Knee Jerk Reaction?

Is the ESPN Bet experiment already over, or is everyone giving up on the Penn-ESPN project far too early?

The Bulletin Board

NEWS: Is the criticism of ESPN Bet deserved?

BEYOND the HEADLINE: How much stock should you put in the RSI and Penn sale rumors?

WAY BEYOND the HEADLINE: Delaware and DC had the same problem but arrived at different solutions.

LOOSE ENDS: DraftKings divests from VSiN; Supplier-side competition heats up; PLN + Birches Health

VIEWS: When it comes to the US sports betting market, opinions vary.

AROUND the WATERCOOLER: Zombie partnership deals.

STRAY THOUGHTS: More STTP news… coming soon.

SPONSOR’S MESSAGE - Sporttrade was borne out of the belief that the golden age of sports betting has yet to come. Combining proprietary technology, thoughtful design, and capital markets expertise, our platform endeavors to modernize sports betting for a more equitable, responsible, and accessible future.

Sporttrade’s newest feature, The Tape, prints all trades made on the app in real-time.

Industry Observers Lack Faith in ESPN Bet

Few projects have been met with more pessimism than ESPN Bet.

The Penn-ESPN mashup has been written off as a failure from the outset. Any market share gains were from promotional spending, and when the spigot was turned off and handle share fell, naysayers pounced. There are jeers about the lack of integration with ESPN products, and now “insiders” are saying the product isn’t ready for prime time.

Per Earnings+More, “Speaking on condition of anonymity, multiple ex-Penn employees suggested that internally there is a lack of faith in the quality of the product with key personnel of the customer acquisition side not having been replaced.”

Here’s the thing. We were told all of this in advance. The product was rushed to market because, in the US, you’re damned if you do and damned if you don’t. For Penn-ESPN, the decision was between:

Getting to market with the product as-is.

Waiting for upgrades while competitors gobble up more and more customers.

As I wrote in June:

“While I’m a big believer in the dangers of the sunk cost fallacy, pulling back on ESPN Bet before it’s been given a chance seems like absolute folly. Penn has admitted the product is not on par yet, nor has it made a full-scale marketing push – Penn’s goal is to have both remedied near the start of the NFL season.”

The seeming desire to see Penn-ESPN Bet fail is unusual, but there are some genuine concerns.

As Dustin Gouker wrote in his Closing Line substack:

“I’ve heard a lot made of 1. further integration with ESPN and 2. an improved sportsbook product. I am skeptical that No. 1 is going to create anything beyond incremental gains. If No. 2 is the real game-changer, Penn shouldn’t have lit money on fire to create a clean break from Barstool and then license the ESPN brand.”

But again, I’d point out that we knew product improvements weren’t expected until the start of the 2024 NFL season. Yes, the current numbers are concerning, but as I’ve previously said, it’s not at a pull-the-plug point. Now, if ESPN Bet enters 2025 without a significant increase in its market share, the naysayers will be proven correct.

Beyond the Headline: The Latest RSI and Penn Sale Rumors

Jake Pollard did a great job breaking down the possible sale of Rush Street Interactive and Penn Entertainment for CDC Gaming Reports, including the complexities accompanying an acquisition of this magnitude.

Rush Street Interactive is one of the non-FanDuel/DraftKings success stories. The company’s scalpel-like approach has, as Pollard writes, produced “a strong online casino-focused business, and in its home state of Illinois, has succeeded in becoming a top three sports betting operator.”

RSI has been involved in M&A rumors for several years, but new reports indicate a sale could be announced in the coming weeks, before the start of the NFL season. Potential suitors could include Ceasars and BetMGM.

However, these are just rumors, and industry veteran Roger Gros quickly dispelled previous rumors: “I have confirmed that there is nothing accurate about this story other than the fact that RSI has a “strong financial performance and expanding footprint in the iGaming market.”

A sale of Penn (land-based and interactive divisions) is a bit more complicated. A previous rumor of a joint acquisition by Boyd Gaming and Flutter makes sense, but it would need to thread several needles to become a reality.

As Pollard wrote, “On a theoretical level, Boyd bidding for Penn’s regional properties and Flutter acquiring the digital outlets made sense, but that initial thesis quickly fell apart when looking at ESPN Bet’s numbers, which, for all theScore Bet’s prowess in Canada, don’t look strong enough to move the dial for Flutter.”

Further, Penn shareholders feel the stock is undervalued and may not be willing to sell off the company piecemeal at the current valuation.

Way Beyond the Headline: Pulling and Not Pulling the Plug

Washington, DC, gave up on its lottery-run sports betting monopoly even though FanDuel had righted the ship after taking over from the disaster that was Intralot’s Gambet DC app.

Delaware nearly did the same but decided to leave Rush Street Interactive as the state’s sole online gambling provider. And for good reason. Since taking over from 888, RSI has more than tripled its predecessor’s results.

