Charged Twice

It's still unclear if Illinois will tax the per-wager surcharges sports betting operators will soon roll out (in response to the state's per-wager fee) as gaming revenue.

The Bulletin Board

THE LEDE: Sports betting operators seek tax clarification in IL.

ROUNDUP: PLAYSTUDIOS points to sweeps entry; Tales from the FAIR BET Act Town Hall; Kalshi proposes policy change to trading errors.

NEWS: Novig raises $18M as it preps for CFTC license.

VIEWS: A deeper dive into L&W’s sweepstakes opposition.

AROUND the WATERCOOLER: Tax expert talks about the possibility of Congress repealing the gambling loss deduction cap.

STRAY THOUGHTS: A Marvelous quote.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: How Will Illinois Treat Sports Betting Surcharges

As reported last week, DraftKings and FanDuel are trying to figure out how Illinois will treat their soon-to-be-imposed surcharge on wagers after Illinois became the first state in the nation to implement a per-bet wager fee on sportsbook operators, which charges $.25 per wager for the first 20 million bets annually, and $.50 per wager after that.

In response to the per-wager fee imposed by the state, several sportsbooks are passing on to the customer via surcharges or imposing minimum bet amounts.

Three sportsbooks have imposed a minimum wager amount:

BetRivers — $1 minimum

Hard Rock — $2 minimum

BetMGM — $2.50 minimum

Three other operators have added their own per-wager surcharge:

Fanatics — $.25 per-wager fee

DraftKings — $.50 per-wager fee

FanDuel — $.50 per-wager fee

As I wrote on Monday, DraftKings CEO Jason Robins (as well as Flutter CFO Rob Coldrake) discussed the uncertainty during company earnings calls:

On Illinois taxing the per-wager fee DraftKings is charging: “Our position is this was a pass-through, and it shouldn't be taxed. I think Illinois has taken a little bit of a different view on it, so we're going to try to obviously resolve that before we implement the charge, which isn't happening until September 1… I think if it ends up being treated as taxable revenue, then there's really no benefit to do that versus incorporating into the pricing… This will be a really interesting experiment to find out what the sort of net effects of implementing such a charge will be. And that will give us great data… as we think about other states that may have higher tax rates and what we want to do there.”

In the same vein: Flutter CFO Rob Coldrake said the company was moving forward under the assumption the pass-through fee would not be taxed as a sports wager. “Obviously, we’re monitoring the situation quite closely,” Coldrake said. “If there’s a different way it’s perceived by the state, we’ll adjust accordingly.”

The uncertainty appears to be entirely on the operator side. While the Illinois Gaming Board (IGB) hasn’t expressly said how it will treat the surcharges, it’s certainly tipped its hand.

“On July 10… the IGB explained that, while operators are not prohibited from charging fees on sports wagers, they will have to report the revenue they make from those fees on their tax forms,” SBC Americas noted.

“These fields should be used for any additional revenue received in relation to the conduct of sports wagering,” IGB wrote to operators. “This includes, but is not limited to, per-wager fees not already reflected in the handle fields.”

Roundup: PLAYSTUDIOS Sweeps Entry; FAIR BET Act Town Hall; Kalshi Policy Change Proposal

PLAYSTUDIOS prepping for US sweepstakes launch [Sweepsy.com]: PLAYSTUDIOS isn’t letting the legal and regulatory challenges confronting the sweepstakes industry stop its plans to launch an online sweepstakes platform featuring casino-style games across qualified US states by late 2025. CEO Andrew Pascal dropped the news during the company’s Q2 earnings call on August 4, highlighting the use of proprietary content and social mechanics to boost engagement and differentiate from competitors like VGW and ARB Interactive.

Four quotes from the FAIR BET Act Town Hall [VegasInsider] ~ More on the town hall in the Around the Watercooler section:

Adam Robinson, a board member for American Bettors' Voice: "It's a policy with mass unintended consequences. A lot of livelihoods depend on a fair tax for gaming. If the big players leave, revenue will drop across the board."

Russell Fox, a federally licensed tax professional: "There's plenty of bad law out there. But this [provision] is gonna especially hurt casinos long term. Whatever you tax, you get less of. It needs to be fair. Anything that creates the perception that it's not fair is going to have an impact on [behavior]."

Becky Harris, former NGCB Chair and current distinguished fellow in gaming and leadership at UNLV: "We begin to see that pressure on bet prices, and we price people out of the market. To have Congress at this late date come in on [gaming] taxes ... is really troubling. That policy is bad policy."

Virginia Valentine, president of the Nevada Resort Association: "We have a very robust locals market. [Tax policy] needs to be fair. Anything that creates the perception that it's not fair, that makes people not want to go in and enjoy [gambling] recreationally, that's going to have an impact on us."

Kalshi is considering changes to its trader error policies [InGame]: Following a July incident involving anomalous MLB bets, Kalshi is tweaking some of its rules to attract institutional traders. According to InGame, “Kalshi submitted a proposed rule change to its regulator, the Commodity Futures Trading Commission (CFTC)… Under the proposal, traders would now have to pay $10,000 to Kalshi in order to request a review into trades made in error.”

SPONSOR’S MESSAGE - Episode 85: Who Has the Best US Casino App?

Host Brad Allen is joined by EKG director of product analysis Jimmy Neilly to discuss EKG’s 1H25 Online Casino App Testing Report, including:

Why BetRivers continues to fall down the rankings

The factors behind bet365’s rise

How arcade games helped DraftKings to the top spot

Listen to the episode here.

News: Novig Raises $18M as it Readies for Version 3.0

Novig launched in Colorado in January 2024, with a new idea for sports betting (well, US sports betting):

“Instead of charging everyday bettors, Novig generates revenue by charging market makers and professional bettors. With a user-friendly interface and cutting-edge features, Novig aims to redefine the sports betting experience for Colorado sports fans.”

That redefinition lasted just a few months, with the betting exchange pulling out of Colorado in April to reimagine its offering.

Those reimagined offerings were to eschew the regulated sports betting market and relaunch as a sweepstakes model, which it did in September. Now the company is taking the logical next step, and after an $18 million seed round, is seeking to follow in Kalshi’s footsteps and seek a Commodity Futures Trading Commission (CFTC) license.

From InGame’s excellent reporting on the development:

“Novig currently operates across the U.S. as a sweepstakes operator… However, it plans to pursue CFTC registration, co-founder and CEO Jacob Fortinsky told InGame. But Fortinsky added that being CFTC-approved and the sweepstakes model would not necessarily be “mutually exclusive,” though he didn’t offer more detail on how the two would work together.”

As InGame notes, the licensing process through the CFTC can be a 1-2 year process in the best of times, and given the current tumult surrounding the Commission, it could take even longer.

Views: Light & Wonder’s Opposition to Sweepstakes

Earlier this week, I wrote a quick entry on Light & Wonder’s (a newsletter sponsor) opposition to sweepstakes, and President and CEO Matthew Wilson’s recent comments during the company’s earnings call, saying that despite overall positive numbers, “top-line erosion and increased marketing costs” in the company’s social casino offerings is caused by unregulated sweepstakes sites. “In states that have taken action to eliminate sweeps, we have seen a noteworthy uplift in our performance,” Wilson said. “As this issue is further addressed … we expect to benefit from a more favorable market environment in states that ban sweepstakes gaming.”

I ended the entry with the too-short and poorly phrased line: “For L&W, it comes down to regulated vs. unregulated.”

It was pointed out to me that social casinos aren’t “regulated” (as gambling products) at all, so what is Light & Wonder’s gripe with sweepstakes sites?

Light & Wonder focuses on free-to-play mobile games inspired by real casino slots and table games. Like sweepstakes sites, these apps allow users to purchase virtual coins for extended gameplay but without any option to redeem winnings for real money or prizes.

Social casinos using virtual currency without real-money wagering are generally not regulated in the same stringent way as real-money gambling platforms, as they don’t meet the legal definition of gambling in most jurisdictions. There's no actual monetary prize involved for the core gameplay. As such, these games are “regulated” as non-gambling entertainment, allowing free operation without licenses, and largely unregulated beyond standard app store and consumer laws.

The differentiation is the “added layer” sweepstakes operators offer. Light & Wonder (and others) positions its products as pure social casinos and has explicitly avoided entering the sweepstakes space, viewing it as unregulated (in the gambling sense of the word) competition that impacts their revenue in some markets.

In contrast, companies that offer social casinos and sweepstakes blend free-play social elements with promotional sweepstakes mechanics through a dual-currency system: "Gold Coins" for fun, non-redeemable play and "Sweeps Coins" that can be obtained for free (via mail-in requests, bonuses, or purchases of Gold Coins) and redeemed for real cash prizes or gift cards.

The sweepstakes industry will say that, like Light & Wonder’s social casinos, it’s not gambling in the classical sense of the word, and falls under the same non-gambling entertainment (plus sweepstakes) laws.

As Light & Wonder’s Howard Glaser told me during his Straight to the Point Talking Shop Podcast appearance, if states were to sign off on and regulate sweepstakes, Light & Wonder would explore the opportunities — thus far, every state that has examined sweepstakes has reached the conclusion that they are gambling — there have been failed bills and the sweepstakes industry is contesting classifications in courts.

STTP Note: I’ve extended an invitation to numerous folks in the sweepstakes industry to come on the podcast to discuss the topic, and I’ve yet to have any takers.

Around the Watercooler

Social media conversations, rumors, and gossip.

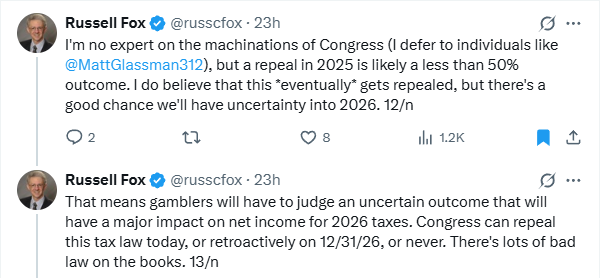

Circling back to the FAIR BET Act town hall, tax lawyer Russell Fox wrote an interesting X thread expanding on his thoughts:

The possibility of Congress retroactively repealing the deduction cap is something I raised during an appearance on Double Down with Breslo, where I said the deadline to change it isn’t 2025, it’s December 2026:

Stray Thoughts

“It's hard to do roadwork at 5 AM when you're sleeping in silk pajamas.” ~ Marvin Hagler