Hype And Hubris

Prediction markets overpromising and underdelivering, and they are beginning to lose the plot.

The Bulletin Board

THE LEDE: The truth about the prediction market truth machine.

BEYOND the HEADLINE: Prediction markets have support at the highest levels, but will it last?

NEWS: Massachusetts redirects casino Community Mitigation Funds, again.

QUICK HITTER: Outlier closes $10.7 million funding round.

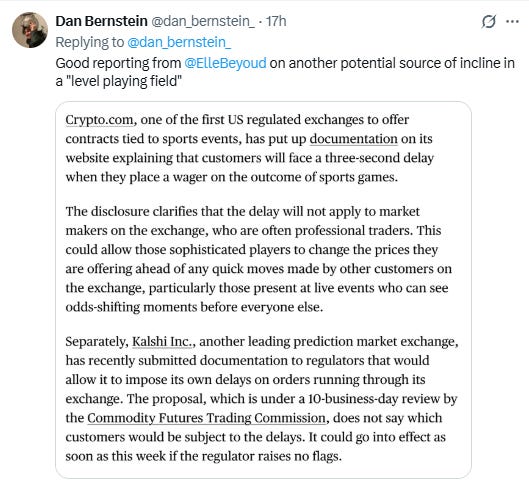

AROUND the WATERCOOLER: An uneven playing field.

STRAY THOUGHTS: A history lesson on game-changing technologies.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: What Happens When Prediction Markets Miss?

One of my mantras is, underpromise and overdeliver. But not everyone finds that as useful as I do.

Kalshi and Polymarket are the greatest thing since sliced bread, as they believe they can aggregate collective wisdom into pinpoint-accurate probabilities, cutting through the noise to find the signal and reveal “the truth.”

As Polymarket CEO Shayne Coplan claimed following the 2024 presidential election: “Make no mistake, Polymarket single-handedly called the election before anything else. The global truth machine is here, powered by the people.”

More recent examples include:

Tarek Mansour, the co-founder of Kalshi said the total addressable market of a product that can settle a difference of opinion on anything is bigger than the stock market: “ The long-term vision is to financialize everything and create a tradable asset out of any difference in opinion.” STTP Note: The clip is in ratio territory on X.

Paradigm cofounder Matt Huang recently tweeted, “Prediction markets are a civilization-scale truth telling machine, but they’re also a kind of breadth-first search for the set of interesting and useful financial exposures that society demands. (Much like YouTube was a breadth-first search on media).”

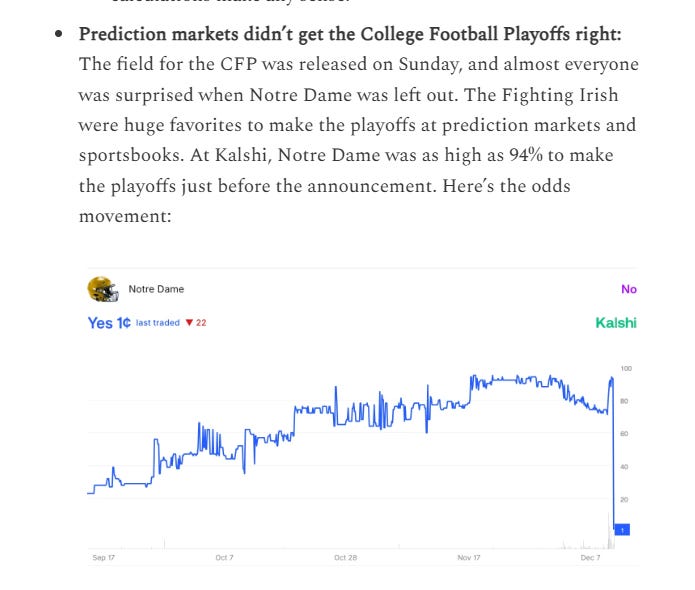

The argument is that skin in the game somehow ensures an honest appraisal of an unknown. The reality is that prediction markets are often overpromising and underdelivering, because, like everything else, they’re fallible; they’re based on probabilities, not “quintessential truth machines.”

Remember when Nate Silver was thought of in the same way? Or how about Allan Lichtman, who the news media propped up like the Oracle of Delphi after his model correctly predicted every presidential winner from 1984 on… Until he missed on the last one.

I’m a [former] poker player, so I have a good grasp on variance. These examples illustrate a pattern: We anoint forecasters as infallible until they aren’t. Prediction markets are the latest in this line, but their misses pile up just as quickly.

In 2016, Hillary Clinton was at 80% odds to win the presidency right up to election night. More recently we had the “who will be the next Pope?” market, which missed badly.

Or, as Dustin Gouker posted in his Event Horizon newsletter:

Probabilities are just that, and 80% odds will miss 20% of the time — No one is crossing the road without looking if they have a 80% chance of not getting hit by a car, but they’ll call a poker game rigged if their pocket Aces lose to Pocket 4s.

More importantly, just because someone didn’t get hit isn’t a sign of “truth.” And if they do get hit, it doesn’t mean the odds were wrong. However, when you overpromise, those misses start to look more like black eyes than normal variance (more on this in the Beyond the Headline section below).

But, instead of just admitting there isn’t any magical wisdom in these markets, we’re now being told what we need is more insider information so the markets are correct. We’ve had a few examples of this, including a suspected Google insider that recently pocketed over $1 million on Polymarket by betting on unreleased search algorithm details.

