Lingering Questions

Predictions markets are growing fast, but they still have a very long way to go before we classify them as competitors to the sports betting industry.

The Bulletin Board

THE LEDE: I have a lot of questions about prediction markets… and other people are starting to ask them, too.

BEYOND the HEADLINE: Kalshi’s pricing is worse than traditional sportsbooks.

ROUNDUP: ROGA announces new certification program; G2E main stage speakers; Quote of the Week (Maybe the Year).

VIEWS: Loss deduction cap remains as the FAIR Bet Act is blocked again.

AROUND the WATERCOOLER: Why does it always turn into gambling?

STRAY THOUGHTS: Unwinnable arguments.

Sponsor’s Message: Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, Chief Strategy Officer, Matthew@edgemarkets.io

The Lede: Still Questions About Prediction Markets

I’m a big ‘what-if’ guy. You give me an idea, I’ll poke holes in it; that’s what I do. It’s a sometimes annoying, often valuable trait.

So when everyone was talking about the opportunities prediction markets represent, and the clear path they have to overtake traditional sportsbooks, given the less restrictive environment they operate in, I had questions.

Is it even competitive with traditional sportsbooks (pricing, UX, catalog)? If it does take off, how long until limiting begins (there’s a reason traditional sportsbooks do this)? And what happens when everyone and their brother is in the space?

On the catalog and the need to limit bettors, as I said on my podcast with Dustin Gouker back in April, “The more markets you offer, the more mistakes you're going to make. The more you're going to have savvy people coming in.”

Kalshi CEO Tarek Mansour says that won’t happen, but I have doubts: “You will never be limited for winning too much on Kalshi, we welcome traders of all sizes and encourage smart money to join.”

On competition, which is already becoming a reality, I wrote last week:

“Think of it this way: If FanDuel, DraftKings, BetMGM, Caesars, bet365, and Underdog can all offer prediction markets on sports, then it’s just another product in a crowded marketplace that is also competing against traditional sportsbooks, DFS, sweepstakes, and everything else. The advantages of being a prediction market evaporate, and it becomes a battle of UX, marketing budgets, and brand recognition.”

Another question I’ve consistently asked is starting to get far more attention: What is the actual opportunity?

Last week, it was the team at Jefferies that started asking questions about TAM:

“As reported by Earnings+More, Jefferies said the idea of a global TAM of $100 billion ‘greatly overstates the potential profitability.’”

“And while prediction markets are still just getting their feet wet, E+M noted that ‘Jefferies estimates Kalshi and Polymarket’s combined handle in H125 was $1.5 billion vs. US OSB handle over the same period of $85.2 billion.’”

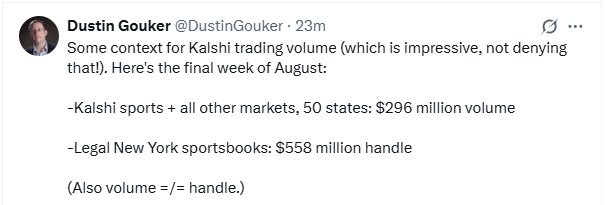

And as Dustin Gouker noted:

And as I said yesterday, and in the past, “prediction market trading volume is likely at least double what a traditional sportsbook would report for handle, so Gouker’s comparison above is more like $558 million for sportsbooks in New York, and, at best, $150 million for Kalshi across the country for all markets.”

Gouker expertly summed up the landscape on prediction markets in a recent newsletter, saying, “It’s both getting very big and has a long way to go.”

Another question I’ve tossed out into the ether was recently broached by Citizens, which noted that the pricing at Kalshi isn’t all it’s cracked up to be.

“The two largest advantages of using an exchange over a sportsbook are 1) better pricing and 2) the ability to easily cash out, in our view. Despite some in the industry pushing the notion that exchanges have better pricing, this is currently not true for the average consumer, according to the data we tracked during week 1 of the NFL season.”

Citizens tracked odds for 30 moneyline bets and over/under wagers/contracts, as well as the implied operator pricing for multiple NFL games in Week 1, for FanDuel, DraftKings, and Kalshi.

What did Citizens find?

“When adding in the transaction fee compared to the traditional sportsbooks, on average (figures 1 and 2). Pricing on Kalshi for the money line and over/under was 10% and 25% more expensive compared to DraftKings for the NFL slate on Friday, and 16% and 23% more expensive compared to FanDuel, respectively.”

Citizens notes that the prices tightened on Sunday, but Kalshi “was still 7% more expensive compared to FanDuel/DraftKings, with over/under 10% more expensive.”

