You're The Best Around

What states should you keep an eye on for online casino legislation in 2026? Straight to the Point has a list of no less than 10.

The Bulletin Board

THE LEDE: Examining the best online casino candidates heading into 2026.

WEEKEND CATCH-UP: Stories That May Have Slipped Through the Cracks.

VIEWS: How impactful will the 90% gambling loss deduction cap be (for poker)?

AROUND the WATERCOOLER: Maine continues to be a hotbed of controversy.

STRAY THOUGHTS: Sponsorship opportunities.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: iCasinos Best(?) Candidates in 2026

Online casino legalization efforts have ground to a halt since Rhode Island snuck a legalization effort over the finish line in late 2024. And while I don’t expect much movement in 2026 as none of the current obstacles have been removed and it’s an election year, there are still contenders, even if they are Buster Douglas vs. Mike Tyson-level underdogs.

So, with that in mind, what states should you keep an eye on in 2026? Here are Straight to the Point’s top states to watch:

Arkansas

Florida

Illinois

Indiana

Maine

Maryland

Massachusetts

New Hampshire

New York

Virginia

Also keep an eye on dark horse candidates like Hawaii, Wyoming, Colorado, and Iowa.

And here is STTP’s quick analysis of Arkansas, Florida, Illinois, Indiana, and Maine — I’ll examine Maryland, Massachusetts, New Hampshire, New York, and Virginia in an upcoming newsletter. For deeper dives into all online casino and sports betting legislation you can sign up for STTP’s premium subscription service, The Forecast.

Arkansas

Arkansas took a couple of bites at the apple in 2025 (SJR 8, sponsored by State Sen. Brian King, and HB1861, sponsored by State Rep. Matt Duffield), with the goal of offering an alternative and other gray and black market sites cited as the impetus for online casino legalization. The same arguments will be made in 2026, but consensus among the state’s stakeholders remains elusive.

As STTP wrote in December in my “5 Best iCasino Candidates in 2025” entry:

“A battle is brewing in Arkansas as Saracen Casino continues to push for regulatory changes that would authorize online gambling (starting with 50/50 raffles) via regulatory approval. You can find a full explanation of the Arkansas rule Saracen is trying to leverage here. Saracen CMO Carlton Saffa recently said he anticipates online casinos will begin in 2025 after voters nixed the Pope County casino. Saffa has also been highly critical of rival Oaklawn, which opposes online casino legalization.”

Florida

Florida is already an iCasino state… well, sort of. In October 2025, Hard Rock Bet added games powered by “past motor racing,” which the company claims are not slot machines because the underlying mechanics that determine the outcome use historical racing results — a claim similar to those made for historical horse racing machines (HHRs) — but they are in fact, online slot machines.

The big question heading into 2026 is threefold:

Will anyone challenge the legality of the games?

Will the Seminoles expand their online casino offerings?

Will Florida and the Seminole Tribe officially legalize iCasino?

“STTP considers tribal gaming states the best dark horse contenders in 2025. One such state is Florida, where the legalization of online casinos can be achieved through a tribal compact between the governor and the Seminole Tribe… Also working in Florida’s favor is that the original compact that brought mobile sports betting to the state requires the Seminoles and the governor’s office to begin the online casino compacting process within three years after the sports betting compact’s effective date.”

Illinois

There are always online casino efforts in Illinois, including two last year (SB 1963, sponsored by State Sen. Cristina Castro, and HB 3080, sponsored by State Rep. Edgar González, Jr.), but that’s been the case for more than a decade and there is nothing to show for it.

On the plus side, Gov. J.B. Pritzker called iCasinos an idea worth exploring last year, but STTP believes online casinos are going to sit on the sidelines until the VGT industry is on board, which is unlikely to happen anytime soon, considering a March 13 hearing turned into an anti-legalization struggle session. Looking ahead to 2026, there will be an industry vs. Chicago fight over tax rates, and VGT authorization in Chicago will tamp down further expansion talks.

