Follow The Leader

To no one's surprise, DraftKings is following FanDuel's lead and plans to add a $.50 transaction fee to all sports wagers in Illinois.

The Bulletin Board

THE LEDE: DraftKings follows in FanDuel’s footsteps with a $.50 transaction fee.

BEYOND the HEADLINE: Wyoming has a sports betting tax increase proposal.

ROUNDUP: Missouri license applications; Athlete abuse lessens; Federal excise tax; Another trade secret lawsuit; FD + Kalshi rumor

NEWS: Class-action lawsuits filed against Kalshi, Robinhood, and Susquehanna.

BEYOND the HEADLINE: More prediction market news.

VIEWS: LA Gov. vetoes sweepstakes bill.

AROUND the WATERCOOLER: Highlighting two Quintenz comments.

STRAY THOUGHTS: If I just had a few more hours in the day.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: DraftKings Will Add $.50 Transaction Fee in IL

DraftKings is following FanDuel’s lead, as the company has announced it is imposing a $.50 transaction fee on all wagers placed in Illinois beginning September 1, 2025. The move is an effort to offset the new per-wager fee ($.25 on the first 20 million wagers, $.50 after that) the state has added to licensed sportsbooks’ tax burden.

“Illinois has been an important part of our growth, and we’re proud to have contributed meaningfully to the state through tax revenue, job creation, and a sustained investment in responsible gaming tools and resources,” DraftKings CEO Jason Robins said in a statement. “We are disappointed that Illinois policymakers have chosen to more than triple our tax rate over the past two years, and we are very concerned about what this will do to the legal, regulated industry.”

There is some chatter on the internet about what smaller operators will do, and whether they will absorb the $.25 per-wager charge (only DraftKings and FanDuel process enough bets to reach the $.50 threshold). My guess is that every operator of any significance will add a transaction fee in Illinois.

“This is not a typical tax increase. If FanDuel didn’t pass on the cost, it would be inviting all sorts of issues with customers placing small-dollar bets. For the same reason, other operators will have to do the same (or, alternatively, set minimum bet amounts, like minimum credit card transactions). They need to disincentivize customers from placing small-dollar bets, which can overwhelm FanDuel with high-tax, low-profit wagers.”

As Citizens notes, small wagers are not a trivial percentage of bets (more than 20% of wagers placed are $3 or less):

Another looming question is whether other states will follow Illinois’ lead?

While STTP believes Illinois is an outlier here, the sportsbook’s willingness to offset the fee with its own fee (and thereby assume the role of the bad guy) could provide lawmakers in other states with cover to pursue similar tax hikes.

All that said, states are treating their licensed sportsbooks extremely unfairly. As I wrote when Illinois raised its sports betting tax rate over a year ago:

“In the movie Grosse Pointe Blank, there’s a scene where Dan Akroyd’s character is told he lost a “contract,” and he responds with, “Preparations have begun in good faith.”

“And that’s pretty much how the industry should feel, and not just about tax rates — small random (and often pointless) RG changes or large items like ending Delaware’s monopoly or recategorizing DFS games as illegal gambling despite previously authorizing them.

“The bottom line is that states offer operators access under one set of terms. Operators accept those terms and invest millions to set up shop. Then, the states change the terms when the operator’s only recourse is leaving.”

Beyond the Headline: Add Wyoming to the Tax Hike List

Wyoming is the latest state to consider increasing its sports betting tax rate.

“A Wyoming legislative committee is proposing three tax hikes on multiple gaming industries, and a plan to insert a money-monitoring system into gaming machines across Wyoming bars, casino-style halls and truck stops.”

The sports betting component would double the current rate from 10% to 20%.

Wyoming joins a growing list of states that have introduced bills or proposed tax increases, with Illinois, Maryland, Louisiana, and Colorado passing legislation (Gov. Jeff Landry still needs to sign the Louisiana bill). Meanwhile, efforts in New Jersey, Ohio, and North Carolina remain active.

Roundup: MO Licenses; Athlete Abuse; Federal Excise Tax; Trade Secrets; FD+Kalshi Rumor

DraftKings and Underdog apply for Missouri sports betting licenses [Covers.com]: The first two Missouri sports betting applications have been submitted: “DraftKings and Underdog are the first sportsbooks to apply for an operating license in the Show Me State, Missouri Gaming Commission public relations coordinator Elizabeth Hoffman confirmed with Covers on Thursday. The approval process, which opened May 15, requires operators to be investigated by state officials and meet the requirements and rules to obtain a license.”

March Madness online abuse declined, according to NCAA [Associated Press]: In a bit of good news, “Online abuse related to sports betting decreased during the NCAA’s March Madness basketball tournaments compared with the prior year.” The not-so-good news is that this was largely due to the fact that the bar was set relatively low: “People involved in the competition still received more than 3,000 threatening messages.”

Bill would fund ICE with federal sports betting excise tax dollars [WFMJ 21]: We’ve always wondered where the revenue collected from the federal excise tax on sports betting goes, and we would finally get a (head-scratching) answer to that if a new bill from US Rep. Michael Rulli is passed (very unlikely). The Giving Alien Migrants Back through Lawful Excise Redistribution (GAMBLER) Act would redirect $300 million in federal gambling excise taxes to fund ICE's enforcement, detention, and deportation operations. The bill establishes a Border Enforcement Trust Fund, aiming to enhance border security without increasing taxes.

PrizePicks alleges former employee stole trade secrets [SBC Americas]: PrizePicks is suing former employee Judah Huffman, alleging he stole trade secrets to secure a job at DraftKings. PrizePicks alleges Huffman used ChatGPT to analyze his noncompete and uploaded sensitive PrizePicks documents, including brand planning and 2025 team goals. PrizePicks seeks an injunction to prevent Huffman from working at DraftKings or using the alleged secrets. This is the second such case, with both involving DraftKings. Previously, DraftKings accused a former executive, Michael Hermalyn, of stealing secrets for Fanatics — that case has since been settled.

Rumor Mill: FanDuel in discussion with Kalshi [Front Office Sports]: “FanDuel has discussed a deal with the upstart trading exchange Kalshi that would include various betting efficiencies, Front Office Sports has learned… industry sources say nearly all the sportsbooks and federally regulated exchanges (which include a number of other crypto exchanges that don’t currently offer prediction markets) are having discussions with each other to figure out frameworks of potential collaborations.”

SPONSOR’S MESSAGE: 330 million bets researched. Every major sportsbook. One leading platform.

Outlier is the go-to research tool for serious bettors, and we’re looking for partners ready to share in our success. You have the reach, we have the product. Let’s win together.

Inquire at Partners@Outlier.bet

News: Class-Action Lawsuit Filed Against Kalshi, Robinhood, and Susquehanna

Another day, another lawsuit, but this one is different.

A fifth state, and perhaps the most significant threat, was later added: Kentucky. Why is Kentucky a significant threat? Because of an antiquated law that cost PokerStars $300 million after a multi-year lawsuit.

I consulted with attorney Andrew Kim to determine if this was a lawsuit I should be paying attention to, or if it was a run-of-the-mill class-action suit that often arises in these types of larger legal discussions.

According to Kim, it’s the former, but the cases are likely to be slow-moving.

As he posted on X, he anticipates Kalshi will try to get it out of state and into federal court, “which will be more receptive to the preemption arguments that Kalshi will inevitably raise.” However, “that will be difficult, because these suits are being brought under state law, and there’s no obvious basis for getting this into federal court.”

And as Brett Smiley wrote for InGame, the inclusion of Susquehanna is also something to keep an eye on:

“And furthermore, these cases are notable for the involvement of Susquehanna International Group, LLP, led by very wealthy and well-known businessman Jeff Yass, whose private company also known as SIG serves as market maker for Kalshi, providing liquidity for trading on the platform.

“In practice, these market makers employ precisely the same business model as the sportsbooks this Commonwealth has regulated,” the plaintiff Massachusetts Gambling Recovery LLC writes.

Beyond the Headline: More Prediction Market News

Tribes jump into prediction market fight [Daniel Wallach, LinkedIn]: Per Daniel Wallach, “A coalition of Native American tribes will be filing an amicus brief in the 3rd Circuit on Tuesday in support of New Jersey's appeal of the preliminary injunction granted to Kalshi. The brief is exceptional -- addresses IGRA, preemption, "swaps," and delivers the goods on Rule 40.11(a)(1).” Pechanga.net is asking tribes to join the amicus brief by Noon today.

New exchange gets CFTC approval [Prediction News]: “Railbird Exchange received CFTC approval to operate as an event contract derivative exchange on Friday afternoon, according to FrontOfficeSports. The report mentioned Railbird has been “seeking CFTC licensure for years.”

SI Predict is up and running [Event Horizon]: SI Predict is live (web-based only) with about 20 markets available: “The platform — using Sports Illustrated branding — is the idea of a prediction market without the need for the Commodity Futures Trading Commission.”

News: Louisiana Gov. Vetoes Sweepstakes Bill

After unanimously passing both chambers, Louisiana’s sweepstakes prohibition bill was vetoed by Gov. Jeff Landry on Thursday.

Why did Landry veto the bill? In a letter to the legislature, Landry called the legislation unnecessary:

“Our current Louisiana Gaming Control Board has the regulatory authority, control, and jurisdiction over all aspects of gaming activities and operations pursuant to the Louisiana Gaming Control Law…

“The Board is already taking active steps to combat illegal gambling in Louisiana, especially against illegal offshore wagering and illegal online sweepstakes companies operating in Louisiana.

“… As such, this bill is a solution in search of a problem that is already being solved by our current system, and some of the language in this bill is overly broad and could be interpreted in an adverse manner which may harm or impede our current enforcement actions taken against these bad actors.”

STTP has heard from multiple industry sources that the newly created sweepstakes group headed by VGW, the Social Gaming Leadership Alliance (SGLA), was able to convince Gov. Landry that the bill was not adequately debated. As an aside, the SGLA added two new members to its roster: Yellow Social Interactive (YSI), a global social gaming operator, and Play Studios, a global gaming studio.

On the Louisiana veto, SGLA Executive Director, former Congressman Jeff Duncan, said the following in a press release:

“Gov. Landry's veto gives all stakeholders an opportunity to pursue a sensible solution to allow Louisiana residents to continue playing online social games, explore revenue streams for the state and create a licensing and regulatory environment which applies the highest standards of player protections and responsible social gaming… Louisiana now has a chance to craft innovative legislation that balances these interests and benefits the state and its communities."

In a press release applauding the veto, the other sweepstakes trade group, the Social and Promotional Games Association (SPGA), claimed victory, adding Louisiana to the list of states (Maryland, Mississippi, Arkansas, and Florida) that rejected sweepstakes bills this year:

“Governor Landry’s veto is a powerful affirmation that not all online games are gambling and that innovation should not be met with prohibition,” said a spokesperson for SPGA. “This legislation blurred critical legal distinctions and risked punishing legitimate businesses that comply with well-established sweepstakes laws and offer free-to-play experiences.”

The SPGA went on to say, “Sweepstakes-based games are not gambling… Conflating these lawful models with illegal gambling operations would have created confusion, harmed innovation, and eroded consumer choice.”

However, sweepstakes opponents are also claiming victory, noting Landry’s classification of sweepstakes casinos as illegal gambling:

Sweepstakes prohibition bills have been signed into law in Connecticut, Nevada, and Montana. There are also active efforts underway in New York (having passed the Senate), New Jersey, Illinois, and Ohio.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Around the Watercooler

Social media conversations, rumors, and gossip.

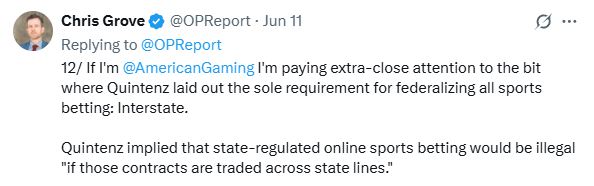

While everyone is focused on Quintenz’s pro-prediction markets comments, this answer has flown a little under the radar:

Not only is Quintenz telling Kalshi it’s full speed ahead on sports contracts, he is suggesting that state-level sports betting is likely being operated illegally.

While this seems an out-of-left-field statement, it’s a potential threat that I’ve mentioned in the past:

“There is an argument to be made that the Wire Act doesn’t apply to online poker, casino, and lottery, but there’s no question that it applies to sports betting. Yet, that has spread like wildfire across the country. While it’s occurring on an intrastate basis, it’s clear that transmissions are crossing state lines and that data used to facilitate wagering is, too.”

Another Quintenz statement worth highlighting is the idea that the CEA special rule prohibiting contracts “against public interest” (terrorism, war, and “gaming”): “That provision of the statute troubles me in terms of trying to execute it with repeatability and legality.”

It sounds like he is saying the special rule is all-powerful and trumps everything else, except when it doesn’t.

Stray Thoughts

Too much news, so no time for random thoughts today.