And don’t expect parlays to be any different:

“The company appears to be looking to roll out parlays (link); however, we expect pricing to be even more inferior compared to DraftKings and FanDuel with the collateral needed by the market makers to trade the product.”

As I’ve said several times about the prediction market opportunity: “Where’s the proof?”

Beyond the Headline: Kalshi’s Pricing Is Not Good for the Little Guy

According to Citizens, “Kalshi charges a transaction fee for every contract traded on its platform, which was $1.63 for 100 money line contracts on average in our analysis and $1.75 for over/under.”

What should raise a few eyebrows is that “Kalshi charges the fee to its retail customers (average bettors) while providing more favorable terms for the sharps/whales/VIPs, and institutions, who are not often subject to the fee.”

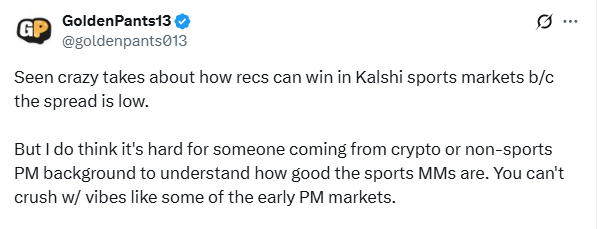

As some on X have hypothesized, the idea that trading sports contracts is good for everyone may not be true:

The theory is that if Kalshi can attract more market makers to its platform, it will increase liquidity and be able to offer better pricing to its retail customers. Citizens' takeaway is that if more users flock to prediction markets, the pricing delta will narrow. STTP Thoughts: I would like to have a discussion with Kalshi and anyone else of this thinking, and discuss the online poker ecosystem of old.

In Summary, “While the jury is still out on the total addressable market for the U.S. prediction markets, the data above highlights the risk of competition to the existing real money gaming operators, which should be viewed as minimal,” Citizens wrote. “Together with inferior pre-game pricing, UI/UX, and cashout, we do not view betting exchanges as a competitive threat to profitability for existing operators.”

Or simply put by Dustin Gouker, “It’s both getting very big and has a long way to go.”

Roundup: ROGA Certification Program; G2E Speakers; Quote of the Week (Maybe the Year)

ROGA partners with RGC to create vendor certification program [Press Release]: “The Responsible Online Gaming Association (ROGA)… has partnered with the Responsible Gambling Council (RGC) to launch a US certification program for online operators promoting player well-being and responsible gaming. The certification program will offer a structured, data-driven approach to evaluating operator practices in areas such as self-exclusion, marketing, staff training, and player support tools. It will provide independent validation of operator performance, encouraging progress beyond regulatory minimums, with a focus on long-term accountability and continuing evolution of responsible gaming standards.”

Robins, Hornbuckle, and Jackson, among keynote speakers at G2E [Press Release]: “As we mark 25 years of G2E, we’re proud to continue to be a catalyst for gaming’s growth, and our programming reflects the ideas and leadership shaping the industry’s future,” said AGA President and CEO Bill Miller. In addition to Indian Gaming Association (IGA) Chairman Ernie Stevens Jr. on Monday, and AGA President and CEO Bill Miller on Tuesday, there will be 1-on-1 discussions with:

Bill Hornbuckle – CEO & President, MGM Resorts International

Peter Jackson – CEO, Flutter Entertainment

Jason Robins – CEO, DraftKings

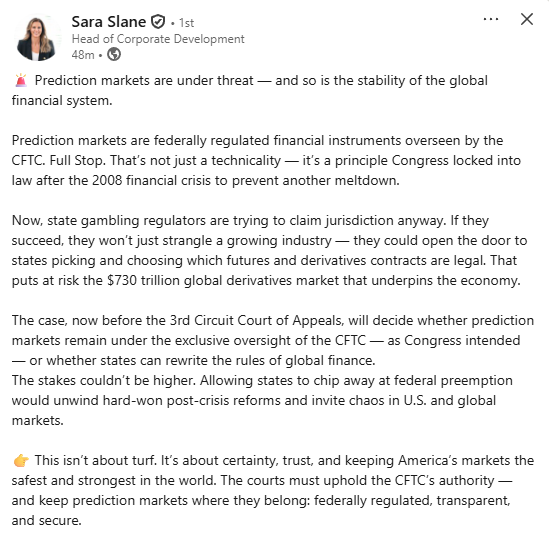

Quote of the Week: This might be the wildest social media claim I’ve ever seen. Someone please tell me how the capability of prediction markets offering sports contracts is the glue holding the $730 trillion global derivatives market together. Even more, does the existence of prediction markets in any form impact the global derivatives market?

