To The Show That Never Ends

Why break a good streak? For the fourth consecutive newsletter, I look at the CFTC vs. prediction market carnival (or Karn Evil if you get the title reference).

The Bulletin Board

THE LEDE: Gambling bills are being filed fast and furious.

ICYMI: Virginia and Maryland hop on the C&D train; Wynn acquires London casino; GeoComply data shows “untapped potential.”

NEWS: Crypto.com responds to the CFTC’s request to suspend markets.

VIEWS: Maryland Governor includes sports betting tax increase in budget.

AROUND the WATERCOOLER: New Jersey has a “Reverse Sweepstakes” bill.

STRAY THOUGHTS: Partisan support.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade is now live in their fifth state; Virginia

The Lede: Welcome to Gambling Bill Season

We already have online casino bills in Maryland and Virginia and now, we have two more states to add to the list: Wyoming and Indiana.

Wyoming - HB 162, sponsored by Rep. Bob Davis.

Wyoming State Rep. Bob Davis introduced HB 162 this week. Under the bill, the Wyoming Gaming Commission would regulate the newly created industry.

The bill calls for a minimum of five licensees.

An initial five-year license would cost $100,000, with a $50,000 renewal fee.

The tax rate is 16%, with the first $300,000 earmarked for problem gambling treatment.

Previous STTP coverage on Wyoming’s online casino efforts and Spectrum Gaming’s report.

Indiana - HB 1432, sponsored by Rep. Ethan Manning.

Indiana will also take another shot at legalizing online casinos in 2025. State Rep. Ethan Manning, who chairs the Public Policy Committee, filed HB 1432 this week.

HB 1432 is a comprehensive gambling expansion effort that, in addition to online casinos, would legalize online lottery sales and pull tabs.

Online casino licenses would be available to:

A licensed owner of a riverboat.

An operating agent operating a riverboat in a historic hotel district.

A permit holder conducting gambling games at the permit holder's racetrack.

A license costs $500,000, with an annual renewal fee of $50,000.

In year one, the tax rate is 26%. In year two, it shifts to a tiered tax structure ranging from 22% to 30%, with some of the revenue used to subsidize the horseracing industry. HB 1432 also imposes an annual $250,000 fee for problem gambling research and treatment for each riverboat casino operated by a licensee.

ICYMI: Virginia and Maryland Hop on the C&D Train; Wynn Acquires London Casino; GeoComply Data

Virginia is sick of offshore gambling operators: A report from the Virginia Gaming Compliance Committee has regulators pondering their options when it comes to illegal gambling operators. Per Covers.com, “Comments made at a Virginia Lottery Board meeting on Tuesday also suggest officials in the commonwealth could try to do something about it [offshore sites], and perhaps soon.” According to the board, the Virginia State Police will speak with the Attorney General’s office about cease-and-desist letters.

Maryland sends 11 cease-and-desist orders: The Maryland Lottery and Gaming Control Agency revealed it had sent 11 cease-and-desist letters to gray market operators it believes are offering illegal gambling in the state. The list of 11 operators, which was supplied to Dustin Gouker at the Closing Line, includes numerous sweepstakes operators: Golden Hearts, Zula, McLuck, REBET, Fortune Coins, StakeUS, BETUS, BETNOW, SlotsAndCasino, Everygame Sportsbook, and BetAnySports. Of particular interest (h/t Geoff Zochodne), the MLGCA also reached out to payment processors "demanding that they block access."

Wynn Resorts acquires London casino: Wynn Resorts has agreed to acquire (subject to regulatory approval) Crown London (Aspinalls), “a small, members-only casino in the heart of London's upscale Mayfair district.” Wynn Resorts CEO Craig Billings called the acquisition a conduit “in a global gateway city… for Wynn guests to visit our resorts, particularly Wynn Al Marjan Island, which is slated to open in the first quarter of 2027 in Ras Al Khaimah in the United Arab Emirates."

GeoComply releases data on seven online candidate states: In newly released data, GeoComply (a newsletter sponsor) analyzed data from seven unregulated states — Texas, Nebraska, Alabama, Georgia, Minnesota, South Carolina, and Mississippi — that points to the untapped potential in these markets. GeoComply stated, “As lawmakers prepare for the 2025 legislative sessions, the data is clear: demand for legal sports betting is undeniable, and the benefits are far-reaching. It’s time to bring the protections and opportunities of a regulated market to states still on the sidelines.” STTP will take a deeper dive into this data next week.

Why hire Steve Ruddock? Over the years, Steve has advised startups, national gambling companies, government agencies, and investment banks on a wide variety of topics.

Whether you’re looking for market research, want to raise your brand awareness, or are trying to develop responsible gaming strategies, Steve can help with honest, balanced, no-nonsense analysis of the situation.

Steve’s unique experience and insights are often the missing piece to the puzzle.

Reach out for more information: Straight to the Point Consulting.

News: Crypto.com Responds to CFTC Review

It’s been a wild week for the prediction markets, which have been on a rollercoaster ride of good and bad news.

Good News: The resignation of CFTC chair Rostin Behnam, who has voiced numerous concerns about prediction markets. The incoming Trump administration will pick the next CFTC chair and is expected to be friendly to prediction market and crypto companies.

