Bring The Receipts

Prediction markets were warned by the CFTC to have a plan of place in the event of an adverse legal outcome like the one recently handed down in Massachusetts.

The Bulletin Board

THE LEDE: Kalshi’s Massachusetts problem.

ROUNDUP: A look at the stories you may have missed.

QUICK HITTER: Gambling Loss Deduction will stay at 90% (for now).

NEWS: AIBM Announces New Policy Hub and Webinar (that includes me).

AROUND the WATERCOOLER: More on insider trading.

STRAY THOUGHTS: Just like the good old days.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: The Holes in Kalshi’s Geolocation Arguments

Massachusetts Judge Christopher Barry-Smith was expected to grant an injunction that would require Kalshi to cease its operations in Massachusetts on Friday, but at the hearing, the judge hit the pause button, setting another hearing sometime next week, and pushing back potential enforcement.

As InGame noted, a decision is unlikely before the Super Bowl:

“The exact date of the new meeting has not yet been set, but it appears that the decision on whether to enforce the stay may not be made until an even later date, as Massachusetts will have an opportunity to respond to Kalshi’s motion for a stay by Jan. 30, and Kalshi can then reply by Feb. 4.”

At issue is Kalshi’s ability to geofence the state, something it has argued, including in Massachusetts, is logistically and financially impossible — Kalshi claims it would take months to implement.

However, even the prediction-market-friendly Commodity Futures Trading Commission (CFTC) warned prediction markets in late-September that this is a potential outcome and they should have a plan in place.

From the CFTC advisory (covered by STTP in October):

“The Divisions are issuing this Advisory to caution FCMs, IBs, DCMs, and DCOs that State regulatory actions and pending and potential litigation, including enforcement actions, should be accounted for with appropriate contingency planning, disclosures, and risk management policies and procedures.”

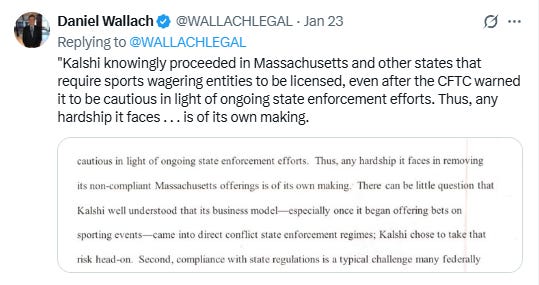

As Daniel Wallach noted, “The CFTC's warning letter to DCMs to be cautious in light of state enforcement efforts and make "contingency plans" for adverse court rulings ironically convinced the Court to find that the "public interest" weighed in favor of granting a preliminary injunction to Massachusetts.”

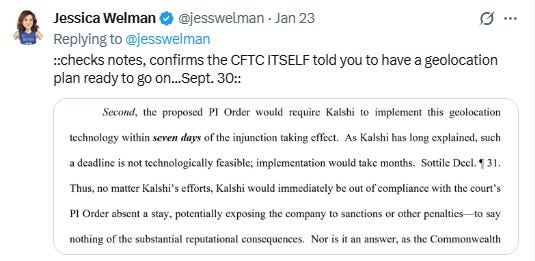

And as Jessica Welman noted, Kalshi’s claim that it’s not technologically feasible to put geolocation technology in place on such a short deadline, ignores the nearly four months that have passed since the CFTC advised it make contingency plans for just such an event — as Judge Barry-Smith said, any hardship is of its own doing.

Further, the CFTC noting this is a potential outcome, and telling prediction markets to make contingency plans, shoots a hole in Kalshi’s other argument against geofencing; that limiting access violates the CFTC’s impartial access requirement and could cause the CFTC to consider punishment. That seems unlikely if the regulator is telling you to make those plans.

As attorney Andrew Kim noted in a LinkedIn post when the advisory was released, “A CFTC exercising this kind of prudence about parallel authority may not share the view of prediction market operators that the agency's “exclusive” jurisdiction should exclude the states.”

Roundup: So Much News; So Little Newsletter Space

UFC cancels fight for suspicious betting activity [ESPN]: “The UFC canceled a bout at UFC 324 between Alexander Hernandez and Michael Johnson on Saturday “after the contest was flagged for suspicious betting activity,” per ESPN. The reason for the cancellation hours before the fight wasn’t initially given, but “UFC CEO Dana White confirmed at his post-fight news conference it was for suspicious betting activity.”

Missouri won’t ban college player props… yet [Associated Press]: “Missouri gambling regulators on Thursday rejected a request from the NCAA to restrict bets on the performance of college athletes in response to recent betting scandals but left open the possibility of revisiting the issue as the state’s fledgling sports betting market gets better established.” As the AP reported, regulators made it clear that they weren’t ready to make such a change this early into the state’s sports betting experiment: “I just don’t feel that I have enough information to grant a request by the NCAA to prohibit this type of sports wagering, because I don’t know enough yet,” commission chair Jan Zimmerman said.

Santa Anita sues for return of gaming machines [Los Angeles Times paywall]: After having its recently installed HHR machines removed after two days, Santa Anita Park has filed a 52-page writ of mandate against the California Department of Justice in Los Angeles Superior Court. As Casino Reports noted (no paywall), “The suit seeks the return of 26 betting machines (and the cash inside them) that state agents seized on Saturday, just two days after the machines went live.” Of note, trade unions, including the Teamsters and SEIU (many have close ties with race tracks) are backing Santa Anita. Previous STTP coverage of Santa Anita’s HHR machines.

Robinhood-Susquehanna complete acquisition of MIAXdx [Event Horizon]: “The two companies announced in November that they were buying a controlling stake in MIAXdx. The acquisition is aimed at improving Robinhood’s prediction market offering.” As Event Horizon notes, “Currently, Robinhood offers prediction markets as a futures commission merchant, listing markets from both Kalshi and ForecastEx in that role. The acquisition gives Robinhood both a designated contract market (DCM) and a derivatives clearing organization (DCO) registered with the Commodity Futures Trading Commission.” Previous STTP coverage.

Polymarket banned in Portugal [CoinDesk]: “Portugal’s gambling regulator, SRIJ, ordered Polymarket to shut down after the platform saw over 103 million euros ($120 million) in bets on the country’s presidential election. Betting on political events is illegal in Portugal, and the regulator gave Polymarket 48 hours to cease operations in the country.”

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

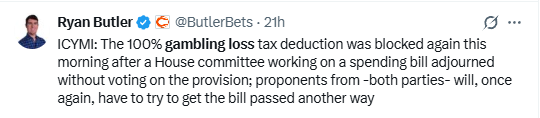

Quick Hitter: Gambling Loss Deduction Remains at 90%

The gambling loss deduction cap will remain at 90%, at least for the time being. An effort to try to attach an amendment to the Consolidated Appropriations Act, HR 7148, restoring the gambling loss deduction cap to 100%, was not adopted.

As I said last week when there was an inkling of momentum, restoring the 100% cap was always a bit of a long shot:

“If you had asked me a week ago I would have said unlikely, but there is a growing push from the industry that is raising its chances. That said, the same Congress that passed the bill is still in place, and fiscal hawks in the GOP-controlled committee have blocked similar fixes. Furthermore, assuming it passes the House, it would need to survive the Senate.”

News: AIBM Announces New Policy Hub and Webinar

The American Institute for Boys and Men (AIBM), in partnership with Arnold Ventures (which is supporting the project with a $2 million grant), has launched a new Sports Betting Policy Hub “to curate research, track policy as it develops, and connect experts working on the issue.”

From the press release, the AIBM Sports Policy Hub will work on:

Ongoing policy analysis: Monitoring industry and policy developments, aggregating data, and delivering practical, decision-ready insights.

Coordination and convening: Connecting researchers, advocates, industry representatives, and policy leaders, supporting aligned strategies, and reducing duplication of effort.

Public awareness and journalistic partnerships: Expanding public understanding of sports betting’s financial and social costs through journalism partnerships and sustained media engagement.

Alongside the launch, AIBM announced the addition of Jonathan D. Cohen (STTP Podcast guest #46) to its team. Cohen will serve as policy lead at AIBM, as well as releasing a measured, middle of the road policy paper, “outlining the state of sports betting in America and exploring different regulatory approaches.”

I will be participating in a webinar, along with Cohen, Brianne Doura-Schawohl, and Chris Grove on February 5th at 1 pm ET, to discuss the key policy issues that will shape sports betting in 2026. You can RSVP here.

Quick Hitter: FanDuel Launches Play With A Plan

After splitting from the American Gaming Association (AGA), FanDuel has launched a new responsible gambling campaign that takes a similar ‘proactive’ approach to the AGA’s Play Smart From the Start campaign launched last year — STTP is a fan of these campaigns.

Here is the way FanDuel explains Play With A Plan:

“‘Play with a Plan… promotes introspective decision-making and proactive gaming management rather than restrictive messaging… [It] helps to empower customers to evaluate their gaming habits proactively, providing actionable guidance that emphasizes what players can do while reinforcing FanDuel’s commitment to meaningful consumer protections in regulated online sports betting. It works to reframe the conversation around responsible gaming by treating it like any other smart habit.”

And here is the description of the AGA’s Play Smart From the Start:

“The gaming industry reminds consumers to make informed choices to enjoy gaming responsibly as entertainment. Recent research shows that players don’t see a difference between responsible gaming messages and problem gambling messages. As a result, most players tune out and don’t believe the message is for them. Play Smart from the Start is designed to be relevant to all players.”

“When it comes to promoting responsible gaming, positive messaging trumps negative warnings,” AGA President and CEO Bill Miller said. “Our research shows consumers are motivated by pursuing positive outcomes – fun, enjoyable entertainment – than by avoiding negative consequences.”

Per the FanDuel announcement, “The “Play with a Plan” initiative encourages users to interact with responsible gaming tools to fit their preferred gaming experience, including:

My Spend, a dashboard providing customers with detailed insights into their deposit and betting activity over week, month, and three-month periods.

Loss Limits, which allows users to set a limit on the amount of money they are willing to risk daily, weekly, or monthly.

Deposit Alerts, which enables customers to establish daily, weekly, and monthly budget parameters with automated notifications.

Around the Watercooler

Social media conversations, rumors, and gossip.

Welcome to the wildest debate of our time: Insider trading is good actually.

That we are even entertaining this as a legitimate activity is blowing my mind.

As Adhi Rajaprabhakaran wrote:

“Prediction markets aren’t stocks, and the legal framework governing them is different. The economic purpose is different too. And the technological reality of blockchain-linked liquidity pools makes enforcement of insider trading prohibitions, as traditionally understood, somewhere between difficult and impossible.

“This isn’t a defense of the Maduro trade. I’m trying to think clearly about what “insider trading” even means in prediction markets, why the concept doesn’t translate cleanly from equities, and why society is going to have to grapple with a new reality: prediction markets will attract informed money, and that might be fine.”

But as Jeff Edelstein noted in a recent column (and as I noted last week via Chris Hayes), prediction markets are offering markets that lend themselves to insider trading:

“But besides gambling on foreign leaders getting the boot, you can also bet on what MrBeast will say in his next video. Or who might host Saturday Night Live this season. Or what words officials of American Airlines will utter during their next earnings call. Or when xAI will release Grok 4.2. Or will Apple release a MacBook with cellular connectivity before 2027. And on and on and on and on and on with markets where someone, somewhere knows the answer.”

As Edelstein put it, “Don’t ever — as in ever — buy contracts on anything where the outcome is potentially already known by someone else.”

I would go a step further and say, stop offering these goofy markets in the first place.

Stray Thoughts

Massachusetts is buried in snow and the Patriots are in the Super Bowl. The universe is healing.