SPONSOR’S MESSAGE: The Future of Prediction Markets in 2025

Prediction markets are growing fast in the U.S., but regulators aren’t aligned on whether they’re innovation or unlicensed gambling.

That’s where Vixio, the leading authority on global gambling and payments regulation, comes in. Our experts track every enforcement, policy shift, and industry move so you don’t have to.

Download our latest report to see what’s next for prediction markets in 2025—and what it could mean for your business.

Views: It (The FAIR Bet Act) Never Had a Chance

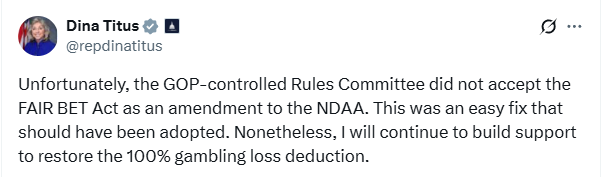

Bettors had their fingers crossed that Nevada Rep. Dina Titus’s effort to reinstate the gambling loss deduction to 100% (which the One Big Beautiful Bill dropped to 90%) would be attached to a piece of must-pass legislation. Backstory on the OBBB reducing the gambling loss deduction cap.

On Saturday, I’ll release a podcast episode with the American Gaming Association’s (AGA) Joe Maloney. The podcast was recorded a couple of weeks ago, and in it, I said Rep. Dina Titus’s attempt to attach the FAIR Bet Act to the National Defense Authorization Act (NDAA) was a long shot.

On Tuesday, Rep. Titus delivered the news:

As I note in the forthcoming podcast, this was, as Gandalf would say, a fool’s hope, as a member of the minority party getting an amendment attached to the NDAA is unlikely — there were over 1,000 amendments proposed by the way. Furthermore, while the FAIR Bet Act does have bipartisan support, it’s lacking support from leadership.

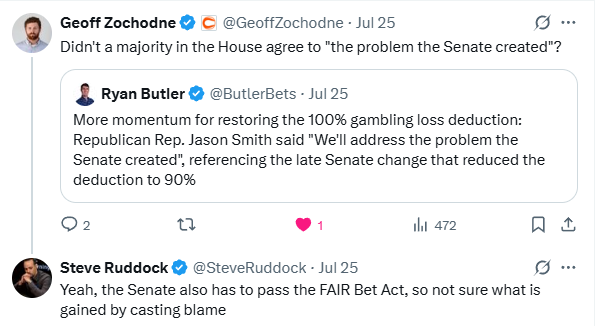

One other point, and this can be seen in Titus’s tweet above (and the tweet posted below following a hearing where the FAIR Bet Act was discussed), everything is politics, and throughout the process, this has turned into political finger-pointing, with the House blaming the Senate and Democrats pointing fingers at Republicans for lowering the loss deduction threshold.

Some adage about honey and vinegar comes to mind.

So what happens next?

The legislation still exists and could be brought up as a standalone bill (unlikely).

Rep. Titus (or someone else) could try to attach to another piece of must-pass legislation, try being the keyword here.

There’s always 2026. While it would bring about loads of uncertainty for bettors, no one is paying 2026 taxes until January 2027, so there is always the hope that Congress retroactively reinstates the 100% loss deduction sometime next year.

SPONSOR’S MESSAGE - Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan.

Join us as we build the future of sports gaming.

Visit: https://underdogfantasy.com/careers

Around the Watercooler

Social media conversations, rumors, and gossip.

A fascinating post from recent podcast guest Kim Lund, who points out that every time we have some new innovation, that innovation quickly steers more and more toward a gambling product, to the point where there is very little difference between the two:

The reason is pretty straightforward: The route to market is through gambling companies, and entrenched companies aren’t interested in games that don’t have significant overlap with their core products. Startups bring fresh, interesting ideas to them, but they say, ‘Come back when you have a blackjack game.’

Stray Thoughts

I’ve been harping on this a lot lately, but you can’t overcome this messaging with ‘well, actually…’ rebuttals:

Once you engage in arguments about the amount of harm or cannibalization, you’ve already lost. You’re letting the opposition choose the field of battle and define the terms of victory and defeat.

But you can’t ignore it either, and therein lies the lesson. As I previously noted, “There’s a saying in self-defense circles: whoever starts it usually finishes it.”

As Kim Lund put it on LinkedIn:

“So what is the other side of the story? That the dark side of the story isn't as dark as it is being portrayed? As Alun Bowden is so good at reminding the industry of - of course these reports will be ugly when the industry's counter-narrative is that only half of all those bad things are true; $14B in social costs ain’t that much right, and 2.5m people suffering from severe gambling addiction is nothing compared to cancer.”

And since I referenced Kim twice in this newsletter, here are my podcasts with him: