Weekender: Flutter Investor Day Presentation

A different kind of Weekender. Instead of highlighting the week's top news, I have a second feature column, as I give my thoughts on the Flutter Investor Day presentation.

The Bulletin Board

FEATURE: Breaking down the Flutter Investor Day… From the STTP readership POV

HOUSEKEEPING: A look at recent podcasts, featured articles, and more from yours truly.

Sponsor’s Message - Vixio, a leading RegTech provider for gambling compliance, has released its 2024 U.S. Sports Betting Outlook.

As of September, Vixio predicts the U.S. online sports betting market will be worth $24.2bn to $27.8bn by 2028.

Download your copy of the U.S. Sports Betting Outlook here.

Who is Vixio? Vixio takes the heavy lifting out of regulatory monitoring to help mitigate risk and uncover growth opportunities. Vixio’s award-winning GamblingCompliance platform is trusted by the world’s biggest gambling brands for insights into specific requirements in 180+ jurisdictions to stay current with the ever-evolving gambling regulatory landscape.

The Big Takeaways from Flutter Investors Day

In a four-hour Investors Day presentation, Flutter executives highlighted the company’s successes, including its pole position in the US and the still endless opportunities. As one Flutter slide read, “We are the global leader but still have just a small share of the total market opportunity today.”

Flutter CEO Peter Jackson pointed to “a long runway of growth ahead through regulatory expansion boosting TAM, as well as structural tailwinds like the continued shift from retail to online.”

“While we have podium positions in many of these jurisdictions, our market share of this total opportunity is still relatively small,” Jackson said. “It's a very fragmented market.” As one Flutter slide read, “We are the global leader but still have just a small share of the total market opportunity today.”

The opportunities alluded to grabbed the most attention, particularly Flutter’s new market estimates for North America and the US, which raised some eyebrows.

Flutter’s forecasts put the combined US sports betting and online casino market at $63 billion in 2030, with 80% of the population having access to legal online sports betting and 25% to online casino games.

Flutter is also confident in its ability to grab a substantial share of these new markets (seen in the next two slides) through what Flutter refers to as its “flywheel,” which Jackson explained as:

“Our scale enables us to deliver a leading customer proposition. This generates higher customer numbers and revenue growth, which deliver greater operating leverage on that revenue and in turn, drives even greater scale. This facilitates even more investment, turning the customer flywheel and ensuring we go from strength to strength.”

Jackson called the company’s scale advantage “The Flutter Edge.”

“Our local brands enjoy all the benefits of a global leader while still retaining their local focus and challenger mindset, enabling them to win in all their respective markets without the distraction of central teams or roadmaps,” Jackson said. “That’s why we’re winning around the world.”

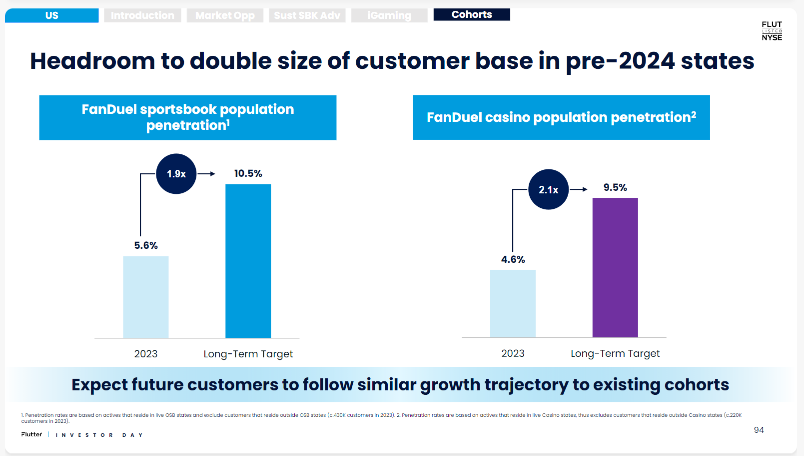

FanDuel CEO Amy Howe mentioned that higher player values combined with improved online casino penetration and advocacy efforts in still-to-be-regulated markets justified the aggressive forecast.

