Will It Be Bachelor Number 1, 2, or 3?

Allwyn emerges as a surprise frontrunner to acquire PrizePicks, but it's not the only suitor according to industry chatter.

The Bulletin Board

THE LEDE: A surprise suitor for PrizePicks emerges.

ROUNDUP: New prediction market announced; Former Entain CEO charged; AGA releases NFL betting estimates; FanDuel’s new P2P DFS product.

NEWS: Bet365 responds to IL per-wager fee with surcharge on bets below $10.

VIEWS: State auditor thinks MGC is too lax on sportsbooks.

AROUND the WATERCOOLER: CA Sweepstakes bill moves to Senate floor.

STRAY THOUGHTS: More thoughts on what ails Las Vegas.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: PrizePicks Bidder Emerges

As noted last week, PrizePicks’ transition away from against-the-house games to a 100% peer-to-peer model was a not-so-subtle signal that the brand may be positioning itself for a sale, as it eases any regulatory scrutiny/hurdles.

Straight to the Point first started tracking the shift toward peer-to-peer when DFS 2.0 was having its own sweepstakes moment in 2023-2024 (a couple of examples here and here). The M&A talks around PrizePicks began more than a year ago, in July 2024, when the company “hired Moelis to explore merger and acquisition opportunities, including a potential sale of part of the company.”

According to Earnings+More, a frontrunner has emerged that would value PrizePicks at around $2 billion, with talks nearing a conclusion, per E+M.

“Allwyn has emerged as the frontrunner to buy PrizePicks… with multiple sources telling E+M that the privately held European lottery and gaming giant is now the likeliest buyer.”

As Eilers & Krejcik Gaming (a newsletter sponsor) recently noted, Fanatics is another name that may be kicking PrizePicks’ tires. However, a Fanatics spokesperson told E+M, “Fanatics Betting & Gaming is not involved in any transaction regarding PrizePicks, despite any speculation in the press.”

Who Is Allwyn?

Allwyn is not a household name in the US, but the Czech Republic-based company has its hands in numerous gambling products and jurisdictions. It manages national lotteries in countries such as the UK, the Czech Republic, Greece, Austria, Italy, and Cyprus, and has recently expanded into the US.

The company owns and operates (at least in part):

UK National Lottery

Illinois Lottery

Czech Republic Lotteries

Austrian Lotteries

Greek and Cypriot Lotteries

Italian Fixed Odds Numerical Lotteries

German Online Lottery Reseller

Austrian Casinos and Gaming (Casinos Austria)

Stoiximan Ltd (Online gaming in Greece and Cyprus)

Kaizen Gaming International Limited (Online sports betting and iGaming)

Instant Win Gaming Limited (Online lottery content provider)

Allwyn Lottery Solutions Limited (Gaming technology solutions)

Novibet (Online sports betting and gaming)

So, while not a household name, Allwyn is valued at $13 billion. By comparison, Flutter is valued at around $54 billion, DraftKings at around $24 billion, and bet365 at around $12 billion.

The company has also been expanding its presence in the digital arena while divesting some of its land-based assets. As E+M noted, the company tapped Kresimir Spajic as CEO of Allwyn Digital to lead its efforts to “evolve in a more digitally led and connected way,” and hired Alexis Zamboglou, former managing director of Evoke in the UK, as its Chief Strategy and Transformation Officer.

Roundup: New Prediction Market; Former Entain CEO Charged; AGA NFL Betting Estimates; FanDuel P2P Product

Ex-Polymarket team starts a new prediction market [Betting Startups]: “The team behind Polymarket has resurfaced with a new venture called The Clearing Company, which raised a $15M seed round led by Union Square Ventures with participation from Haun Ventures, Variant, Coinbase Ventures, Compound, and others. Co-founders Toni Gemayel, Liam Kovatch, Nira Eyal, Nick Emmons, and Jayavardhan Munnangi are building on-chain, permissionless prediction markets designed to meet regulatory standards while remaining accessible to retail users.”

Former Entain CEO charged in UK [Earnings+More]: “The UK’s Crown Prosecution Service has charged former Entain CEO Kenny Alexander and 10 others with offences relating to bribery, conspiracy to defraud, fraudulent trading, cheating the public revenue, evasion of income tax, acting as a director of a company when undischarged bankrupt and perverting the course of justice,” Earnings+More is reporting. “In the summary of the DPA, presiding judge Dame Victoria Sharp said Entain was guilty of breaching section 7 of the Bribery Act 2010. Specifically, the judgment went on to say the ‘alleged bribery offenses occurred primarily in Turkey.’”

$30 billion will be wagered legally during the upcoming NFL season [Press Release]: Per the latest American Gaming Association (AGA) research, “Americans are expected to wager an estimated $30 billion on the upcoming 2025 NFL season through legal US sportsbooks… This represents an 8.5% increase over last season’s revised estimated handle of $27.6 billion.”

FanDuel launches new peer-to-peer DFS product, FanDuel Picks [Press Release]: Following a soft launch in four states in April, “FanDuel… is introducing FanDuel Picks, a new peer-to-peer fantasy sports product [that] offers fans a simplified way to engage with their favorite athletes and a chance to win up to 1,000x their entry fee by building lineups and selecting whether the athletes will beat their projected stats during games.” The games are now available in 12 states.

News: Bet365 Adds Per-Wager Surcharge in IL

Bet365 is the latest (and last) Illinois sportsbook to react to the state adding a per-wager fee ($.25 on the first 20 million wagers and $.50 per-wager thereafter).

The following email was sent to a reader over the weekend:

Illinois’ ten licensed sportsbooks are dealing with the state’s per-wager fee in different ways, with half adding their own per-wager surcharge and half installing minimum bet amounts:

BetRivers — $1 minimum

ESPN Bet — $1 minimum

Hard Rock — $2 minimum

BetMGM — $2.50 minimum

Circa Sports — $10 minimum

Bet365 — $.25 per-wager fee on bets below $10

Caesars — $.25 per-wager fee

Fanatics — $.25 per-wager fee

DraftKings — $.50 per-wager fee

FanDuel — $.50 per-wager fee

Views: Is Massachusetts Too Easy on Sportsbooks?

Massachusetts State Auditor Diana DiZoglio is shocked that the Massachusetts Gaming Commission doesn’t audit sports betting ads before they appear, citing numerous examples of missing or not overt enough helpline numbers and 21+ language.

“State Auditor Diana DiZoglio’s office conducted an audit of the MGC that spanned from June 2021 through June 2023 regarding its oversight of both casinos and sports wagering and came away with some harsh conclusions about the agency, including its treatment of sportsbooks.

“‘The Massachusetts Gaming Commission has a responsibility to follow the law and provide adequate oversight, especially pertaining to gambling addiction issues,’ said DiZoglio. ‘Our findings reveal regulatory breakdowns that we encourage the Commission to continue addressing over the course of the next six months, at which time we will conduct our post-audit review.’”

The MGC being too lax was not on my 2025 bingo card, as it’s often propped up as the most stringent regulatory body, to the point of hairsplitting.

Of note, New Jersey online casino regulations (written in 2013) require all advertising, marketing, and promotional materials to be submitted for DGE approval. This was followed to the letter early on (operators told me approval could take upwards of a month, making spur of the moment campaigns impossible), but eventually relaxed as it proved uneccesary and too much of a burden.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Around the Watercooler

Social media conversations, rumors, and gossip.

The California bill banning sweepstakes is on the move.

Sweepstakes proponents are speaking out against the bill, including the Social Gaming Leadership Alliance (SGLA), which expressed “its disappointment that the California Senate Appropriations Committee has moved Assembly Bill 831 (AB831), which threatens to ban online social games with sweepstakes promotions in California, to a vote on the Senate floor,” in a press release.

In addition to sweepstakes operators, others opposing the bill include a trio of California tribes and Publishers’ Clearing House. It should be noted that PCH was acquired by a social casino operator earlier this year.

Part of the SGLA’s response included advocating for legalization/regulation, with the group pointing to a new nationwide poll with an oversample of California voters that “reveals that Californians overwhelmingly oppose banning online social games with sweepstakes promotions… [and] strongly prefer regulation and taxation that would protect consumers, preserve choice, and deliver economic benefits for the state.

According to the SGLA:

“85% agree California should modernize and update laws to regulate and tax online social gaming, providing more money for state budgets.”

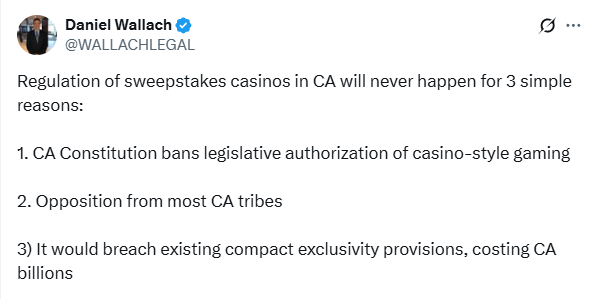

However, as Daniel Wallach noted on X, that’s easier said than done:

Stray Thoughts

I recently read an article by longtime industry analyst Ken Adams on what is causing Las Vegas’s slumping visitation numbers, and if resort fees are to blame.

In the column, Adams writes:

“Undoubtedly, resort fees play a role. Price-conscious travelers seek the least expensive options. Some people have probably decided not to go to Las Vegas because of the cost. Some may have gone to Atlantic City, Mississippi, Missouri, Connecticut, or any one of hundreds of other destinations instead. There are over 1,000 casinos in the United States, and most have hotels. However, if it is cheaper hotel rooms you are looking for, don’t look in any major destination, because they are not necessarily cheaper than Las Vegas. Try New York City, Los Angeles, San Francisco, Chicago, or Miami. And resort fees are not exclusive to Las Vegas.”

Adams is clearly correct on both counts; there are cheaper and closer gambling options, and prices in major cities are also sky-high.

But as I’ve said in the past, casinos, especially those on the Las Vegas Strip, have positioned themselves as entertainment hubs, so they aren’t just fighting other casinos (and online offerings) for customers; they are fighting everything from art museums to sports events.

The Las Vegas Strip has glitzy hotels, fine dining, shows, and, of course, gambling. But gambling is just a form of entertainment/excitement, and there are plenty of new ways to have those experiences without gambling — something you can do any time and any place if that’s your thing.

The truth is, Las Vegas has always been something of a bucket list destination for travelers (like New York City, Paris, or Disney World). In the past, people would have a great experience and would become return visitors. As prices go up, fewer and fewer people are having that great experience, which is also potentially dragging down employment.

As I noted in a column a few weeks ago:

“I’ve always poo-pooed the idea of price sensitivity, but with the caveat that there is a tipping point. My belief has been (and remains) that a resort fee or 6/5 blackjack or 000 roulette won’t keep people away. But when quadruple-zero roulette is rolled out, or when resort fee passes a certain threshold, or is coupled with a dozen other added costs, it might, and the city is starting to realize that something might be wrong.”

Rather than scaring away the first-time visitor, what Las Vegas may be seeing is the slow burn of return visitors (evidenced by the anecdotal evidence in this excellent Nevada Independent article that also offers the industry perspective).

Las Vegas is undoubtedly still a must-visit, but if the bang-for-your-buck ratio dips, the potential that they choose to check off a new bucket list destination increases. If a family vacation to Vegas now rivals the cost of an international trip to Europe or a Caribbean cruise, the decision becomes a no-brainer for many. And then there are the more budget-friendly options, such as Nashville, Austin, and New Orleans.

Think of it this way: Are other cities more expensive? Yes. But what if a big part of the appeal was that Vegas was seen as fine dining and top-tier shows at a budget price? As I’ve said in the past, part of the allure of Vegas was that the little guy got a taste of the high-roller treatment. That’s not part of the equation for paying exorbitant prices in Disney, Paris, or NYC, that’s for other reasons.

Ultimately, the key to reversing this trend isn't just tweaking resort fees or game odds; it's about rediscovering value in the Vegas experience. By emphasizing unique, irreplaceable draws, paying more attention to the little things, while keeping costs in check, the city could reignite visitor loyalty. Otherwise, as choices multiply and wallets tighten, Las Vegas risks fading from must-do status to a “been-there-done-that” or “maybe someday” destination.