Information Overload

Catching up on six prediction market stories. Is Brazil ready to legalize casinos? Challenger brands are ascendant, but whose market share are they taking?

The Bulletin Board

THE LEDE: Catching up on prediction market news.

ROUNDUP: Brazil casino vote delayed; SDSU launches sports and gambling program; Quote of the Week.

QUICK HITTER: OpenAI distances itself from Robinhood’s tokenized stock.

VIEWS: Challenger brands are increasing their sports betting market share.

AROUND the WATERCOOLER: An uncomfortable truth.

STRAY THOUGHTS: Banging your head against the wall doesn’t work.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: 1 2 3 4 5 6 Prediction Market Updates

New structure may increase fees for Kalshi users [InGame]: Kalshi is altering its fee structure, a move that could potentially raise costs for sports traders. The changes aim to optimize revenue as Kalshi expands its offerings, but it has sparked concerns among users who rely on low fees for high-volume trading. Kalshi defends the move, citing the need to sustain platform growth and manage compliance costs amid increasing regulatory pressures, while critics argue that the fee hike could deter smaller traders, thereby reducing liquidity in niche markets. The adjustment reflects broader trends in prediction markets, where finding a balance between user retention and profitability is an unanswered question.

A look at the newest CFTC-licensed prediction market, Railbird Exchange [InGame]: InGame’s Brant James comes through with a fantastic deep-dive into Railbird Exchange, a new player in the prediction market space. Unlike traditional platforms, Railbird focuses on hyper-specific, data-driven contracts and uses AI-driven market-making to adjust odds in real-time based on user activity and external data. The platform leverages blockchain technology for transparency and security, aiming to disrupt competitors such as Kalshi and Polymarket. However, its reliance on crypto infrastructure raises questions about accessibility and regulatory hurdles, especially in the US.

Zelenskyy's suit = Polymarket’s Emperor’s New Clothes? [Forbes]: Polymarket has a $160 Million Problem. Per Forbes: “A Polymarket betting question asked whether Zelenskyy would wear a suit before July 2025. When the Ukrainian president appeared at a June NATO summit in what appeared to be formal attire, chaos ensued. "Yes" holders argued the garment clearly constituted a suit… [and] by July 7, the bets related to this controversy attracted $160 million worth of cryptocurrency… "No" holders disagreed, and the dispute moved to UMA's dispute resolution system known as the Data Verification Mechanism.” As much as we complain about nitpicky regulators, this highlights the problem with these markets existing outside typical regulatory oversight and why regulators can be so pedantic. As Dustin Gouker noted, “The amount of care put into the [market resolution] criteria can be seen throughout the language here, from the grammar (‘is is photographed’) to the lack of definition of what ‘a consensus of credible reporting’ consists of.”

Tribes point to SCOTUS decision in prediction market fight [InGame]: A coalition of tribes is citing a recent Supreme Court decision as further evidence “that the Commodity Futures Trading Commission (CFTC) does not have the right allow Kalshi to self-certify event contracts,” per Jill R. Dorson of InGame. The June 27 SCOTUS decision in Federal Communications Commission v. Consumers’ Research centers on the self-certification process, with the tribes noting, “Unlike the FCC’s role described in Consumers’ Research, the CFTC makes no findings prior to self-certifications, there is no mandatory agency oversight of self-certifications, and there are no standards by which the CFTC implements any decision-making authority over self-certifications.”

Kalshi CEO says the company is “at war” with traditional gambling interests [The Closing Line]: In posts on LinkedIn and X, Kalshi CEO, Tarek Mansour, said, “We're in a brutal, bloody war. The stakes: the right of prediction markets to exist. Today, Kalshi is fighting 100 tribes, 34 states, dozens of self-interested gambling advocacy groups, predatory private companies using 300-year-old British laws.” As Dustin Gouker wrote in his The Closing Line newsletter, the claims range from exaggerated to dubious, with Gouker giving it a 5 out of 10 on my “Source of Truthiness Scale” (TM): “Playing the victim and turning it into the little guy vs. the establishment clearly has played well for Kalshi to date… Meanwhile, Kalshi is also arguably “the establishment.” It has Donald Trump Jr. as an advisor and one of its board members ready to take over the Commodity Futures Trading Commission, the group that regulates Kalshi.”

Kalshi is promoting fake parlay bet slips [Event Horizon]: Dustin Gouker’s Event Horizon newsletter has picked up on numerous instances of fake Kalshi bet slips being used on social media. Gouker notes that Kalshi’s CEO retweeted the fake bet slips, amplifying the confusion. Once again, this highlights the distinction between prediction markets and the licensed sports betting industry, which is subject to strict regulations, including advertising standards that prohibit deceptive promotions. And as Alfonso Straffon tweeted, this could be a sign of things to come:

Roundup: Brazil Casino Vote Delayed; SDSU’s Sports & Gambling Program; Quote of the Week

Casinos coming to Brazil? Maybe. Maybe not. [iGaming Business]: Brazil’s Senate was expected to vote on bill PL 2,234/2022 to legalize land-based casinos, bingo, jogo do bicho, and horse racing on Tuesday. Unfortunately, the vote was postponed due to low quorum, as announced by Senate President Davi Alcolumbre. Already approved by the Justice and Citizenship Committee, proponents argue the bill could boost tourism and create jobs. Critics warn of increased crime and gambling addiction. A DataSenado survey shows 60% public support.