Indiana

Indiana has been a top online casino contender for several years, and while the Indiana House Public Policy Committee (chaired by HB 1432 sponsor Rep. Ethan Manning) passed the bill in a 9-2-2 vote on January 28, 2025, the final vote belies the overall sentiment toward online casino expansion in the state.

Despite committee passage, the bill was shelved in the House after it failed to gain traction in Ways & Means due to stakeholder concerns about cannibalization. Indiana House Speaker Todd Huston said, “There are all sorts of moving parts about how it impacts communities and what it does overall to the gaming environment in Indiana.”

As STTP wrote in 2023, there is strong opposition in a state that still has the taint of gambling industry malfeasance on its mind:

“Indiana was a top candidate last year, but key lawmakers are already punting in 2024, citing the optics of Former Rep. Sean Eberhart pleading guilty in a federal corruption case. Eberhart supported a 2019 bill in exchange for a promised post-legislative job with Spectacle Gaming at a salary of $350,000… [Senate President Pro Tem Rodric] Bray believes the fallout might extend past 2024, putting Indiana online gambling hopes on ice for years to come.”

And there is also the industry opposition, which is consolidating with the formation of the National Association Against iGaming (NAAiG), which I wrote about in 2024:

“The most notable voice of opposition was Churchill Downs, which expressed skepticism that legalization and regulation would reduce the black market. Churchill Downs and other online-skeptical land-based casino stakeholders present the most considerable obstacles to legalization… STTP believes the real battle will be in the Senate.

“Senate Appropriations Committee Chair Sen. Ryan Mischler is a longtime gambling critic, and Senate Pro Tempore Rodrick Bray is also a skeptic but rumored to be warming to online gambling.”

Maine

After being resurrected in May, LD 1164, Sponsored by State Rep. Ambureen Rana, managed to pass the Maine House and Senate. The bill would allow each of the state’s tribes to partner with an online casino operator, and while the bill is still active, it is opposed by the state’s gambling regulators, who are encouraging Gov. Janet Mills to officially veto the bill — Mills has put it on ice until the legislature reconvenes in 2026 (at which point she is expected to veto the bill).

If you scroll down to today’s watercooler section you’ll get a good feel for why online casinos are unlikely to get the nod in Maine, despite legislative approval. One significant reason is the structure of the bill, which gives absolute control to Maine’s tribes (even though the state has two commercial casinos operated by Penn and Churchill Downs).

As previously noted, even other online operators oppose the bill:

“The bill would grant online casino exclusivity to the state’s tribes, excluding the two commercial casino operators, Penn and Churchill Downs. The latter is a member of the National Association Against iGaming (NAAiG) and opposes online gambling.

“An unexpected opponent was FanDuel. In written testimony, FanDuel said it “welcomes the Legislature’s consideration of legalizing iGaming,” but is “concerned that it will not create the healthy, regulated market that we have seen in many other states.”

“The concern is that it will be shut out of the market, as DraftKings has already partnered with the Passamaquoddy Tribe, and Caesar’s has partnered with the Penobscot, Maliseet, and Micmac Tribes. These existing partnerships would limit the market to two operators.”

Weekend Catch-Up: The Stories That May Have Slipped Through the Cracks

Brazil will be bumping its tax rate up to 15% [Next.io]: Brazil’s President Luiz Inácio Lula da Silva signed legislation “that will increase taxation on betting companies operating in Brazil, with the rate set to rise from 12% to 15% by 2028.” As STTP previously reported, Brazil rescinded a previous tax increase that would have bumped the rate to 18%. There are separate, active efforts working their way through the Brazilian legislature that would raise the rate to 18%.