This type of trading is not finding the wisdom of crowds, it’s creating a piggy bank for informed elites, who can exploit everyone else. This “solution” [insider trading is good, actually] is an admission of the problem: If markets need secret knowledge to work, they’re not aggregating truth; they’re laundering asymmetries.

And as I noted yesterday, there is growing skepticism and concerns coming from expected and unexpected corners — here is another one I came across:

Beyond the Headline: The Prediction Market Perception Problem

And then there is the failure of perception. Prediction markets don’t exist in a vacuum. So, what happens when prediction markets point to Democrats winning the House in 2026, or the Senate, or the Democratic presidential nominees beating the Republican candidate in 2028?

Will conservatives accept this as “truth,” or dismiss it as fake news? We’ve seen this before—Trump supporters in 2020 rejected the signals favoring Biden, and similar skepticism on the other side of the aisle fueled 2016’s underestimation of Trump.

That’s why prediction markets have a selective trust problem. When outcomes align with our views, they’re genius; when they don’t, they’re rigged. Add in “wishcasting” (which I’ve mentioned in the past), and markets amplify echo chambers rather than tear down the walls.

In the end, prediction markets offer intriguing insights, but they’re not a panacea. Like Silver’s models or Lichtman’s keys, they’re tools, always interesting, often useful, but just another tool that’s as fallible as the humans behind it.

News: Massachusetts Raids Casino Piggy Bank (Again)

When Massachusetts looked into legalizing casinos, one of the biggest concerns was community harm. To counteract that, the state created the Community Mitigation Fund when it legalized casino gambling in 2011. Funds and grants began in 2015, following the opening of the state’s first casino in Plainville (Plainridge Park Casino, operated by Penn).

And everything was working as it should… until recently.

The CMF receives 6.5% of the tax revenue paid by casinos, which is supposed to be set aside for local grants in host and surrounding communities. However, CMF funds are being rerouted for the second year in a row, as the Massachusetts legislature is keeping the money that should go to the CMF for the state’s general fund.

As the Commonwealth Beacon reported, “In the 2025 state budget, lawmakers allowed a temporary redirection of those gaming revenues – a move Gov. Maura Healey branded as a one-time maneuver to free up $100 million for state spending during a tight budget year. But the 2026 state budget saw the Legislature again redirect the funds to priorities like transportation, education, economic development, and tourism.”

SPONSOR’S MESSAGE: What do you do when you can’t trust your “trust signals”?

Documents? Easily faked. IDs? Easily simulated. IP? Easily spoofed.

In this new era of digital identity, cybercriminals are using state-of-the-art tech to sneak into iGaming platforms—and sneak out with up to 7-figures-a-month in damages.

Static KYC signals can’t keep up. When operators stitch solutions together, good players are hit with friction. And the bad ones still slip through the cracks.

In other words, yesterday’s tools aren’t working.

GeoComply’s digital identity platform uses real-world signals that fraudsters can’t easily fake. We combine precise location verification, device intelligence, behavioural analysis, and KYC data to give you a high-res picture of trust. So you can see the difference between a high-LTV player and someone hiding behind a deepfake—and take confident action, in real-time.

Watch our latest video and discover what’s at your fingertips today.

Quick Hitter: Outlier Closes a $10.7 Million Funding Round

Outlier, a sports betting research tool that provides access to historical and real-time data has announced the close of a $10.7 million Series A funding round.

Per the press release:

“The round includes $5.7 million in equity financing led by Discerning Capital and an additional $5 million in dedicated user acquisition financing arranged to accelerate subscriber growth. The investment marks a significant milestone as Outlier scales its data-driven analytics platform and expands its subscriber base.”

Discerning Capital’s Davis Catlin said on LinkedIn:

“For those of you interested in our thesis, it’s pretty simple at its core: as wagering grows, more people begin to wager, they lose money & they look to get smarter about their bets. Outlier is a great tool to take advantage of that wave of consumers looking for betting tools. Also the growth in ways to wager (e.g. regulated gambling, prediction markets, sweeps & DFS+) will benefit the business as customers look to navigate across more apps.”

You can listen to my previous podcasts with Outlier CEO Evan Kirkham and Discerning Capital’s Davis Catlin at the links below:

Episode 33: Creating Smarter Sports Bettors with Evan Kirkham

“Research needs to be at the point of sale.” ~ Evan Kirkham

Episode 71: Gambling Industry Missteps and Misplaced Optimism with Davis Catlin

“This is a marketing industry. The app just has to be good enough — the real battle is convincing people why your brand is the one they should use.”

Around the Watercooler

Social media conversations, rumors, and gossip.

Reporting from Bloomberg paints a bleak picture for retail traders (AKA, bettors) on prediction markets:

Stray Thoughts

I ran across this article about an AI bubble in Persuasion, and boy, did it remind me of something else that is a little more relevant to the newsletter:

“Unfortunately, the history of technological advances suggests a more cautious approach. Unforeseen innovations and financial bubbles go together like thunder and lightning. Sudden breakthroughs attract the attention of entrepreneurs, and investors soon follow. What’s it going to be worth, and how quickly? When no one knows, valuations soar as speculators—afraid of missing out on the next big thing—pile in at any price…

“From railroads to electric lights, recorded music, automobiles, airplanes, radio, TV, and even the Internet, it often takes years—if not decades—for use cases to become clear and markets to develop, as consumers and businesses learn how to adjust their activities to take advantage of the new technology…

“In true bubble fashion, the race today is not to build useful products, but to attract the attention of investors, largely by beating competitors at specialized benchmarks only vaguely related to real-world scenarios.”