Bad News: Analysts believe the federal government will step in and take action against illegal and unregulated gambling products, including quasi-gambling products. As STTP has been warning, federal action is coming.

Good News: Donald Trump Jr. was named as a strategic advisor to Kalshi, which Chris Grove called the cake being baked: “Looking forward to a rush of CFTC-mediated sportsbooks led by Kalshi, Robinhood, and Crypto.com (followed by some state-based legal challenges, probably with NY at the vanguard), the return of Polymarket to the U.S. market, and a bunch of too-late-to-the-party startup decks in 2025.”

Bad News: The CFTC announced a review of Crypto.com’s sports markets and requested the company suspend the markets until the review is complete. Crypto.com responded to the request by saying (h/t Geoff Zochodne):

"It is disappointing that the current and imminently departing CFTC leadership would take this action while not allowing the incoming CFTC leadership to determine how free markets operate under its administration. The majority’s decision to apply this rule contradicts recent Federal Court rulings and conflicts with the current Commission’s own statement set forth in its recent rule proposal.

"We remain committed to working with the CFTC and will continue to support our customers and the trading of our sports title event contracts in all 50 states without interruption while we review the CFTC’s notification."

To be continued…

News: Tax Increases are Back on the Menu in Maryland

For the second consecutive year, Maryland is considering raising its tax rate on sports betting.

As noted in my coverage of Maryland’s efforts to legalize online casinos, the state is staring down a $3 billion budget deficit. But, instead of looking to online casinos, Maryland Gov. Wes Moore proposed a doubling of the state’s sports betting tax rate from 15% to 30%, as well as an increase to the table game tax rate at brick-and-mortar casinos from 20% to 25% in his 2026 budget.

The tax bumps would only chip away at the looming deficit, raising $95 million (sports betting) and $31 million (table games).

While it has only occurred in two states to date, STTP has been ringing this alarm bell since Ohio bumped its tax rate in 2023.

The team at JMP Securities is on the same page. In a recent note, they wrote, “We have largely expected these types of announcements in 1H25… In our preview for the year, we highlighted tax rate adjustments as a key theme to watch after the upward tax rate adjustments in Ohio (2023) and Illinois (2024).”

It’s important to remember that this is only the governor’s budget proposal. The legislature will have something to say about how the state will address the $3 billion budget deficit. Still, it should be noted that Ohio’s 2023 and Illinois’ 2024 tax increases started with a governor’s proposal.

Sponsor’s Message - In this state-by-state guide, Vixio has outlined the regulatory landscape for sweepstakes.

Discover the state of sweepstakes across the U.S. and the emerging trends, empowering you to minimize the risk of non-compliance.

Download your copy of the U.S. Sweepstakes Guide here.

Who is Vixio?

Vixio takes the heavy lifting out of regulatory monitoring to help mitigate risk and uncover growth opportunities. Vixio’s award-winning GamblingCompliance platform is trusted by the world’s biggest gambling brands for insights into specific requirements in 180+ jurisdictions to stay current with the ever-evolving gambling regulatory landscape.

Around the Watercooler

Social media conversations, rumors, and gossip.

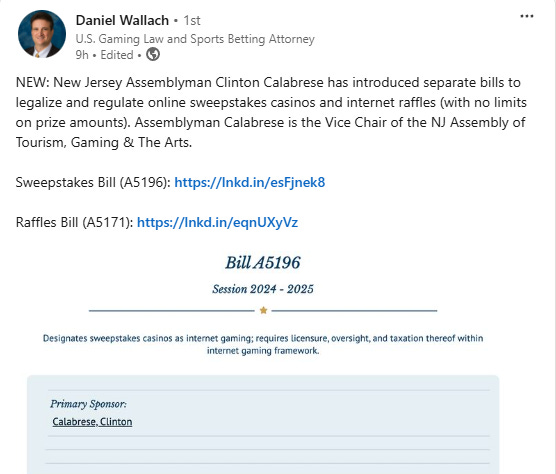

Sweepstakes legislation alert (h/t Daniel Wallach)!

The interesting part is that it’s a “reverse sweepstakes” bill. Instead of trying to shut down operators, the New Jersey bill seeks to legalize the activity.

As Vixio Regulatory Intelligence’s Mackenzie Shanke said on LinkedIn:

“The bill would designate sweepstakes casinos as internet gaming and require licensure, oversight and taxation thereof within an internet gaming framework. A huge shift in what has so far been an anti-sweepstakes casinos movement across the states.”

Stray Thoughts

Gambling expansion bills are rarely partisan issues. It took me many years to understand this, but as I said on X in response to the Saagar Enjeti tweet below (Saagar is becoming a strong voice of reason for reining in online gambling in the US):

“I've been involved in this for 15 years and can't recall a party-line vote on gambling expansion or a situation where a party was for or against it.”

On the Republican side of the aisle, Libertarian-leaning members support legalization, while social conservatives oppose it. In the middle are the rank and file memberswho prefer legalizing and regulating an industry and creating a new revenue stream over raising taxes on citizens or businesses.

On the Democrat side, support is more tepid — Republicans tend to be sponsor gambling expansion bills. Many Dems point to the social harms (and evidence that it disproportionately impacts the poor and most vulnerable) of gambling, with support coming from rank-and-file members who see the new tax dollars as benefitting their district or some pet project.