True Treasure or Fool's Gold

People are rushing to prediction markets like Kalshi to trade sports contracts, worrying licensed sportsbooks. Should they be concerned? Yes and no.

The Bulletin Board

THE LEDE: How disruptive will prediction markets be? That’s up to the CFTC.

BEYOND the HEADLINE: Trading volume vs. handle.

ROUNDUP: PA iPoker update; MGC discusses limited bettors; Sweeps bans lose steam: Quote of the Week.

NEWS: Hawaii sports betting bill moves to conference committee.

VIEWS: Kansas lawmakers vote to prohibit sports betting license renewals.

AROUND the WATERCOOLER: DC lawsuit isn’t as crazy as it sounds.

STRAY THOUGHTS: A strong argument for online casinos.

SPONSOR’S MESSAGE -Light & Wonder, Inc. is the leading cross-platform global games company. Through our three unique, yet highly complementary businesses, we deliver unforgettable experiences by combining the exceptional talents of our 6,000+ member team, with a deep understanding of our customers and players. We create immersive content that forges lasting connections with players, wherever they choose to engage.

At Light & Wonder, it’s all about the games. The Company is committed to the highest standards of integrity, from promoting player responsibility to implementing sustainable practices.

The Lede: The Prediction Market Opportunity

In one of my first featured columns, Black Swans and Robert Frost, I cautioned against declaring winners in the US sports betting market.

“Many people believe the battle for US sports betting has already been fought and won. FanDuel and DraftKings occupy the head and the foot of the table… But I’ve seen this movie before. The online gambling industry turns on a dime and can undergo radical change in the space of a couple of years… and what we know now may not be true just a couple of years from now… thinking the current hierarchy will remain intact is foolhardy.”

“And, of course, there is always the possibility of another black swan event, which could take the shape of federal intervention, a game-changing product, a scandal, or cultural backlash against the recent increases in gambling.”

And every six months or so, I check in on the “challenger brands” in the space. And as I repeatedly have said, “Too many are trying to beat FanDuel and DraftKings at their own game instead of carving out a unique niche. They are trying to beat a stronger opponent with strength or trying to overcome strength with finesse when the only option is some combination of both.”

Prediction markets are starting to look like that disruptive product. They are not trying to out-DraftKings/FanDuel, and instead are offering something different — or at least different enough.

Given the landscape, they could be a Black Swan event on par with the 2011 Department of Justice Office of Legal Counsel opinion that opened the door to intrastate online gambling and the repeal of PASPA in 2018.

The opportunity is massive. Still, unless the CFTC opens the floodgate and courts agree (which I’ll tackle in a moment), I don’t think prediction markets spell the end of licensed sportsbooks. We haven’t seen that in other markets like the UK or Australia, where regulated betting and exchange platforms operate side by side, each serving different customers and needs.

Betting exchanges are not new, and even prediction market sites like Polymarket exist alongside licensed (and unlicensed) sportsbooks. As the team at Citizens recently pointed out, it’s not all sunshine and puppy dogs; sports markets on Polymarket lack liquidity outside of tentpole events.

As the Citizens team noted, “exchanges need liquidity,” with the firm estimating “prediction markets could generate $555M of revenue (2025E) in the U.S. (sports only) with only a minor level of cannibalization of the traditional sports betting market, compared to the legal online market generating ~$16bn in total in 2024.”

The same appears to hold true for Kalshi, as noted by Alfonso Straffon in this chart he posted on X, with the comment, “Not surprised to see March Madness… at the very top... with Bitcoin markets a distant third. What is a bit surprising (concerning?) is how little everything else does by way of contracts traded... although I'd speculate the presidential election was a big market too given the 'economic value' there.”

And keep in mind that trading volume is not the same as handle, it’s even more inflated (see the Beyond the Headline header below).

The more likely outcome is for the CFTC to allow sports markets and more clearly define what “the public interest” refers to. In that scenario, I believe the two products can uneasily coexist, and the most prominent players will likely offer some combination of the two. And for what it’s worth, prediction markets are more intuitive to follow along with for major events:

As the team at Citizens highlights, “The infrastructure of an exchange slightly differs from a sports betting platform, and we would expect new entrants to initially rent or purchase existing platforms for speed to market.”