Under 888, Delaware struggled to cross $1 million in monthly online casino revenue and never surpassed $1.5 million. In June, under RSI, the state reported more than $5 million in online casino revenue.

SPONSOR’S MESSAGE - SUBSCRIBE NOW to Zero Latency, the new podcast from Eilers & Krejcik Gaming that provides unparalleled insight into the U.S. online gambling industry through interviews with industry insiders and analysis from EKG experts.

Loose Ends: DraftKings Divests from VSiN; Supplier-Side Competition Heats Up; PLN + Birches Health

DraftKings sells VSiN back to original owners: It’s official: DraftKings has sold VSIN back to Musburger Media. The terms of the deal were not disclosed, but previous reporting indicates the sale price would be well below the $70 million price DraftKings paid for VSiN in 2021. Per the press release, “Original VSiN founders Brian Musburger and Bill Adee, who were part of the team that previously launched and led the multi-platform broadcast and content company, will lead it moving forward.”

GeoComply and EPIC face new competition: An excellent piece from Mike Seely at Sports Handle examines the increasingly competitive supplier/service provider landscape in the US online gambling market. Seely looks at the new competitors that have entered the geolocation and responsible gambling space, challenging GeoComply and EPIC.

PLN and Birches Health team up: Pro League Network has entered into a strategic collaboration with Birches Health “to ensure that wagering on Pro League Network sports – including CarJitsu Championship, SlapFIGHT Championship, and Ultimate Tire Wrestling – is done in a healthy, sustainable manner.” According to CDC Gaming Reports, “Birches Health will offer comprehensive, virtual support to PLN’s 500,000 subscribers” through “seamless access to online solutions that encourage responsible gaming best practices through direct integrations.”

Is US Sports Betting a Runaway Success or an Unmitigated Disaster?

Depending on who you ask, the US sports betting industry is either booming or an unsustainable catastrophe.

Speaking at last week’s National Council of Legislators from Gaming States conference, sports bettor Billy Walters said “(per reporting by SBC Americas Jessica Welman), “I wanted to see sports betting legalized. I want to see it regulated. I wanted to see the criminal element out of it. I wanted to see jobs created, taxes created.”

Walters’ hopes were quickly dashed (from his perspective), as he said at NCLGS, “I have some very deep concerns about the future of sports betting.”

Walters attributed it to an outsized European influence on US sports betting, claiming European operators don’t understand US bettors and that lawmakers rushed legislation without input from “experts.”

I would argue that this isn’t a European problem; it’s a business problem. Walters and other professional bettors want to be able to use their skills without friction. Operators want to limit their ability to print money.

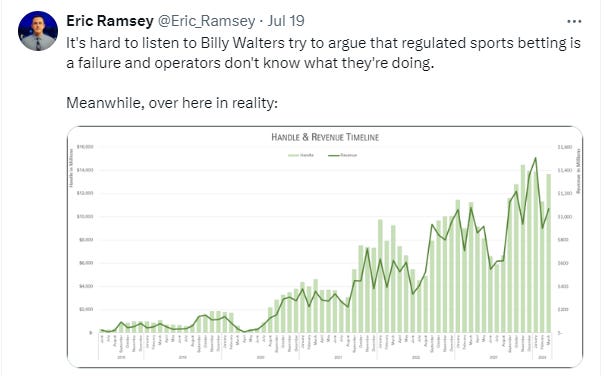

A lot of the concerns about sustainability voiced by professional bettors like Walters don’t line up with the results:

Virtually every conversation I have includes someone asking me about the sustainability of high-hold wagers like SGPs, and there’s really no good answer other than that operators will know when they’ve reached the customer pain point. Further, US operators get criticized for high hold rates, but those are blended rates, a mixture of high and low hold bets.

As I tell everyone, the market adjusts.

Sponsors Message: Kero is a premier micro-betting provider, powering more than 150 operators across the globe.

Our extensive coverage of fast markets in Football, Basketball, Baseball, and Soccer is a proven method for increasing in-play handle and hold.

Talk to us about how we utilize algorithmic recommendation to power highly contextual micro markets for the ultimate in-play experience.

Around the Watercooler

Social media conversations, rumors, and gossip.

A lot of sportsbooks are closing up shop in the US, and one of the underreported aspects of the exodus is the many partnerships that have been signed, as Sporttrade (a newsletter sponsor) CEO Alex Kane recently tweeted:

This reminds me of the zombie market access deals so many sports books signed, expecting states always to run mobile betting through land-based gaming operators.

But as I said above, the market adjusts, and let’s hope that Kane’s follow-up tweet comes to fruition:

Stray Thoughts

Another big announcement is coming soon! I’m really excited about this next project launch, which will bridge the gap between the STTP newsletter and consulting businesses.