Wave 2: Is ESPN Bet's Fast Start Sustainable?

Part 2 of a three-part series on the second wave of US sports betting operators looks at ESPN Bet's early performance and future outlook. Part 1: Fanatics. Part 3: Bet365.

In Part 1 of this series, I looked at Fanatics’ entrance into the US sports betting arena. But Fanatics isn’t the only new competitor gunning for the industry’s top dogs, DraftKings and FanDuel. One of the other companies with its eyes set on being the number one operator in the US is ESPN Bet.

As I did with Fanatics, ESPN Bet will be weighed and measured in four ways:

Its approach (thus far).

How successful has that strategy been to date?

Its chances to get on the podium in the future.

And I will ask (and possibly answer) one big question.

Sponsor’s Message: BroThrow.com is building the most player-friendly company in sports gaming.

Our subscription-based, no-juice sports betting platform provides the fairest, simplest way to bet on sports with your friends.

Check out our tech: https://brothrow.com/

The Long Winding Road to ESPN Bet

ESPN Bet is a partnership between Penn Entertainment and ESPN, but the journey to ESPN Bet is anything but a straight line.

ESPN wasn’t Penn’s first sports betting choice. That honor goes to Barstool Sports. That marriage will go down somewhere between incompatible and doomed from the start, as it resulted in a full reset from Penn in August 2023, including handing Barstool back to founder Dave Portnoy for $1.

The relationship between Penn and Barstool began in January 2020 when Penn agreed to purchase a 36% stake in Barstool Sports with the option to buy the entire company in multiple rounds. In February 2023, Penn completed the sale, having purchased 100% of Barstool Sports for around $500 million. Six months later, Penn sold it for $1.

As I wrote in August, it wasn’t from a lack of trying by either party but rather “radically different corporate cultures” that led to the inevitable divorce:

“It’s pretty clear that Penn and Barstool entered the relationship with the best intentions and wanted it to work. Based on its unique sports-driven content and user engagement, Barstool thought it possessed the perfect recipe for sports betting success. Penn was the chef that could put it all together. The result was something less than a Michelin-star restaurant.”

Penn did have some contingency plans in place, as it had also purchased theScore sports betting platform (for the princely sum of $2 billion), giving it a high-caliber tech stack and allowing it to change brands on a dime. And that’s precisely what it did in August.

Enter ESPN.

ESPN is by far the better-known brand, but more importantly for Penn, after three years of regulatory and public relations headaches caused by Barstool Sports, ESPN is a far less controversial brand.

So, how has ESPN Bet fared since its mid-November launch? I’m glad you asked because I have some answers below.

ESPN Bet’s Early Results

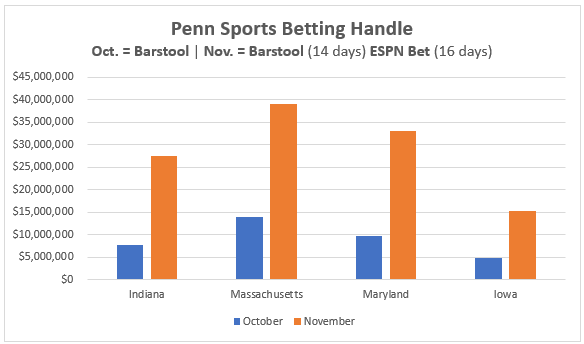

ESPN Bet launched in mid-November, and we have the first batch of results from its half-month of operation in several locales.

Here’s a look at the difference ESPN Bet has made in four of those markets:

Keep reading with a 7-day free trial

Subscribe to Straight to the Point to keep reading this post and get 7 days of free access to the full post archives.