The Worldwide Leader

ESPN Bet integrations touted during the announcement of a new media rights deal between ESPN and the NBA/WNBA.

The Bulletin Board

NEWS: Walt Disney mentions ESPN Bet in its press release about the company’s new NBA media rights deal.

VIEWS: Is PrizePicks shifting away from DFS 2.0?

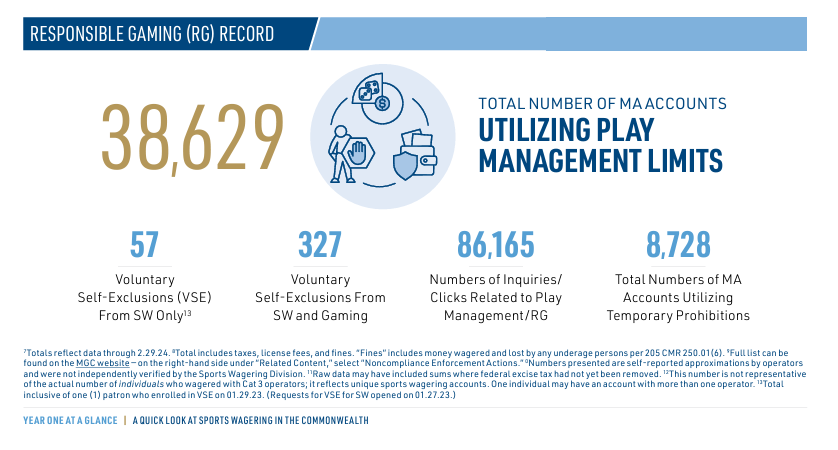

NEWS: A look at some of the more interesting data points from a recent Massachusetts sports betting report.

QUICK HITTER: Nebraska lawmakers are expected to discuss mobile sports betting today.

AROUND the WATERCOOLER: The wild swings of a professional gambler.

STRAY THOUGHTS: Radical change takes time.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade’s newest feature, The Tape, prints all trades made on the app in real-time.

Disney Hints at ESPN Bet Integrations

The press release from Walt Disney Company and ESPN announcing its new media rights deal with the NBA and WNBA contains a nugget indicating that the ESPN Bet project is just starting.

Per the press release:

“Walt Disney Company and ESPN have reached a landmark 11-year extension with the National Basketball Association and Women’s National Basketball Association for NBA and WNBA media rights.”

Now, for the interesting bit:

“The new agreement provides ESPN with all necessary rights to create best-in-class sports betting experiences for NBA and WNBA fans. ESPN will have increased rights to utilize NBA and WNBA highlights and content within its sports betting coverage and to support or integrate into ESPN BET promotions. Furthermore, ESPN has secured the rights to future NBA-focused sports betting specials and series.”

And that was in a press release from the Walt Disney Company. How times have changed.

As I’ve been saying since the launch of this newsletter (which coincided with Penn ditching Barstool for ESPN), the integration will take time, but more importantly, ESPN has to be on board. For ESPN Bet to work (grow its market share to 10% or more), it has to differentiate in some way. With ESPN, it has the assets, but deploying those assets hasn’t come to fruition yet.

What’s going on at PrizePicks?

One of the more intriguing items that popped up last week was the news that PrizePicks has hired Moelis to explore merger and acquisition opportunities, including a potential sale of part of the company.

According to the Earnings+More newsletter, “PrizePicks is looking at identifying “areas of growth,” according to insiders.” Those “areas of growth” include a funding round to compete in online sports betting.

Unlike Underdog Fantasy (a newsletter sponsor), one of its chief rivals, PrizePicks has remained true to its DFS roots, at least thus far. Underdog is a licensed sports betting operator in North Carolina.

However, as Eilers & Krejcik Gaming (a newsletter sponsor) reports, channel checks suggested nothing is imminent on the sports betting front for PrizePicks. Instead, PrizePicks has been publicly saying that free-to-play is a bigger priority than OSB.

PrizePicks CEO Adam Wexler said that free-to-play games were going to be a big category of exploration for us in the year ahead during an appearance on The Joe Pomp Show in June.