Colorado tribes take sports betting case to appellate court [InGame]: “Colorado’s Ute tribes are taking their claim that the state is denying them the right to offer statewide mobile sports betting to a federal appellate court. The tribes — the Southern Ute and Ute Mountain Ute — initially sued the state in July 2024 arguing that like their commercial counterparts, they should be able to offer online sports betting throughout Colorado.” STTP reported on this case extensively in October, as the judge’s decision focused on “where a bet takes place,” as well as when it was originally filed due to its West Flagler arguments.

New agreement could see New England Revolution moved to Everett [FOX 25 News]: There may soon be another reason to head to Everett, MA, as “Across from Wynn Casino, on the shore of the Mystic River, the Kraft Group is intending to build a new soccer stadium, a new home for the New England Revolution,” per local reporting. “Boston Mayor Michelle Wu, in a New Year’s Eve press release, announced a $48-million agreement with the Kraft Group that provides money for infrastructure that would address traffic and transit issues in this dense urban area.” Encore Boston Harbor has consistently fallen short of its revenue goals, so adding another destination in the vicinity could help close the gap.

Quote of the Week: “I think that’s something we need to take a serious look at… We need about $6 billion just to put in infrastructure. So how do we do that? We can’t just rely on the legislature.” ~ Department of Hawaiian Home Lands Director Kali Watson on potential revenue from gambling legalization.

SPONSOR’S MESSAGE - Groundbreaking Partnership for Player Protection: Mindway AI and DraftKings Join Forces

Mindway AI has announced a partnership with DraftKings, integrating the award-winning Gamalyze solution into DraftKings’ Responsible Gaming Center. This collaboration reinforces a mutual commitment to player education and responsible gaming by providing a science-based tool that evaluates real decision-making during a simulated card game. Gamalyze offers objective insights and personalized feedback, empowering players to manage their gaming habits responsibly.

To learn more about this groundbreaking collaboration, visit Mindway AI here.

Views: Gambling Loss Deduction Impacts Less Than 1%

In a recent Nevada Independent column, poker Hall of Famer Erik Seidel painted a bleak picture of poker in 2026: “Next year I am kind of forced into retirement,” the longtime Las Vegas resident told The Nevada Independent. “Everyone who I’ve spoken to plans on either cutting back or stopping.”

Unlike the new 90% gambling loss deduction cap, Seidel is 100% correct. The policy should have significant impacts throughout the poker world.

The key word is should. Because if you know professional poker players, you know the following is true:

Players like Seidel have the luxury of taking a year off, or cutting back. Most don’t.

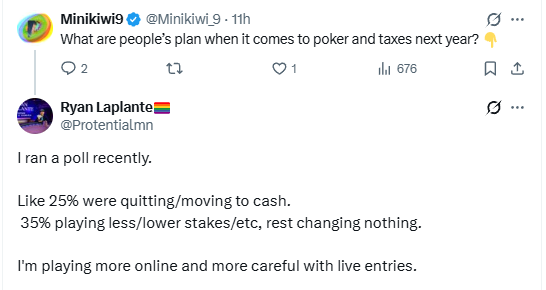

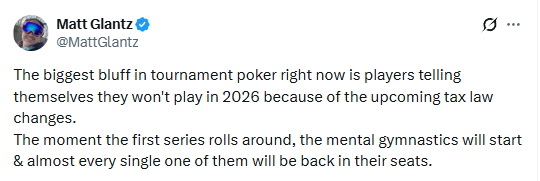

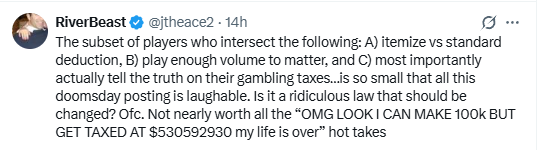

Furthermore, as I’ve been saying all along, the subset of players this will impact is tiny, and the subset of that subset that will change their gambling behaviors because of the 90% cap is even smaller (plenty of the VIPs I allude to below don’t care about the taxes):

“I’ve seen many posters calling this a crisis-level event that could impact tens of millions of taxpayers. The new cap on gambling loss deductions is a crisis-level event… if you are a specific type of gambler — a professional or a losing VIP who receives numerous W-2G tax forms.