On the “call me skeptical” side is Eilers & Krejcik Gaming’s Chris Krafcik, who noted on LinkedIn that on a per-adult basis, Flutter’s projections (in the third chart) are “pretty high”:

“If you make a squish-reasonable assumption about US 21+ population in 2030 (I used 275mm), you get implied OSB GGR / adult of $177 and iGaming GGR / adult of $349.

“For context, the only market currently doing anywhere near this level of productivity is NJ, where T12M OSB GGR / adult = $163 and iGaming GGR / adult = $310.”

Gideon Bierer of Partis Solutions had a slightly different take, noting that New Jersey may be the best comp for other states in the future:

“I agree that NJ is an outlier, but with organic growth (& inflation), NJ will probably be way ahead of these metrics by 2030.”

Krafcik also questioned if Flutter’s estimate of legal online casinos available to 25% of the US population by 2030 was feasible – EKG and other firms have grown bearish on legalization efforts and predict very little change over the next several years.

As Krafcik tweeted:

“Flutter’s crystal ball is interesting—undoubtedly it contains information to which I'm not privy. I do not see, though, how you can get to this kind of a TAM build without some very aggressive, non-consensus state expansion assumptions.”

Still, it wouldn’t take much to get to 25%.

FanDuel’s online casino is currently available to 11% of the US population – FanDuel doesn’t possess a license in the lottery-run states of Rhode Island and Delaware or poker-only Nevada.

To get to 25%, online casinos would need to be legalized in states with a combined population of around 40-50 million. New York alone gets you halfway there.

Yes, the environment has been inhospitable to legalization for years, and 2025 isn’t looking great. Still, 2030 (which would require legalization to occur by the end of 2028) is a long way off, and things can radically change over the course of a couple of years.

STTP Thoughts: Assuming Flutter’s estimates are correct (and there is no reason to think they aren’t considering the data they are working from), it’s hard to imagine a scenario where a $63 billion TAM is reached in 2030 without significant pushback.

As I wrote on Friday, advertising restrictions are already a growing threat, and so is the potential for states to want to increase their piece of the pie, as Illinois did with its tax increase earlier this year.

Basically, Flutter is extremely bullish in what many see as a bear market for expansion, given the recent outcomes and the air of uncertainty swirling over the industry (limiting bettors, tax increases, Congressional action, advertising restrictions, and more).

Housekeeping

PODCASTS:

This week’s episode of the STTP Talking Shop Podcast featured a podcast first, as I spoke to not one but two guests, Sean Topchi and Derek Ramm of Kinectify. The conversation focused on AML and compliance, including the allegations of illegal bookmaking at Resorts World and the recent Wynn settlement. You can listen to the podcast here.

COLUMNS:

This week’s featured column dove deep into sports betting and gambling advertising restrictions. The US is looking to enact tighter advertising controls, while the rest of the world has beaten the US to the punch.

Over at Casino Reports, I penned a column on why the gambling industry should take the SAFE Bet Act very, very seriously.

Why hire Steve Ruddock? Over the years, Steve has advised startups, national gambling companies, government agencies, and investment banks on a wide variety of topics.

Whether you’re looking for market research, want to raise your brand awareness, or are trying to develop responsible gaming strategies, Steve can help with honest, balanced, no-nonsense analysis of the situation.

Steve’s unique experience and insights are often the missing piece to the puzzle.

Reach out for more information: Straight to the Point Consulting.

The Forecast is a premium service that consists of quarterly reports and weekly updates on the US online gambling sector. I created it specifically for individuals and organizations interested in an unbiased, clear-cut assessment of the landscape. It will launch in November at a cost of $2,600 annually.

Reach out to Steve@igamingpundit.com for more details or to register your organization.