SDSU launches sports betting and gaming program [CDC Gaming Reports]: San Diego State University has launched the Institute on Sports Wagering and Gaming (ISWAG) within its L. Robert Payne School of Hospitality and Tourism Management. Led by Dr. Brandon Mastromartino, ISWAG aims to lead in applied research, policy analysis, and academic-industry collaboration in the sports betting industry. The institute will focus on responsible gaming, public policy, and educational pathways.

Quote of the Week: “Are these new activities flouting the law, exploiting a loophole, or simply a new product innovation? We won’t know until the dust settles, but we can already see that the patchwork will continue as different legislative efforts and gaming board actions play out.” ~ Sue Schneider, SBC Americas

Quick Hitter: OpenAI Distances Itself from Robinhood’s Stock Token Model

This one is loosely connected to my usual coverage, but highlights the growing complexity of innovation vs. regulation that STTP has been discussing.

As reported by Covers.com, OpenAI has publicly distanced itself from the tokenized stock products on Robinhood that claim to represent its equity. OpenAI has stated that it has no affiliation with the product or a partnership with Robinhood, and that the company’s equity remains private and not publicly traded. The tokens, which allow users to trade synthetic versions of OpenAI’s stock, have raised concerns about misrepresentation and regulatory compliance.

This development highlights the growing tension between traditional finance and crypto-based financial instruments, as tokenized assets often operate in regulatory gray areas. Robinhood has not commented on OpenAI’s statement; however, the platform’s role in offering such products highlights the challenges of balancing innovation with investor protection. The overarching question is whether (when?) there might be tighter scrutiny of tokenized securities by regulators.

SPONSOR’S MESSAGE - Episode 80: Should U.S. Sportsbooks Launch Betting Exchanges?

Host Brad Allen is joined by Smarkets CEO Jason Trost to discuss:

Smarkets’ effort to get a CFTC license

How leading sportsbooks should handle the events contracts opportunity

Why events contracts will end up “winner take most”

Listen to the episode here.

News: Challengers Cut Into FD and DK Market Share

Per the latest US Sports Betting Market Monitor from Eilers & Krejcik Gaming (a newsletter sponsor), DraftKings and FanDuel continue to dominate the US sports betting landscape, but several challengers are cutting into their market share.

Per EKG, the “Challenger” brands (Hard Rock, Fanatics, and Bet365) have increased their market share (gross gaming revenue) from low single digits in 2023 to 17% in 2Q 2025, while the DraftKings and FanDuel duopoly has seen its market share decrease from 75% in 2Q 2023 to 67% in 2Q 2025.

More than the top-tier operators, the rise of the Challenger brands has come at the expense of the established Tier 2 operators (BetMGM and Caesars per EKG), which have seen their overall share decline from 17% to around 11%. The “Lower Tier 2” operators (ESPN Bet and BetRivers) have remained relatively steady, according to EKG.

Around the Watercooler

Social media conversations, rumors, and gossip.

Whether you like it or not, these are four truths gamblers need to recognize. Legalization is said to have brought gambling “out of the shadows,” but there are plenty of people who would like it to return to the shadow realm.

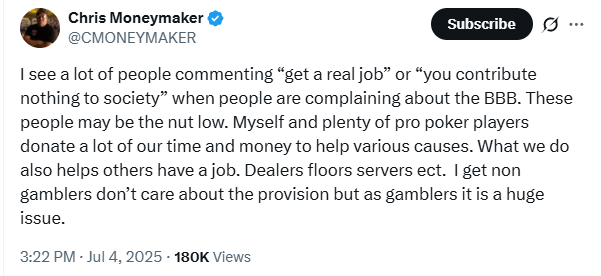

Here is Chris Moneymaker’s post on the topic (reminder that Chris was an accountant before he won the 2003 WSOP Main Event):

Stray Thoughts

Jonathan Michaels, the founder and principal of the consulting firm Michaels Strategies and a former guest on the STTP Talking Shop Podcast, penned an opinion piece for SBC Americas on the current state of industry lobbying and why it might be time to reconsider the lobbying approach.

In his piece, Michaels wrote:

“Part of the reason for this lack of success [legalizing online casinos] is that legalization proponents keep trying to use the same playbook it used to help expand sports betting, which focuses largely on tax revenues generated and the presence of illegal operators in the market.”

I wholeheartedly agree, as anyone who regularly reads the newsletter is well aware of, considering I talk about this ad nauseam, to the point that I have more to say on the topic, but fear turning the newsletter into a one-topic rant.

I’ll save my thoughts on what can be done for another time (or private conversations) and leave you with some of my previous rants newsletter entries on the subject: