: Irrational markets.

STRAY THOUGHTS: Flipping the bird.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: CFTC Breaks Silence on Sports Contracts

I have an unfinished draft article on the lack of action (in either direction) from the Commodity Futures Trading Commission (CFTC) regarding sports contracts. It begins with the words, ‘Say something. A-N-Y-T-H-I-N-G!

That article may now be destined for the rubbish bin.

As first reported by Dan Bernstein at Sportico, the CFTC has (somewhat) broken its silence on the existence of sports contracts:

“The Divisions are aware that certain registered entities and registrants are listing or facilitating the trading or clearing of sports-related event contracts, or may be interested in the future in doing so, and that there are market participants interested in trading these products. The Divisions are also aware of various forms of State regulatory actions and pending and potential litigation concerning the legality of sports-related event contracts listed on DCMs.

“The Divisions are issuing this Advisory to caution FCMs, IBs, DCMs, and DCOs that State regulatory actions and pending and potential litigation, including enforcement actions, should be accounted for with appropriate contingency planning, disclosures, and risk management policies and procedures. The Divisions note that FCMs, IBs, DCMs, and DCOs should be prepared to identify such contingency plans, disclosures, and risk management policies and procedures as part of the routine registration, oversight, and examination activities of the CFTC and applicable self-regulatory organizations, including monitoring legal developments and have risk mitigation and contingency plans in place to deal with any developments that may affect customer, market participant, or clearing member positions and funds.

“FCMs, IBs, DCMs, and DCOs should provide customers, market participants, and clearing members with regularly updated information, including information based on any States in which they operate or engage in activity, to ensure that such customers, market participants, and clearing members understand the possible effects should State regulatory actions or ongoing or new litigation, including enforcement actions, result in termination of sports-related event contract positions. Among other things, FCMs and DCOs should ensure that their customers and clearing members are aware of liquidation or close-out policies and procedures that the FCM or DCO may deploy for sports-related event contracts as well as how the FCM or DCO will handle any necessary disposition of customer or clearing member funds and property.”

And we also got these gems in the footnotes:

“The Commission has not, to date, been requested to take or taken any official action to approve the listing for trading of sports-related event contracts on any DCM… All sports-related event contracts that are currently listed for trading on DCMs have been listed pursuant to self-certifications filed by the relevant DCM.

“The Commission has not, to date, made a determination regarding whether any such contracts involve an activity enumerated or prohibited under CEA section 5c(c)(5)(C)(i) … or Commission regulation 40.11(a)... The activities enumerated under CEA section 5c(c)(5)(C)(i) and Commission regulation 40.11(a) are: activity that is unlawful under any Federal or State law; terrorism; assassination; war; and gaming…

“(“[T]he Commission would like to note that its prohibition of certain ‘gaming’ contracts is . . . to ‘protect the public interest from gaming and other event contracts.’”) and at 44786, FN 35 (“[T]he Commission ‘needs the power to, and should, prevent derivatives contracts that are contrary to the public interest because they exist predominantly to enable gambling through supposed event contracts.’”).

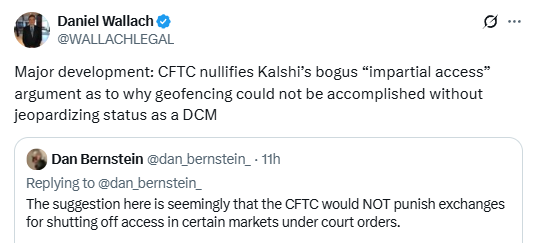

As Bernstein noted on X, “A key tenet of Kalshi’s courtroom arguments is that going offline in any states or tribal territories, even temporarily, would break CFTC core principles and lead the agency to consider punishment.”

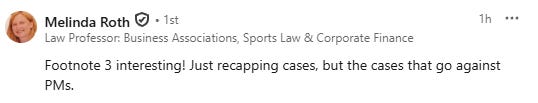

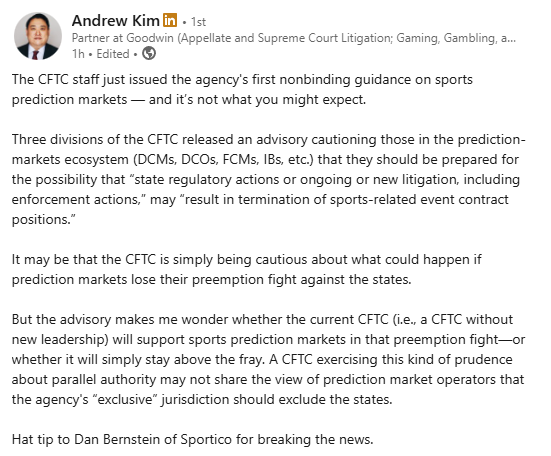

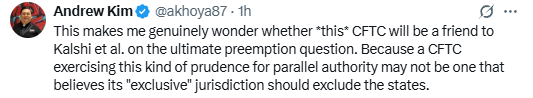

Attorney Andrew Kim, one of the more level-headed voices analyzing the situation, also summarized what this might mean on LinkedIn and X:

Interesting Timing

Notably (and apropos of Kim’s *this* CFTC statement), the news arrives on the heels of Kalshi launching parlays, the day after the SEC-CFTC roundtable, the day after a Kalshi lawyer (and potential CFTC chair nominee) filed a lawsuit against acting Director Caroline Pham, and on the same day that we learned from Politico that, as many had suspected, Brian Quintenz has been removed from consideration by the Trump administration to head the CFTC — possibly a coincidence, and possibly not. Who will replace Quintenz as the nominee just got a whole lot more interesting.

“The White House withdrew Brian Quintenz’s nomination to chair the Commodity Futures Trading Commission late Tuesday, according to two people granted anonymity to discuss the decision ahead of a public announcement.

“A small but powerful agency, the CFTC oversees a broad swath of financial markets including those tied to the cryptocurrency industry. In July, crypto billionaires Tyler and Cameron Winklevoss pressed President Donald Trump to reconsider his selection of Quintenz to lead the Wall Street regulator.”

Bottom Line: Buckle up, we’re nowhere near the finish line.

Roundup: MGC Talks Limiting; Daly Lands at Aristocrat; FanDuel Inks Agreement with Amazon

Massachusetts Gaming Commission discusses limiting bettors [InGame]: The MGC once again addressed the practice of restricting bettors during a hearing yesterday. After analyzing data from sportsbooks, the commission sought to answer, “Whether there is a trend showing that players who demonstrate a tendency to win have their limit decreased and players who demonstrate a tendency to lose have their limit increased. The data received from operators confirms that the answer to that question is yes.” While the percentage is small, it is an issue, and as InGame notes, “The MGC has been considering whether or not to restrict operators from limiting bettors for more than a year. The net result of Tuesday’s meeting was that staff will begin to research and craft regulations around bet-limiting. The commission is specifically interested in considering a regulation that would require that bettors be notified that they have been limited and explain why.”

Former Catena Media CEO Michael Daly joins Aristocrat [Next.io]: Former Catena Media CEO Michael Daly has landed a new gig with Aristocrat: “Aristocrat has appointed Michael Daly as its new senior vice president of business development and strategic execution, marking a high-profile addition to the company’s leadership team as it accelerates international growth.”

FanDuel inks deal with Amazon [Press Release]: FanDuel has entered into an agreement with Amazon to become the official odds provider and an official partner of the NBA & WNBA on Prime Video. “Fans who opt in to NBA on Prime’s new bet tracking and Odds View features will experience compelling narratives surrounding the game’s biggest moments with FanDuel’s unique insights from its market-leading sportsbook. As a premier sponsor of the NBA on Prime, FanDuel will play a key role in providing dynamic betting content during NBA action accessed via Prime Video.”

SPONSOR’S MESSAGE - Kambi is the industry’s leading independent provider of premium sports betting technology and services. Trusted by dozens of operators worldwide, each benefitting from the power of Kambi’s global network, Kambi has a proven track record of giving partners the decisive competitive edge required to grow and outperform the market.

As the home of premium sports betting solutions, Kambi offers an expansive product portfolio that caters to the evolving needs of operators and players alike. At its core is Kambi’s flagship Turnkey Sportsbook, renowned for its scalability, flexibility, and unrivaled track record of delivering world-class betting experiences globally. Complementing this are Kambi’s cutting-edge standalone products: Odds Feed+, Managed Trading, Sportsbook Platform, Bet Builder, Esports, and Front End.

News: Exclaim Recovery Is Now Live

Exclaim Recovery is officially live today. You can check out Exclaim Recovery here.

Exclaim Recovery is the brainchild of former casino executive Dan Real (a recent guest on the Straight to the Point Talking Shop Podcast). It’s a free, one-stop resource aimed at tackling gambling addiction through a resource-filled website, an AI assistant named “Hope” for distress detection and referrals, and a community that emphasizes lived experience. With only one certified therapist per 10,000 struggling gamblers, Dan aims to fill gaps for millions of underserved gamblers who are experiencing issues or at-risk.

You can listen to my entire conversation with Dan here — His journey in the gambling industry is fascinating:

Episode 64: A New Approach to Gambling Addiction with Dan Real

“With expansion comes addiction. And you better start acknowledging that because it’s going to look real bad real soon.” ~ Dan Real

News: Evive Now Available Through DraftKings Responsible Gaming Center

There’s another piece of news on the responsible gambling/problem gambling front to report: Evive, a behavioral health technology platform, has announced it will provide customers access to Evive’s evidence-based tools and resources through the DraftKings Responsible Gaming Center.

“As gambling has gone increasingly digital, support needs to go digital as well. This is about meeting people where they are at,” Sam DeMello, the Founder and CEO of Evive, told Straight to the Point. “Giving people support when they need it and in a way that they want to access it. With all eyes nationally on the fight over a phone system, this is true digital innovation, modernizing the support infrastructure to reflect the modern gambling experience.”

Per the press release, Evive’s platform is designed to offer an intuitive, player-friendly experience:

Intelligent Support: Clinically informed resources during breaks in play.

Personalized Matching: Tools and educational content tailored to each player’s unique profile.

“By embedding this innovative platform within the DraftKings Responsible Gaming Center, we are giving customers more tools and resources to help them play responsibly on their own terms,” Lori Kalani, Chief Responsible Gaming Officer at DraftKings, said in the press release. “This effort enhances the responsible gaming options available to DraftKings customers, with potential to expand across the customer journey.”

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Around the Watercooler

Social media conversations, rumors, and gossip.

Early reaction to the news that Kalshi has added parlays to its offerings.

From Monday:

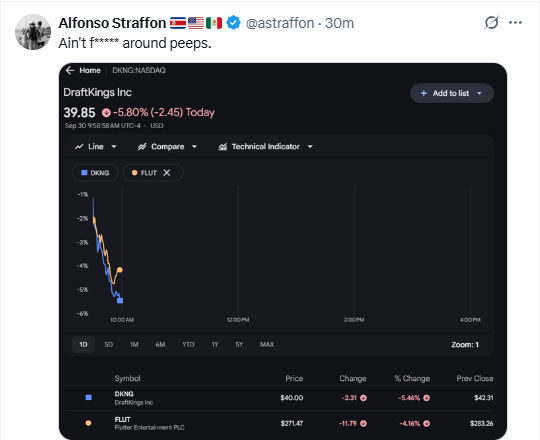

The situation at 10 AM on Tuesday:

DraftKings closed at $37.40 (down 11.59%) and Flutter at $254 (down 10.33%).

As I said on X:

Or simply put, the markets, at least when it comes to gambling, are rarely rational.

Stray Thoughts

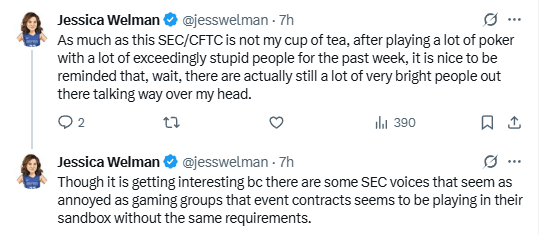

This is one of my favorite parts of my job, interacting with people who are real experts. It also makes spotting the charlatans a lot easier.

As Welman noted in her second tweet, not everyone at the SEC was buying what prediction markets were selling.

And it seems other panelists were also annoyed: