Jack Of All Trades

A deep analysis of DraftKings' acquisition of Jackpocket and why it's a bigger deal than most people think.

The #1 story last week was the acquisition of Jackpocket by DraftKings.

The deal caused quite a stir across social media and has led to plenty of vapid analysis and a mixture of hot and cold takes - composing this column has cemented my long-held belief that there are perhaps a dozen people with the knowledge and expertise to speak about online lottery in the US and even fewer capable of talking about online couriers.

Among the more insightful commentaries was this must-read X thread from Chris Grove, which will be the jumping-off point for several headers in the column.

SPONSOR’S MESSAGE - SUBSCRIBE NOW to Zero Latency, the new podcast from Eilers & Krejcik Gaming that provides unparalleled insight into the U.S. online gambling industry through interviews with industry insiders and analysis from EKG experts.

A Big Win for DraftKings?

We know the deal is a massive win for Jackpocket, a company I’ve known for many years and a team that is easy to root for.

As I posted on X:

“I always knew it was a (750) million-dollar idea and have been impressed by Peter Sullivan and the whole operation: great product, great vision, and did everything the right way.

“If you want to know how impressive the company is, just look at how long the employees have worked there. No one leaves. Very impressive in the gambling industry."

But what about DraftKings? Grove called it a “headline S-tier deal” for DraftKings “at a critical juncture in the development of the US market.”

He went on to say:

“Why is it a win for Jason Robins and DraftKings? Let us count the ways:

“Access to a 1m+ user base [Draftkings tapped the database at 6 million with 1.8 million actives and 700,000 unique monthly users], many with funded wallets. That's worked out well for DKNG in the past.

“Access to a fantastic customer acquisition machine. I don't think anyone acquires RMG customers cheaper than JPK.”

It’s hard to disagree with any of these comments, so let’s start there.

The “More” Thesis

Considering the current dearth of new markets on the sports betting and online casino front, growth (the end-all-be-all for publicly traded companies) has to come from somewhere.

According to Grove’s “more” thesis, “the winner of the U.S. online gambling market will be the company that offers the most mores - more products, more brands, more price points, and more options for more consumers.”

Shareholders love more.

Efficient CAC

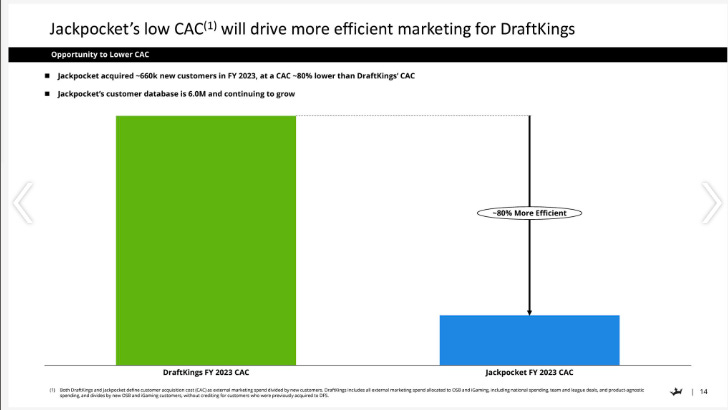

The following chart from DraftKings’ presentation highlights JackPocket’s low customer acquisition costs.

Still, I would caution that this is uncharted territory. It’s a first-of-its-kind tie-up in the US (and yes, that geographical distinction matters), which means we are making (educated) guesses at how the two companies and their users will interact.

The US Online Lottery Opportunity Is Just Beginning

I will skip over the pure financials Jackpocket posts and the estimates given by DraftKings during its recent earnings call and focus on the current online lottery landscape in the US.

This is where the deal stands out in my mind. Jackpocket was acquired for the handsome sum of $750 million, but the company, and online lottery for that matter, is just getting started.

Currently, 14 states are offering online tickets through the state lottery. Jackpocket is active in 16 states (as seen in the map below), plus Washington DC and Puerto Rico (not seen in the map below). All told, Jackpocket currently has access to roughly 1/3 of the US population. That leaves a lot of room for growth.

One thing to notice is that Jackpocket is active in four states that offer online products through the Lottery. Meaning, don’t confuse Jackpocket with a placeholder product. The Lottery doesn’t care if the ticket sales come from their website or Jackpocket; a sale is a sale, and the same amount of money lands in the Lottery’s coffers regardless of the source. Returning to the “more” thesis, the more sales the better.

Jackpocket will be welcome in states that offer online products through the lottery, and those states shouldn’t care if Jackpocket outperforms the official lottery website. In fact, they should welcome it.

As Jackpocket CEO Peter Sullivan told me in 2020, the lottery courier business is a win-win situation:

“The state doesn't have any integration costs, they're not licensing any software, and we're paying for all the marketing dollars that lead to additional sales for that state. Rather than a workaround or a stand-in, I think it's actually much more beneficial than an iLottery product. We don't ask for anything special… we're using the existing point-of-sale solutions that were provided by their existing lottery.”

In addition to more states, there is the possibility of Jackpocket expanding its instant win game offerings (currently available to Jackpocket users in Colorado and Texas) because, again, for the Lottery, a sale is a sale. However, as I’ll explain in a bit, this could be an area of concern for state lotteries.

Keep reading with a 7-day free trial

Subscribe to Straight to the Point to keep reading this post and get 7 days of free access to the full post archives.