“Since only those who itemize can deduct gambling losses, the actual number of filers itemizing gambling deductions is a small subset of total filers. As I noted on Monday, according to the most recent available data from the IRS (2020), approximately 662,000 tax filers claimed gambling losses as itemized deductions out of 161 million tax returns filed, or about 0.4% of all tax filers.

“And let’s be serious about gambling filings:

“Essentially, although this is not a favorable development for professionals and some VIPs (and there are efforts underway to revert to the old policy), the new rule will affect only a small number of people. It just so happens that those people account for a ton of the gambling done in the US.”

And I’m not the only person with that opinion:

Around the Watercooler

Social media conversations, rumors, and gossip.

Maine sports betting has been one controversy after another.

First there was the September 2024 vote of no-confidence in the executive director of the Maine Gambling Control Unit, Milton Champion:

“Like Chancellor Valorum in the Phantom Menace, Maine’s top gambling regulator has been hit with a letter of ‘no confidence’ signed by all nine state investigators, who claim he has created a ‘toxic work environment.’”

And then there was the fiasco that is retail sports betting in the state, which I covered back in September 2024:

The long leadup to retail betting (more than two years after legalization) intersects with another story Straight to the Point has been covering: the internal strife in the Maine Gambling Control Unit centered around Executive Director Milton Champion. Champion was the subject of a letter of “no confidence” signed by all nine state investigators, who claim he has created a “toxic work environment.”

As I noted in June, Maine State Sen. Joe Baldacci openly questioned why the MGCU took so long to authorize retail sportsbooks.

“It is both surprising and unacceptable that not a single retail operator has commenced operations,” Baldacci said, intimating the delay was not a coincidence. “There’s no comparison; there’s no other place where you could find this kind of stagnation.”

And now there are questions over withheld payments to tribal members from the Passamaquoddy Tribe’s sports betting partnership with DraftKings. According to local press, the partnership has generated over $100 million in gross revenue since 2024, with the tribal cut somewhere around $26 million. The problem is, tribal members haven’t seen any of the proceeds.

On the Sipayik reservation (one of two Passamaquoddy reservations in Maine), demands for transparency over these funds have ignited political turmoil, fueling recall attempts against Chief Pos Bassett amid accusations of withholding money. Controversy is nothing new, as the Sipayik have gone through seven chiefs in 10 years, with four recalled.

Per the Portland Press Herald:

“Where that money is going, how much is spent on advertising and promotions, and how much is reinvested into tribal enterprises is unclear. When tribal members have requested clarity, they say they are rebuffed — further fueling the suspicion of wrongdoing by their leaders.”

Stray Thoughts

The Straight to the Point newsletter has limited sponsorship slots left for 2026.

Whether you’re trying to get your product or ideas in front of legislators, regulators, gaming executives, VCs, industry influencers, or consumers, STTP has you covered. With a growing readership nearing 5,000 subscribers, every ad will have the same reach as a booth at a major conference… at a fraction of the cost.

As STTP pushes toward 6,000 subscribers in 2026, your sponsorship ensures targeted exposure that puts you in front of the right audience.

Packages are flexible and can be tailored to your goals.

Spaces are limited and fill up quickly — I was 90% sold out by March 2025.

Contact Steve (igamingpundit@gmail.com) today to discuss options and secure your spot.

Nice roundup of whats happening state-by-state. The Indiana situation is really intresting becuase it seems like they've been on the verge forever but stakeholder infighting keeps killing momentum. I remeber when Churchill Downs was more open to digital expansion but they've clearly shifted thier stance as land-based revenues stabilized. Maine's tribal exclusivity model is wild too and probly explains why even operators like FanDuel are pushing back instead of lobbying for expansion.