By offering a prediction market site parallel to a traditional sportsbook, an operator can nudge players toward prediction markets for lower hold wagers (avoiding hefty sports betting tax obligations in some states), while avoiding any further regulatory or legal challenges by keeping high-hold products like SGPs in the traditional sportsbook setting. According to Citizens, that could create “a tax arbitrage between sports betting and prediction markets, assuming prediction is not subject to a tax rate near sports betting tax rates (or any at all).”

Essentially, prediction market sites in yet-to-legalize states (or states that have restricted market access) could be gamechangers, further consolidating market share at the top and allowing the most prominent players to pre-seed markets for their full catalog of sports betting products like SGPs.

Now, if the CFTC allows Kalshi and others to offer multicondition SGP-like markets, all bets are off.

Beyond the Headline: Trading Volume = A Numbers Game

Prediction markets use a similar playbook to daily fantasy sports and sports betting, framing the opportunity through handle (or in the case of prediction markets, the even more opaque “trading”) rather than revenue, as Alfonso Straffon pointed out in this post.

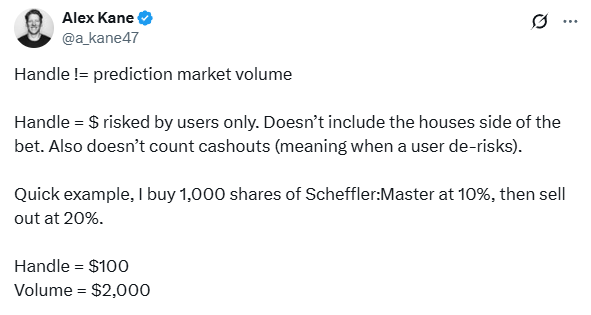

As Sporttrade’s Alex Kane has pointed out, it’s challenging to ascertain how much money was wagered on Kalshi by looking at trading volume:

That $504 million is likely no more than $250 million, and possibly quite a bit less, as contracts can be bought and sold multiple times, with each instance adding to the trading volume, which reflects market activity rather than the amount risked.

Roundup: PA iPoker; MGC Discusses Limited Bettors; Sweeps Bans Lose Steam: Quote of the Week

Pennsylvania interstate online poker nears the finish line [Pokerfuse]: It looks like Pennsylvania shared liquidity will be up and running before the WSOP. According to Pokerfuse, the Pennsylvania Gaming Control Board (PGCB) has confirmed that “operators will be ready to start connecting their Pennsylvania player pools with other states” once the final approval (the signature of Gov. Josh Shapiro) is given. “Our staff has already been working with those operators who wish to participate in the [Multi-State Internet Gaming Agreement] when it has final approvals,” Douglas Harbach, PGCB Director of Communications, said. “That should allow for a launch within the next couple of weeks.”

Massachusetts Gaming Commission update on limited bettors [Covers.com]: During a meeting last week, MGC Division Chief Carrie Torrisi said that while the state’s licensed sportsbooks have provided the data the MGC requested, due to the sheer amount and complexity of the data more time is needed to review it, and send more specific follow-up questions to operators regarding limiting and VIP programs. “We're proud to be the first jurisdiction in the US to openly discuss limiting with the operators, and we're excited to add that interplay, in my opinion … with the VIP programs, and we're going to continue to learn on this matter,” MGC Chair Jordan Maynard said.

Previous STTP coverage of the MGC’s May meeting and September meeting

Sweepstakes prohibition bills fail in Maryland, Mississippi, and Arkansas [Social & Promotional Games Association]: The Social & Promotional Games Association (SPGA) is touting its 3-0 record, after legislative efforts to prohibit sweepstakes failed in three states. Two of the efforts, Mississippi and Arkansas, were tied to efforts to legalize online gambling, while Maryland’s effort was a standalone bill. Several other efforts are still active, including in Nevada, where the Senate has passed SB 256.

Quote of the Week [Sports Betting Dime]: “The Michigan Gaming Control Board currently has investigations open regarding sports prediction markets offered in Michigan by unlicensed entities. These investigations aim to address concerns about consumer protection and ensure that residents of Michigan are safeguarded against potential risks posed by unregulated operators. The MGCB has not issued cease-and-desist letters to such entities at this time,” ~ Michigan Gaming Control Board spokesperson.

News: Hawaii Sports Betting Bill Heads to Conference Committee

Hawaii lawmakers from the House and Senate will begin working on a compromise version of HB 1308, a bill that would legalize online sports betting in the state. The bill is heading to a conference committee.

The House and Senate versions are not too far apart, with the main difference being the tax rate and licensing fee, something STTP noted last week. The Senate version of the bill (the most recently passed) calls for a 10% tax rate and a $250,000 licensing fee. Supplier licenses are also relatively low: $10,000.

The burdens are low enough that the Sports Betting Alliance (likely also realizing that the bill may not pass if the low operator burdens remain) testified that licensing fees for operators and suppliers should be doubled.

STTP is cautiously optimistic that the conference committee can reach an agreement.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Views: What Is Going on in Kansas?

We have some interesting developments in Kansas, where the legislature amended the state budget on Friday to include a prohibition on renewing the state’s sports betting licenses, at least temporarily, as the prohibition expires on June 30, 2026.

The current sports betting contracts (there are six operators in Kansas) don’t expire until August 2027.

The pertinent section of SB 125 reads:

“During the fiscal year ending June 30, 2025… no expenditures shall be made by the above agency from moneys appropriated from the state general fund or from any special revenue fund or funds for fiscal year 2025… to negotiate or enter into any contract or extension or renewal of an existing contract for the management of sports wagering with any lottery gaming facility manager.”

The details on this one are a bit confusing, so I’ll do my best to streamline what is going on.

Kansas legalized mobile sports betting in 2022, with industry-friendly terms: a $100,000 licensing fee and a 10% tax rate.

There have been some grumblings that the state got a raw deal under the current structure, with lawmakers considering a sole-source model, per Covers.com — The ‘we’ll shift to a monopoly’ threat could also be a bargaining chip that will lead to an increase in the financial burdens that sportsbooks pay the state.

The 2025 legislative session is over. That means the legislature must determine its next steps in 2026 (monopoly, higher tax rates, or something else). If it doesn’t overhaul the regulatory structure, the prohibition expires, and the current sports betting licenses can be renewed.

I have to say, raising taxes at license renewal is undeniably fairer and more principled than imposing them on a whim.

Around the Watercooler

Social media conversations, rumors, and gossip.

Last week, I covered a lawsuit filed by the city of Baltimore, claiming sportsbooks use deceptive and unfair practices to hook bettors.

Now we have another lawsuit (Casino Reports has a full writeup) from a nearby jurisdiction with legal sports betting. This one claims the 2018 PASPA repeal doesn’t apply to Washington, DC:

“The District apparently thought that the Supreme Court’s New Jersey (PASPA) decision no longer applied to it. But that is wrong. The Tenth Amendment does not apply to the District of Columbia, so PASPA’s prohibition remains in full force in the District.”

The lawsuit also seeks to claw back winnings, using a “recovery loss” statute:

“A person who, at any time or sitting, by playing at cards, dice or any other game, or by betting on the sides or hands of persons who play, loses to a person so playing or betting, a sum of money, or other valuable thing, amounting to $25 or more, and pays or delivers the money or thing, or any part thereof, may, within three months after the payment or delivery, sue for and recover the money, goods or other valuable thing, so lost and paid or delivered, or any part thereof, or the full value thereof, by a civil action, from the winner thereof, with costs. If the person who loses the money or other thing, does not, within three months actually and bona fide, and without collusion, sue, and with effect prosecute, therefor, any person may sue for, and recover treble the value of the money, goods, chattels, and other things, with costs of suit, by a civil action against the winner, one-half to the use of the plaintiff, the remainder to the use of the District of Columbia.

Before you dismiss it out of hand, a similar law was successfully used against PokerStars in Kentucky.

Stray Thoughts

iDea Growth’s Jeff Ifrah recently made the case for legalizing online casinos in Maryland in a guest commentary in the Baltimore Sun. After going through the usual talking points, Ifrah hit the nail on the head, saying:

“Online gaming is about modernizing Maryland’s entire gaming industry. Consumers expect seamless digital experiences across all entertainment sectors, and gaming is no exception. With our neighbors, Delaware, Pennsylvania, and West Virginia already capitalizing on the digital gaming economy, Maryland cannot afford to fall further behind. Legal online gaming will keep the state competitive, ensuring revenue stays local instead of leaking across state lines or into the unregulated black market.”

This is the type of messaging online gambling proponents need to stick to. The “look at all the money you’re leaving on the table” and “black market” arguments are simply not resonating.