Free-to-play seems to be the next step in Wexler’s plan to evolve PrizePicks from a DFS company to something much larger.

As Wexler wrote in a LinkedIn post earlier this year, “While many in the gaming sector know PrizePicks as a paid fantasy sports company, we view ourselves as a digital entertainment platform which is building a brand at the heart of sports & culture.”

A big part of that appears to be free-to-play, which Wexler called (reported by EKG) “more popular globally, offering a potentially much larger TAM than US OSB.”

“Most people assume our closest competitors are the DraftKings of the world, but I tell people it’s Twitter Sports,” Wexler said, “We are trying to be the best compliment to the live sports viewing experience.”

Circling back to the Moelis news, is PrizePicks looking to offload its core DFS 2.0 product and technology, which also happens to be its most problematic product, perhaps offloading it to an online sports betting operator and shifting its focus to F2P and less controversial DFS offerings?

SPONSOR’S MESSAGE - Join hundreds of operators using OpticOdds for trading, risk management, and Same Game Parlay analysis.

Real-time data and trading tools for sports betting + fantasy operators. Built by those who have done it before.

Looking to join the fastest-growing data provider in the sports betting industry? Join the team now.

Massachusetts Report Contains Some Unique Data Points

The Massachusetts Gaming Commission has released a report on the first year of legal sports betting. As should be expected from the MGC, it is very thorough, with many data points we rarely see — including patron disputes, which numbered just 538.

Another random but interesting stat is of the 153 sports wagering registrants, 67 are marketing affiliates.

According to the MGC, there are 1.6 million active accounts in Massachusetts. That number is not unique bettors in Massachusetts. It would include customers with accounts at more than one licensed sportsbook and customer accounts from other states.

A second statistic also gives us a glimpse into responsible gaming tool usage:

Some quick back-of-the-envelope math shows that 2.3% of accounts have enabled play management limits (deposit, time, etc.), and .5% have used temporary prohibitions. Only 57 sports betting accounts voluntarily self-excluded (.003% of accounts).

Quick Hitter: Sports Betting on Today’s Agenda in Nebraska

One of the big stories over the past couple of weeks is a rekindled effort to legalize online sports betting in Nebraska during a special session aimed at reducing property taxes in the state.

The Nebraska legislature is expected to discuss LB 13 today, a bill that would put mobile sports betting on the November ballot, and what would a gambling expansion discussion be without its own unique wrinkle:

Per the bill summary:

“LB13 - Allow an authorized gaming operator to conduct sports wagering by means of an online sports wagering platform under the Nebraska Racetrack Gaming Act, change the distribution of taxes collected from sports wagering, and change requirements relating to proposals for constitutional amendments submitted by the Legislature.”

The question is, does the appetite exist to tackle mobile sports betting during the special session, or will the legislature settle on a different means to reduce property taxes in the state?

As an aside, the attention on Nebraska shows how desperate the industry is for a win.

SPONSOR’S MESSAGE - Birches Health is a leading national provider of clinician-led Responsible Gaming resources and modern Problem Gambling treatment.

Birches partners with gaming operators, professional sports leagues, teams, media companies, affiliates, and state governments to scale RG solutions and provide integrated pathways to care. Birches’ treatment program is led by a nationwide team of licensed, specialized therapists and covered by insurance and state funding.

Click here to learn more about Birches Health’s resources and services, or email partnerships@bircheshealth.com to discuss RG partnership opportunities.

Around the Watercooler

Social media conversations, rumors, and gossip.

How it started… How it’s going.

As Poker.org reported in its The Org newsletter:

“Allen “Chainsaw” Kessler is ready for autumn so he can get over his worst summer in recent memory. We caught up with him this week and he talked about losing six figures and then hurrying to Oklahoma to try to bust the slump.”

It looks like the slump is over.

Stray Thoughts

The industry is at a crossroads, and the US gambling environment, especially online, is about to undergo a change. It won’t be sudden, and it might be hard to see in real time, but little by little, things will change. The changes will be subtle, but over time, and in aggregate, they will be dramatic.

I see this occurring on several fronts, from RG policies to marketing and advertising to preferred games to licensing and tax rates.