Death And Taxes

The sports betting industry is leaving all options on the table (including the threat of a market exit) as it tries to stave off tax rate increases in Illinois and beyond.

The Bulletin Board

NEWS: The latest on the increasingly messy debate over the Illinois sports betting tax rate.

BEYOND the HEADLINE: California exposed the first chink in the sports betting industry’s armor.

WAY BEYOND the HEADLINE: Interesting comments on the tax rate debate from the Washington Post.

WEEKEND CATCHUP: NGCB rejects Prop Swap; FanDuel becomes the official odds provider for the AP; DraftKings could acquire Simplebet.

NEWS: DraftKings finalizes its $750 million acquisition of Jackpocket.

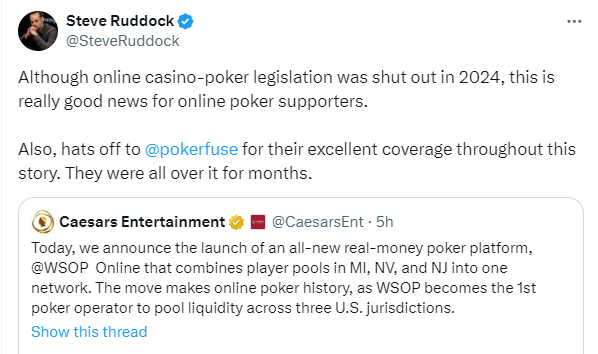

AROUND the WATERCOOLER: WSOP.com links its player pools in Nevada, New Jersey, and Michigan.

STRAY THOUGHTS: Keeping score.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade is now live in Iowa, alongside Colorado and New Jersey.

DK & FD Threaten to Leave Illinois Over Tax Fight

Author’s Note: I will cover this topic — what should the tax rates be? — in a forthcoming feature column.

If you’ve been following along, you know Illinois Gov. J.B. Pritzker has proposed increasing the sports betting tax rate. The legislature is working on the budget, and if you’re an industry person, the situation has gone from bad to worse as Pritzker’s flat increase to 35% has morphed into a graduated tax with an upper limit of 40% despite the industry’s protestations.

Also of note, the new proposal separates retail and online revenue and uses the same graduated approach for each.

The Illinois Senate has already passed the measure, and the House is expected to return to Springfield today as it closes in on a budget agreement. The last version in the House used the same graduated tax rate as the Senate’s.

Pritzker’s proposal to increase the sports betting tax rate from 15% to 35% received a lot of pushback from the industry as tax increases are gaining momentum across the country. To nip them in the bud, the Sports Betting Alliance organized an electronic letter-writing campaign urging Illinois sports bettors to write to lawmakers and the governor voicing their opposition to the idea.

The SBA has also been screaming from every rooftop that tax increases (and numerous other policies) are a gift to the black market, claiming:

More taxes mean worse odds for players

Customers will have access to fewer promotions and bonuses

A tax hike will increase illegal offshore sports betting (they pay 0% taxes)

It appears that the more they protest, the worse they are treated.

Sportsbooks continually escalated the rhetoric while the legislature debated the tax increase, going so far as to threaten to leave the state when the graduated tax rate was introduced, per Capitol News Illinois’ Hannah Meisel:

“Sportsbook operators are threatening the nuclear button. A source close to DraftKings and FanDuel says that “all options are on the table, including withdrawing from the state.”

Now, instead of a 35% tax rate (that many believe could have been negotiated down to 20-25%), the industry is staring down a graduated tax rate based on adjusted gross revenue that starts at 20% and quickly increases from there:

25% over $30 million

30% over $50 million

35% over $100 million

40% over $200 million

FanDuel and DraftKings would be in the top 40% bracket, and several other operators (BetRivers, Fanatics, ESPN Bet) would be in the 30-35% range.

The SBA posted the following statement on X:

Why is the industry pushing back so hard? It almost certainly believes a loss in Illinois, after Ohio doubled its tax rate last year, could open the floodgates across the country.

Not everyone agrees.

Sporttrade (a newsletter sponsor) CEO Alex Kane made the case for a graduated tax rate when he came on the Talking Shop Podcast (listen here). Industry investor Chris Grove called the tiered tax rate a “reasonable” solution in a recent tweet, “A tiered tax approach is one of several reasonable ways to ensure that tax increases don’t have the unintended consequence of decreasing competition in Illinois’ online sports betting market.”

Beyond the Headline: California Was a Turning Point

From 2018 to 2022, the sports betting industry was a runaway freight train blaring DJ Khaled’s All I Do Is Win from the locomotive.

And then it entered California, where something like this happened:

There were signs that the industry’s warnings were less Cassandra and more Chicken Little, like in New York, where it accepted a 51% tax rate, but it was the abysmal 2022 ballot initiative in California that fully exposed it.

California wasn’t just a resounding loss; it was a turning point. It showed everyone the industry wasn’t an unstoppable force. The industry was Deebo, the biggest kid on the playground that nobody messed with out of fear. California shattered that fear, where the industry unwittingly picked a fight it couldn’t win.

A recent spat with the Massachusetts Gaming Commission is another example of the industry picking a fight it can’t win — The question in Massachusetts is, will the MGC put up their dukes or walk away from the fight?

And now, in Illinois, the industry rolled out its usual playbook of astroturfed support, thinking it could influence the policy debate. What it got was an even worse deal (for some participants), as the graduated tax rate hits the biggest operators even harder and could splinter the industry between the haves and have-nots.

Way Beyond the Headline: Interesting Excerpts from WaPo

The Washington Post’s Danny Funt tackled the Goldilocks dilemma (too high, too low, or just right) of the sports betting tax rate.

Two passages from the article caught my eye. The first is:

“New York is an excellent example of a place where those operators have tried to cynically use the lobbying and legislative process to create barriers to entry for other operators,” said Joe Brennan Jr, executive chairman of sportsbook start-up Prime Sports. “They didn’t anticipate that their New York fiasco was going to metastasize to other states.”

Brennan makes a salient point here, and something many people said when New York tax rates were revealed, as these discussions aren’t happening in a vacuum. Every other locale can see what you agree to in New York.

The second provides the non-industry perspective:

“As operators insist they won’t put up with higher taxes, some states are attempting to call their bluff. New Jersey state Sen. John F. McKeon (D) recently proposed raising the tax on online sports betting from 13 percent to 30 percent, noting New Jersey leads the nation in money wagered on sports since 2018, but neighboring New York and Pennsylvania have generated more in taxes because of their higher rates. “Why should they be in a position to make windfall profits?”

And as always, I recommend reading the comments, which are a good bellwether for how sports betting is seen outside the sports betting bubble. Spoiler: They skew very negative, with a “tax the crap out of them” attitude towards the operators.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Weekend Catchup: NGCB Rejects Prop Swap; FanDuel Is the AP’s Official Odds Provider: DraftKings + Simplebet

Nevada Gaming Control Board says no to Prop Swap: The NGCB has denied Prop Swap, a popular sports betting ticket reseller active in 20 states, access to the Nevada market. The regulatory body shot down a proposal that would have allowed Prop Swap to facilitate the sale of sports-wagering tickets prior to the event’s conclusion. Per the NGCB, Prop Swap would constitute an illegal business because it lacks a gaming license.

BetMGM replaces FanDuel as the AP’s Official odds provider: The Associated Press has reached an agreement with BetMGM that makes the sportsbook “the official sports odds provider across the AP global sports report.” The press release states, “BetMGM’s odds will appear in AP’s daily sports odds fixtures, game previews, and other sports stories where odds are mentioned.”

DraftKings eyes Simplebet: DraftKings just finalized its $750 million acquisition of Jackpocket (see below) and picked up Sports IQ, but that doesn’t mean it may not make another big M&A splash. According to Earnings+More, that splash is Simplebet, a micro-betting platform that DraftKings has a 15% stake in and is already a customer of (accounting for 60% of Simplebet’s turnover).

DraftKings Finalizes Acquisition of Jackpocket

DraftKings completed its $750 million acquisition of Jackpocket last week.

“The completion of the acquisition represents an exciting new chapter for Jackpocket and DraftKings alike,” Jackpocket CEO Peter Sullivan said in a press release.

“We are well-prepared to quickly launch cross-sell programs, further improve customer acquisition efficiency, and continue to innovate and differentiate with our overall product portfolio for our customers,” DraftKings CEO Jason Robins said.

The acquisition was announced in February, and there was much hype about the many cross-sell possibilities.

As I noted in my February deep dive, DraftKings CEO Jason Robins was very bullish about the tie-up during the company’s earnings call.

“We know from overlap analysis that we did that those customers will cross-sell very effectively to and from,” Robins said. “We saw that the customers that overlapped were about 50% higher spend on DraftKings’ OSB and iGaming products than customers who didn’t.”

With the deal now completed, we may begin to see how DraftKings plans to integrate Jackpocket and cross-sell between lottery and sports betting customers.

SPONSOR’S MESSAGE - Now live on the OpticOdds screen: player market alternate lines, vig, line history & more…

Built for operators with an emphasis on speed and coverage, OpticOdds offers:

SGP Pricer: query top operators and instantly see how correlations are priced in real-time.

Live Alerts & API Access: get odds updates from sharp sportsbooks on best odds, arbitrage, player markets, reference lines, settlements, injuries, and more.

Market Intelligence: analyze competitor markets to see what you’re missing. Drill into hold, alternate lines, uptime, and release time.

Join top operators at opticodds.com/contact.

Around the Watercooler

Social media conversations, rumors, and gossip.

Pretty big news for the US online poker community, which could use some good news — more on this in tomorrow’s newsletter.

Stray Thoughts

Too many people view everything as wins and losses. They are so busy keeping score — celebrating a victory or bemoaning a loss — that they miss the larger trends and momentum.