A Fight Is Brewing

Prediction markets have become a polarizing force in the gambling industry, and between operators and regulators.

The Bulletin Board

THE LEDE: Arizona pulls Underdog’s DFS license over prediction markets.

ROUNDUP: Chicago OSB tax; Caesars adds pari-mutuel wagering in VA; NY casino updates; MA regulators ready to unveil rules on limiting bettors.

NEWS: Several states express concerns over prediction markets.

VIEWS: Fanatics (unsurprisingly) leaves the AGA.

AROUND the WATERCOOLER: Prediction market space is growing crowded.

STRAY THOUGHTS: Working backwards to justify decisions.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: Arizona Regulators Take Aim at Underdog

Arizona is the first state to pull a gaming license over prediction markets, having notified Underdog (a newsletter sponsor) on Dec. 5 that it intends to revoke the company’s fantasy sports contest operator license — the letter was obtained by Sports Betting Dime via a public records request. Underdog said it plans to appeal the decision.

“ADG has determined that Underdog, by contracting with Crypto, benefitting from Crypto’s services, supporting Crypto’s interests, and providing financial support to Crypto is aiding and abetting Crypto’s illegal conduct in Arizona and providing it with a façade of legitimacy. Moreover, and in the same fashion, Underdog’s relationship with Crypto is an association that poses a threat to the public interest of this State. As a result, the Department hereby provides Underdog notice of its intent to revoke fantasy sports contest operator license FS200008,” a member of the Arizona Department of Gaming wrote in the Dec. 5 notice.

Of note, Underdog’s prediction market offerings are not available in Arizona, which has sparked some intense debate over the license revocation.

Per InGame:

“Chris Kotterman of the Arizona governor’s office told InGame at the National Council for Legislators from Gaming States Winter Meeting on Saturday that the Underdog ban stemmed from unlicensed activity by Crypto.com.

“I think this one was unique because its conduct was focused in Arizona,” he said.

“We know that Crypto.com was offering contracts in Arizona. We told them to stop and then Underdog partnered with them. And so that’s the problem.”

As I noted on X, “Nevada has done this for many years with land-based and online operators and suppliers. And many jurisdictions have gotten more proactive about global gray market activity, particularly if another locale makes a stink about it.”

And as I noted in the newsletter in November:

“The big question is what authority a state regulator would have to revoke a license? As Richard Schuetz often notes, licenses frequently come with a broad reputational clause, and several states have warned licensees, ‘not to go there.’”

And as I noted, Arizona has plenty of leeway to take action, given its licensing rules — Arizona A.R.S. § 5-1305(B)(5) (Grounds for Disqualification from Employment or Licensure):

“Is a person whose prior activities, criminal record, if any, or reputation, habits and associations pose a threat to the public interest or to the effective regulation and control of gaming or create or enhance the dangers of unsuitable, unfair or illegal practices, methods and activities in the conduct of gaming or the carrying on of the business and financial arrangements incidental thereto.”

I noted in a 2019 column (that is still very relevant today) that former Nevada Gaming Control Board (NGCB) Chairman A.G. Burnett explained that during his time with the NGCB, “Nevada regulators were in constant communication with foreign and domestic markets to make informed decisions on gray markets.”

According to Burnett, “Nevada regulators will look at a variety of factors when determining if a gray market is cinder-block gray and OK to do business in, or if it’s charcoal gray and should be avoided. Conclusions are reached after careful research and deliberations.”

Among the factors Burnett cited:

What laws are on the books in that jurisdiction?

Is the jurisdiction actively prohibiting gambling or enforcing laws against gambling providers?

Is gambling out in the open, or is it confined to backrooms and underground casinos?

Does the jurisdiction impose a tax on gambling suppliers?

Does the jurisdiction have a regulatory/licensing system?

What do local gaming law experts think?

The New Jersey Division of Gaming Enforcement was of a different mindset (at least it was back in 2016 when it released the following bulletin:

“Clearly, when a government agency attempts to divine the intentions of another sovereign jurisdiction through a critical evaluation of local circumstances and resulting actions or inactions, any conclusion reached is fraught with the likelihood of error or misinterpretation…

“It is in this context that the Division finds itself attempting to articulate a licensing standard that fulfills its regulatory responsibilities under the Act while also giving proper deference to the sovereignty of other jurisdictions…

“As a result, the Division will examine whether or not the jurisdiction has a law that specifically prohibits internet gaming, and if so, whether the jurisdiction has taken affirmative, concrete action to enforce that law.”

And as I mentioned in November, regulators can also make life very difficult on operators, without pulling their license:

“Even if state regulators don’t have any recourse, pissing off a state regulator is also going to rile up state lawmakers, and if you thought the climate was intense now, just wait until states start coming for two pounds of flesh instead of the usual one.”

Weekend Catch-Up: Chicago OSB Tax; Caesars Pari-Mutuel in VA; NY Casino Updates; MA Limiting Rules

Chicago aldermen put forth alternate budget, including sports betting tax [InGame]: It’s looking more and more likely that Chicago will add a city tax to mobile sports betting operators: “In the “alternate” budget sponsored by 27 of the Chicago City’s 50 aldermen and submitted Wednesday, it included Johnson’s proposed 10.25% tax on all sports betting revenue generated within city limits. The city is looking to plug a $1.2 billion budget gap, with various taxes and levies being considered.”

Caesars adds pari-mutuel racing to VA sportsbook [Press Release]: The Caesars Sportsbook app in Virginia now offers pari-mutuel racing powered by NYRA Bets. Virginia is the eighth state that Caesars has integrated pari-mutuel wagers into its sports betting app: Colorado, Illinois, Indiana, Kentucky, Maryland, New York and Ohio.

New York Gaming Commission to evaluate casino proposals [Sports Betting Dime]: After receiving positive recommendations from the New York Gaming Facility Location Board (GFLB), the New York State Gaming Commission will consider the three downstate casino licenses (Bally’s Bronx, Hard Rock Metropolitan Park, and Resorts World) during a meeting today at 1 PM. The NYSGC has until Wednesday, Dec. 31 to award the licenses.

Massachusetts will tackle player limiting at upcoming hearing [Bookies.com]: “The Massachusetts Gaming Commission (MGC) plans a vote on regulations concerning player limits during a meeting Thursday. An MGC source says the measure enjoys majority support on the Commission. The source adds the regulation it will be “tougher than expected” in terms of patron protection.” Limiting, as well as VIP practices have been hot topics of conversation with the MGC (in 2024 and more recently).

News: Prediction Market Crackdown Continues

Several states have added their names to the anti-prediction markets list.

California [InGame]: According to California Nations Indian Gaming Association Chairman James Siva, Attorney General Rob Bonta’s office, is preparing to join an amicus brief in support of Maryland’s case against Kalshi, and potentially filing a lawsuit.

Arizona [AZ Family]: In addition to today’s lead story, Attorney General Kris Mayes issued a statement last week (regulators already sent cease-and-desist notices to several prediction market platforms) saying it “is aware of the rapid growth of so-called ‘prediction markets’ and the concerns they raise around compliance with Arizona laws… The Attorney General’s Office is closely monitoring how these products are being offered to the public and any efforts to sidestep existing regulatory safeguards.”

Missouri [Covers]: The ink on Missouri’s sports betting launch isn’t even dry, and state regulators are already concerned with the potential impact of prediction markets on licensed wagering. One operator, Underdog, pulled its license application, and MGC Chair Jan Zimmerman told Covers, “I’m for sure watching this and how it will impact sports wagering.”

Washington [Press Release]: On December 9, 2025, the State Gambling Commission released guidance declaring that prediction markets and event-based contracts are not authorized under state law. Still, action seems unlikely: “While prediction markets are an unauthorized activity in Washington State, we acknowledge that the future of prediction markets, including those for sports, political events, etc., remains a subject of ongoing litigation both federally and in other states. We will continue to monitor the ongoing cases as they progress through the court system and will provide updates once the courts provide further guidance.”

Louisiana [iGaming Business]: The Louisiana Gaming Control Board Chair Christopher Hebert issued an advisory letter stating that sports-related prediction markets qualify as illegal sports betting, and warning operators that “may be exploring opportunities to operate, offer or otherwise facilitate access to prediction markets, platforms or event-based contracts.” The letter reads in part, “It is the board’s position that such activities constitute sports wagering under Louisiana law and are not being conducted in compliance with Louisiana Gaming Control law or under a valid Louisiana issued license or permit.”

In related news, as noted on Thursday, several prediction markets have joined forces to form a trade group: The Coalition for Prediction Markets. The groups’ stated goals are, per Axios, “promoting federal regulation — via the Commodity Futures Trading Commission (CFTC) — and warding off legal attempts by state gaming regulators to block their services.”

The current membership includes Kalshi, Crypto.com, Robinhood, Coinbase, and Underdog. Noticeably absent is Polymarket.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Views: Fanatics Leaves AGA Following Prediction Market Launch

In the least surprising news of the week, Fanatics has left the American Gaming Association (AGA).

As reported by SBC Americas:

“A week after the company launched Fanatics Markets on Dec. 3, Fanatics is no longer a member of the AGA. An AGA spokesperson told SBC Americas that Fanatics relinquished its membership last week and the gaming trade body has scrubbed the online sportsbook’s name from its membership list.”

Again, this is not shocking news. As I said when Fanatics launched its prediction market:

“One aspect of this situation to keep an eye on is Fanatics’ American Gaming Association (AGA) membership. DraftKings and FanDuel resigned from the organization when they announced they would be launching prediction markets; Fanatics did not.”

Further Reading: Fanatics Markets Is A Prediction Platform Sports Bettors Should Find Familiar

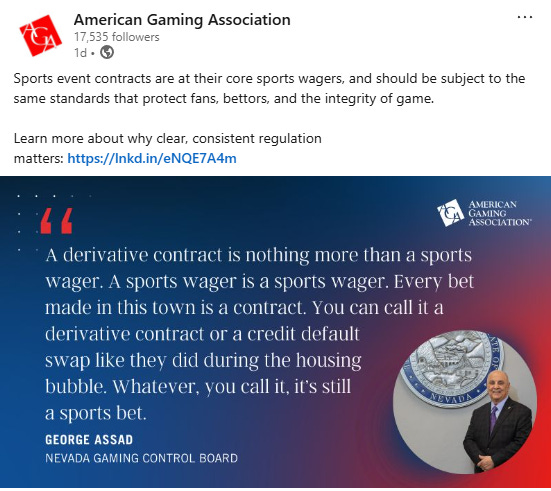

Meanwhile, while the Sports Betting Alliance and iDEA Growth are embracing prediction markets, the AGA is ramping up its opposition.

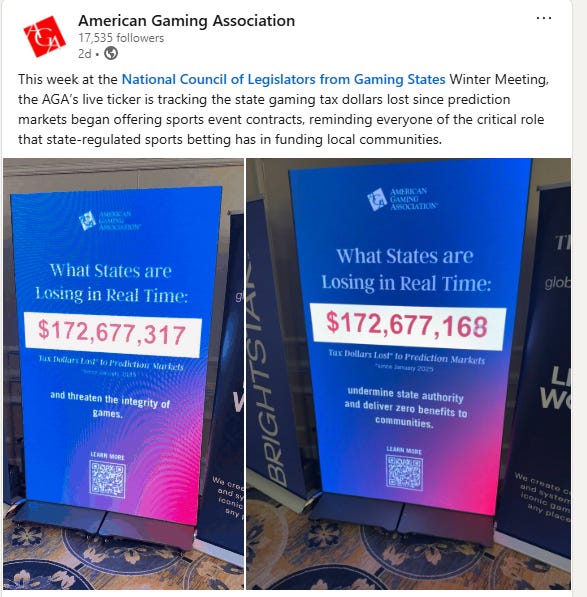

This was posted on LinkedIn:

And the AGA displayed its lost tax revenue counter at the NCLGS conference in Puerto Rico:

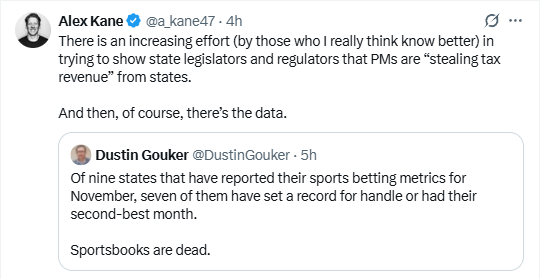

Of course, it’s difficult to know how prediction markets are/will impact traditional sportsbooks at this point in time (basically, it’s too early to know):

STTP Thoughts: Setting aside the impact (positive or negative), after several years of industry coalescence, there is a clear divide happening within the gambling industry, and it’s making the mid-2010s divisions over online gambling seem quaint by comparison. More on this in an upcoming feature column.

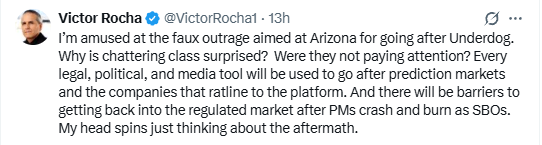

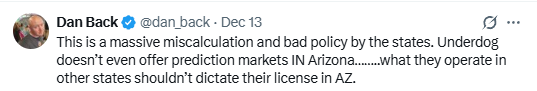

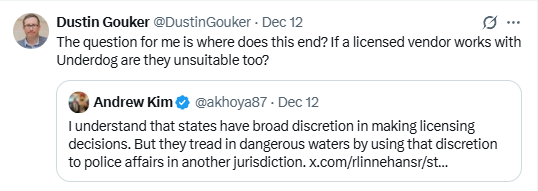

Around the Watercooler

Social media conversations, rumors, and gossip.

There seems to be one of these every day:

As I previously wrote: “Prediction markets might seem like the next big thing, but with regulatory battles raging and the market flooded with competitors, jumping in might backfire.”

“If FanDuel, DraftKings, BetMGM, Caesars, bet365, and Underdog can all offer prediction markets on sports, then it’s just another product in a crowded marketplace that is also competing against traditional sportsbooks, DFS, sweepstakes, and everything else. The advantages of being a prediction market evaporate, and it becomes a battle of UX, marketing budgets, and brand recognition.”

We also have news (from Bloomberg) that Coinbase is launching a prediction market:

“Coinbase Global Inc. plans to announce next week that it will launch prediction markets and tokenized equities, two of the hottest products in the financial markets, according to a person familiar with the matter.”

That is in addition to several other crypto-prediction market developments Dustin Gouker listed in his Event Horizon newsletter:

Gemini just got approval from the Commodity Futures Trading Commission to move ahead with a prediction market.

Kalshi is moving tokenized versions of its contracts onto crypto platforms and wallets; see more below on its integration with Phantom.

Crypto.com is an early adopter of prediction markets in the US.

Polymarket, which was built on chain and is available internationally, is in beta in the US under the CFTC.

Stray Thoughts

In a recent Fifth Column appearance, Dan Abrams rhetorically asked if the Supreme Court Justices ever “come up with an outcome and work their way back? Justices have always done that; it’s not something new.”

This is something I brought up during my podcast with attorney Andrew Kim:

“I like to say I could argue either side of this. And say, here’s why this is right. Here’s why this is wrong. And I think the courts sometimes do the same thing. They’re not supposed to. But I think there is a tendency of, what are the knock on effects if I do this?”