US Sports Betting: Opportunities & Challenges

A presentation by Chris Grove at the NEXT.io Conference offers a great jumping off point to examine the current and future US sports betting industry.

Industry investor Chris Grove released the slides from his presentation at the NEXT.io Conference held in New York City, titled, U.S. Online Gambling: Who Will Win, And How, And Why.

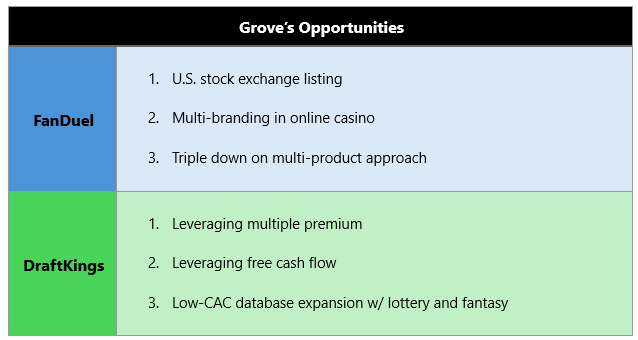

Grove looked at several mobile sports betting operators in the presentation and presented three opportunities and challenges for each. In this column, I’ll use Grove’s slides as a jumping-off point for my thoughts on some (not all) of these companies and the overall sports betting landscape in the US.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Learn more about what makes Sporttrade an unparalleled player experience here.

DraftKings vs. FanDuel

DraftKings and FanDuel have been locked in a power struggle for a decade, first as daily fantasy sports operators, now as mobile sportsbooks, and in the future, as omnichannel online gambling companies.

As the two are so intertwined, I’ll juxtapose the two companies with one another, starting with Grove’s “Opportunities.”

Looking at Grove’s points for both companies, FanDuel comes across as the established company and DraftKings the disruptor, even though they have both been around for roughly the same amount of time.

FanDuel has always been the more cautious older brother, while DraftKings has always played the role of the impetuous younger sibling. FanDuel employs a no-mistakes strategy, while DraftKings is a constant envelope pusher—offering DFS contests on NASCAR laps and rounds of golf when FanDuel wouldn’t.

That is a long way of saying that, at least in the near term, FanDuel will improve around the edges while DraftKings is (more) likely to press for radical change, evidenced by its recent acquisition of Jackpocket.

Moving to Grove’s “Challenges.”

Grove’s “Challenges” mirror the opportunities, painting FanDuel as the legacy product looking to keep challengers at bay and DraftKings as the risk-taker that could shoot to the top or send everything sideways (particularly Challenge #2).

One question I would add to DraftKings’s challenges list is whether the sum is greater than the disparate parts it has assembled.

Massachusetts’ Lottery Director Mark William Bracken has already raised some questions, telling Mass Live, “One of my competitors [DraftKings] that I think is part of the reason for our sales dip is now going to own a company that’s going to be selling lottery products… I’m now going to have an online sports wagering vendor that’s going to be able to facilitate the carrying of my tickets.”

For FanDuel, the question is, can it maintain its lead? Can it continue to improve its best-in-class product faster than its peers, or will the challenger brands begin to close the gap?

FanDuel was an early adopter of SGPs and had a significant product advantage on that front. That gap is closing.

Keep reading with a 7-day free trial

Subscribe to Straight to the Point to keep reading this post and get 7 days of free access to the full post archives.